Get the free BUSINESS - 631-5600

Show details

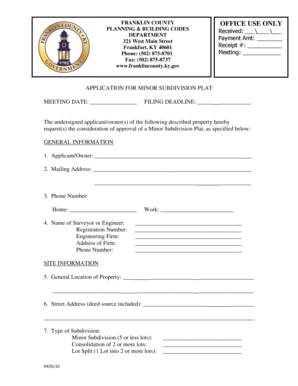

BUSINESS 6315600 PLANT 6310240 MARBLEHEAD MUNICIPAL LIGHT DEPARTMENT 40 TOGA WAY * P.O.BOX 369 MARBLEHEAD, MASSACHUSETTS 01945 Doctor Certification Form (recertify every 90 days for serious illness;

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business - 631-5600

Edit your business - 631-5600 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business - 631-5600 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business - 631-5600 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business - 631-5600. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business - 631-5600

How to fill out business - 631-5600

01

Start by gathering all required information and documents such as business identification number, legal entity information, and contact details.

02

Identify the appropriate form or application specific to business - 631-5600. This may vary depending on the location and nature of the business.

03

Carefully read and understand the instructions provided with the form. Ensure you meet all eligibility criteria and have the necessary supporting documents.

04

Complete the form accurately and legibly. Provide all requested information, including your business name, address, phone number, and any other required details.

05

Double-check the form for any errors or missing information. Make sure all sections are properly filled out before submission.

06

Submit the completed form along with any required supporting documents to the designated authority. This may involve mailing the form or applying online.

07

Pay any applicable fees for processing the business - 631-5600 application. Follow the provided instructions for payment methods and deadlines.

08

Wait for confirmation or updates from the authority regarding the status of your application. This may include requests for additional information or clarification.

09

Once approved, you will receive your business - 631-5600 and any associated permits or licenses. Make sure to comply with any ongoing requirements or regulations.

10

Keep copies of all submitted documents and records for future reference or necessary audits.

Who needs business - 631-5600?

01

Anyone who intends to start and operate a business - 631-5600 needs to fill out the necessary forms and applications.

02

Individuals or organizations seeking legal recognition for their business entity may require business - 631-5600.

03

Businesses planning to operate in specific jurisdictions or industries may be required by law to obtain business - 631-5600.

04

Entrepreneurs looking to engage in commerce, provide services, or conduct transactions often need business - 631-5600 for legitimacy and compliance.

05

Investors or lenders may require proof of business - 631-5600 registration before considering financial support or partnerships.

06

Businesses seeking tax identification or the ability to legally hire employees may need to fill out business - 631-5600 forms.

07

Obtaining business - 631-5600 can provide certain legal protections and benefits, making it essential for those concerned with liability and risk management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business - 631-5600 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your business - 631-5600 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit business - 631-5600 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing business - 631-5600 right away.

Can I edit business - 631-5600 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign business - 631-5600. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is business - 631-5600?

Business - 631-5600 is a form used for filing business taxes.

Who is required to file business - 631-5600?

Any business entity that generates income is required to file business - 631-5600.

How to fill out business - 631-5600?

Business - 631-5600 can be filled out online or by mail following the instructions provided by the tax authority.

What is the purpose of business - 631-5600?

The purpose of business - 631-5600 is to report and pay taxes on business income.

What information must be reported on business - 631-5600?

Business - 631-5600 requires reporting of income, expenses, deductions, and other relevant financial information.

Fill out your business - 631-5600 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business - 631-5600 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.