TX Form 50-151 2023-2025 free printable template

Show details

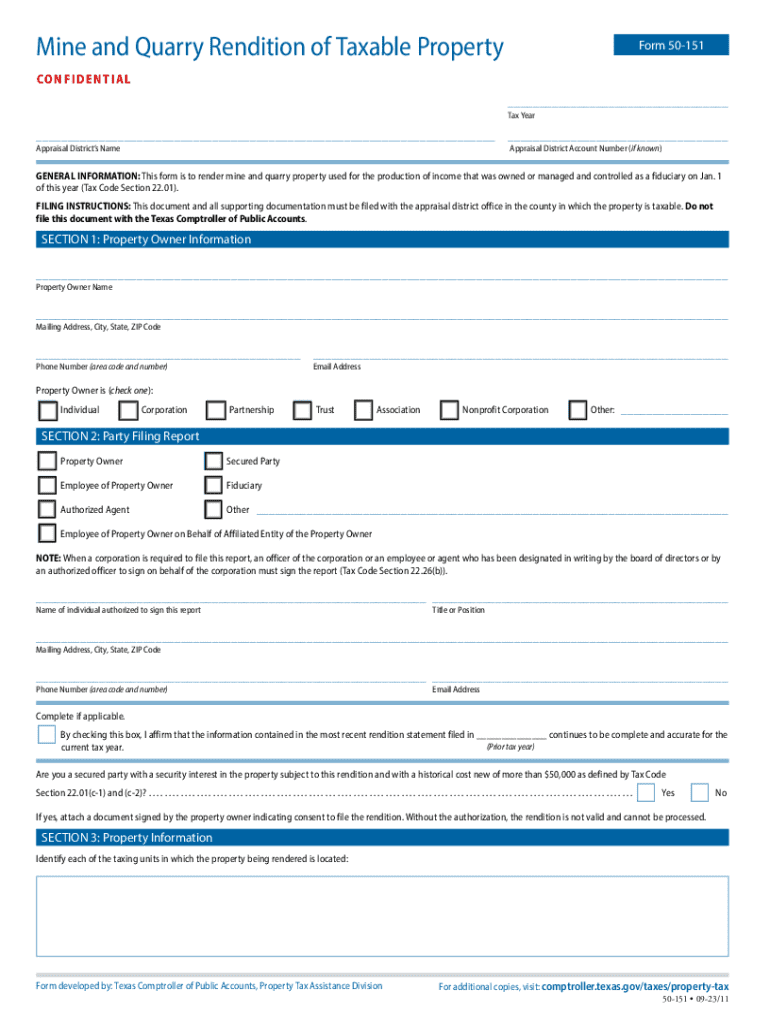

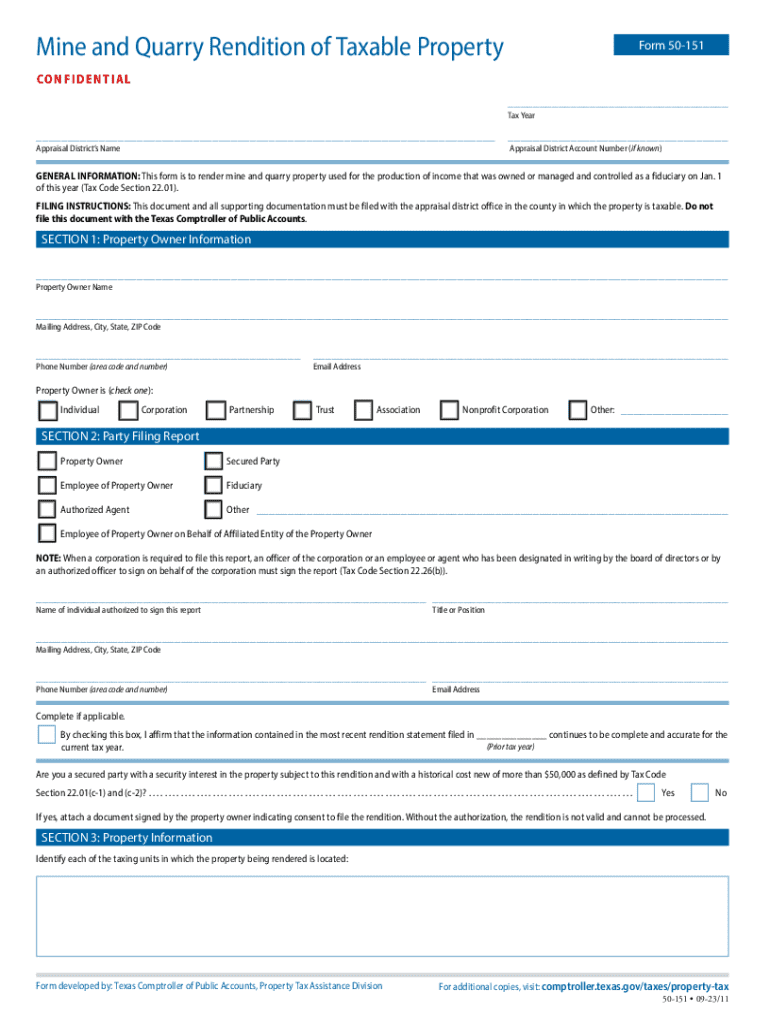

P r o p e r t y Ta x Mine and Quarry Rendition of Taxable Property Form 50151 CONFIDENTIAL ___ ___ Appraisal Districts Name Phone (area code and number) ___ Address, City, State, ZIP Code This document

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Form 50-151

Edit your TX Form 50-151 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Form 50-151 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Form 50-151 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX Form 50-151. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Form 50-151 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Form 50-151

How to fill out TX Form 50-151

01

Gather required information such as student identification, school district information, and details about the special education services.

02

Start the form by filling out the top section with your personal information, including name and address.

03

Provide the name of the school district and the specific campus your child attends.

04

Complete the section regarding the type of special education services received, including dates if applicable.

05

Sign and date the form at the bottom to acknowledge the information is correct.

06

Submit the form to the appropriate school or educational authority as instructed.

Who needs TX Form 50-151?

01

Parents or guardians of children receiving special education services in Texas.

02

School administrators and staff involved in the evaluation and support of students with disabilities.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Texas franchise tax report?

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year.

Who should file Texas franchise tax?

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

What is a tiered partnership election in Texas?

Summary. A multi-tiered partnership—or, simply, a tiered partnership—exists when one partnership (the upper-tier parent) owns a partnership interest in another partnership (the lower-tier subsidiary).

What is a Texas annual franchise tax report?

The franchise tax report determines how much tax your Texas limited liability company (LLC) or corporation owes, as well as keeping your information up to date in state databases.

What is tiered partnership election Texas franchise tax?

Tiered Partnership Election A “tiered partnership arrangement” means an ownership structure in which any of the interests in one taxable entity treated as a partnership or an S corporation for federal income tax purposes (a “lower tier entity”) are owned by one or more other taxable entities (an “upper tier entity”).

What is the difference between upper tier and lower tier partnership?

Tiered partnership arrangements are ownership structures where one pass-through entity, a lower-tier entity, is owned by one or more other taxable entities, an upper-tier entity, allowing limited liability, asset protection, and tax advantages for owners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get TX Form 50-151?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific TX Form 50-151 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make edits in TX Form 50-151 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing TX Form 50-151 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the TX Form 50-151 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your TX Form 50-151 in minutes.

What is TX Form 50-151?

TX Form 50-151 is the Texas property tax exemption application for property owners who are seeking homestead exemptions in Texas.

Who is required to file TX Form 50-151?

Property owners who occupy their residence as their primary home are required to file TX Form 50-151 to apply for homestead exemptions.

How to fill out TX Form 50-151?

To fill out TX Form 50-151, provide personal information including your name, address, and social security number, along with information about your property and the details of the exemption you are applying for.

What is the purpose of TX Form 50-151?

The purpose of TX Form 50-151 is to allow Texas property owners to apply for homestead exemptions which can reduce their property tax burden.

What information must be reported on TX Form 50-151?

TX Form 50-151 requires reporting information including the property address, the owner's name, date of birth, social security number, and details related to the claim for homestead exemption.

Fill out your TX Form 50-151 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Form 50-151 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.