Canada CSIO CA2001e 2014 free printable template

Show details

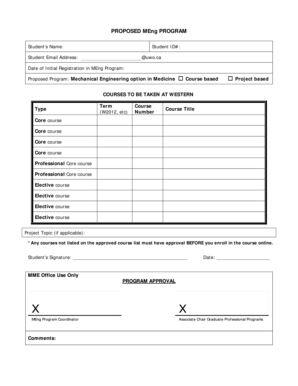

HABITATIONAL INSURANCE APPLICATION QUOTE NEW RENEWAL INSURANCE COMPANY 1. APPLICANT S FULL NAME AND POSTAL ADDRESS BINDER NUMBER POLICY 2. CROSS REFERENCE INFORMATION LIST OTHER POLICIES WITH THIS INSURANCE COMPANY LINE OF CSIO - Habitational Insurance Application CA2001e 201407 Page 1 2014 Centre for Study of Insurance Operations. BROKER S NAME AND POSTAL ADDRESS NAME ADDRESS CITY PROV BILLING METHOD Reset Print POSTAL CODE CONTACT HOME CELL BUSINESS FAX EMAIL BROKER CONTRACT NO. BROKER...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada CSIO CA2001e

Edit your Canada CSIO CA2001e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada CSIO CA2001e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada CSIO CA2001e online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada CSIO CA2001e. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada CSIO CA2001e Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada CSIO CA2001e

How to fill out a habitational insurance application:

01

Gather all necessary documents and information such as proof of ownership, property details, personal information, and any previous insurance policies.

02

Review the application form carefully and provide accurate and complete information. Double-check all details before submitting.

03

Fill out the sections related to property details, including property address, type of dwelling, construction details, and any additional structures or amenities.

04

Provide information about the coverage needed, such as property insurance, liability coverage, and additional endorsements like flood or earthquake insurance.

05

Include details about any existing insurance policies, claims history, and previous coverage.

06

Provide personal details of the policyholder, including name, address, contact information, and social security number.

07

Include the necessary information about other residents or tenants in the property if applicable.

08

Review the application form once again to ensure all sections are completed accurately and sign the application.

09

Keep a copy of the filled application form for your records.

Who needs a habitational insurance application:

01

Homeowners who own or have a mortgage on a property, whether it is a house, condo, townhouse, or apartment.

02

Property owners who want to protect their investment and assets from potential hazards, liability claims, or other unforeseen events.

03

Landlords who rent out their properties to tenants and want to ensure their property is adequately insured against risks.

04

Tenants who want to protect their personal belongings and liability in case of accidents or damages within the rented property.

Fill

form

: Try Risk Free

People Also Ask about

What are the three 3 main types of property insurance coverage?

There are three types of property insurance coverage: replacement cost, actual cash value, and extended replacement costs.

What is the application of insurance?

Application for Insurance means all documents, materials, statements and exhibits, whether or not prepared by the Insured, submitted to the Company by or on behalf of the Insured for the purpose of obtaining a Commitment of Insurance or a Certificate of Insurance.

What is an example of homeowners liability coverage?

Liability covers you against lawsuits for bodily injury or property damage that you or family members cause to other people. It also pays for damage caused by your pets. So, if your son, daughter (or even your dog) accidentally ruins a neighbor's expensive rug, you are covered.

What is habitational?

a place of residence; dwelling; abode. the act of inhabiting; occupancy by inhabitants. a colony or settlement; community: Each of the scattered habitations consisted of a small number of huts.

What does habitational mean in insurance?

A habitational risk insurance policy is designed for commercial residential properties such as apartment buildings, homeowners associations, rented houses, and condominiums. Business Insurance Policies Provide Coverage for the Following Losses: Fire and Lightning. Smoke.

What is a habitational policy type?

Habitational insurance is a form of liability insurance that provides coverage for landlords for claims arising from injuries to tenants or damage to rental properties due to storms, fires, theft or vandalism. In certain locations, this type of insurance policy can also include earthquake or flood coverage.

What are the parts of a life insurance application?

There are basically three sections in a typical life insurance application: Part I - General. Part II - Medical. Part III - Agent's Report.

What are the basic categories of property insurance?

Types of Property Insurance: What You Need to Know Homeowners insurance. Condo/Co-op insurance. Landlord insurance. Renters insurance. Mobile home insurance. Flood insurance. Earthquake insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada CSIO CA2001e from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including Canada CSIO CA2001e. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for the Canada CSIO CA2001e in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your Canada CSIO CA2001e in seconds.

Can I edit Canada CSIO CA2001e on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as Canada CSIO CA2001e. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is Canada CSIO CA2001e?

Canada CSIO CA2001e is a standardized form used in the insurance industry in Canada, primarily for the purpose of reporting insurance transactions and related activities.

Who is required to file Canada CSIO CA2001e?

Insurance companies, brokers, and agents in Canada who are involved in specific insurance reporting are required to file Canada CSIO CA2001e.

How to fill out Canada CSIO CA2001e?

To fill out Canada CSIO CA2001e, one must gather relevant information about the insurance transaction, complete all sections of the form accurately, and ensure that all required documentation is attached before submission.

What is the purpose of Canada CSIO CA2001e?

The purpose of Canada CSIO CA2001e is to standardize the reporting process for insurance transactions, making it easier for regulators and insurance companies to process and analyze insurance data efficiently.

What information must be reported on Canada CSIO CA2001e?

The information that must be reported on Canada CSIO CA2001e includes details of the insurance policy, transaction amounts, policyholder information, and any relevant dates pertaining to the insurance transaction.

Fill out your Canada CSIO CA2001e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada CSIO ca2001e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.