Get the free eat n park payroll department ohio form

Show details

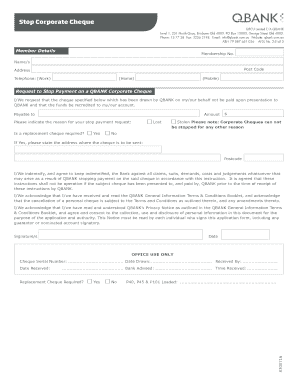

PAYMENT AUTHORIZATION AGREEMENT I hereby authorize Eat n Park Hospitality Group (hereinafter COMPANY) to deposit any amounts owed into my account at the Financial Institution (hereinafter BANK) indicated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign eat n park payroll

Edit your eat n park payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eat n park payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit eat n park payroll online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit eat n park payroll. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out eat n park payroll

How to fill out Eat n Park payroll?

01

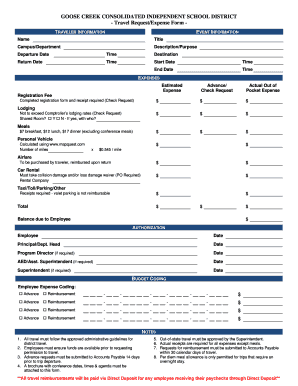

Gather necessary information: Before filling out the Eat n Park payroll, you need to gather all the relevant information. This includes the employee's name, address, social security number, tax withholding information, and any other necessary details.

02

Access the payroll system: Login to the Eat n Park payroll system using your designated username and password. If you don't have access or are unsure about how to login, reach out to your HR department for assistance.

03

Select the appropriate pay period: Choose the correct pay period for which you are filling out the payroll. This ensures that the employee's wages are accurately calculated and reflected in their paycheck.

04

Enter employee information: Input the employee's details, such as their name, position, and department, into the designated fields. Double-check the accuracy of all the information to avoid any errors.

05

Input hours worked: Enter the number of hours worked by the employee during the designated pay period. This includes regular hours, overtime hours, and any other applicable categories.

06

Calculate wages: Use the provided formulas or payroll software to calculate the employee's wages based on their hourly rate and the hours worked. Ensure that any applicable overtime rates or additional bonuses are accurately included in the calculations.

07

Deductions and withholdings: Deduct any necessary taxes, insurance premiums, retirement contributions, or other deductions from the employee's gross wages. Make sure to comply with federal and state regulations while calculating these deductions.

08

Review and verify: Double-check all the entered information for accuracy and completeness. Review the calculations to ensure they are correct. Verify that all relevant information, such as employee tax withholdings or benefit contributions, is included accurately.

09

Submit payroll: Once you are confident that everything is correct, submit the payroll for processing. This can usually be done electronically through the payroll system. Make sure to meet any deadlines set by the company or payroll department.

Who needs Eat n Park payroll?

01

Eat n Park employees: All regular and temporary employees working for Eat n Park require the use of the Eat n Park payroll system. They need it to ensure that their wages are accurately calculated, taxes are withheld properly, and any benefits or retirement contributions are correctly accounted for.

02

Human Resources department: The HR department of Eat n Park needs access to the payroll system to manage and process payroll for all employees. They use it to gather information, review and approve payroll entries, and ensure compliance with employment regulations.

03

Payroll administrators: Payroll administrators within Eat n Park are responsible for maintaining and managing the payroll system. They need access to process payroll, generate reports, and resolve any issues or discrepancies that may arise.

04

Accountants and finance team: The accountants and finance team in Eat n Park use the payroll system to reconcile payroll expenses, prepare financial reports, and ensure accurate recording of payroll-related transactions.

Note: The specific individuals who need Eat n Park payroll may vary depending on the organizational structure and processes within the company. It is essential to consult with your HR department or payroll administrators to determine who specifically needs access to the system.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit eat n park payroll online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your eat n park payroll to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in eat n park payroll without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your eat n park payroll, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit eat n park payroll straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing eat n park payroll.

What is eat n park payroll?

Eat n Park payroll is the system used by the restaurant chain Eat n Park to manage and process employee salaries and wages.

Who is required to file eat n park payroll?

All employees of Eat n Park are required to have their payroll filed through the company's payroll system.

How to fill out eat n park payroll?

Employees can fill out their payroll information by logging into the Eat n Park payroll system and entering their hours worked, deductions, and other relevant information.

What is the purpose of eat n park payroll?

The purpose of Eat n Park payroll is to ensure that employees are accurately compensated for their work and that payroll taxes are properly withheld and paid.

What information must be reported on eat n park payroll?

Information reported on Eat n Park payroll includes employee hours worked, wages earned, deductions, and tax withholding.

Fill out your eat n park payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Eat N Park Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.