UK APSS263 2017-2025 free printable template

Show details

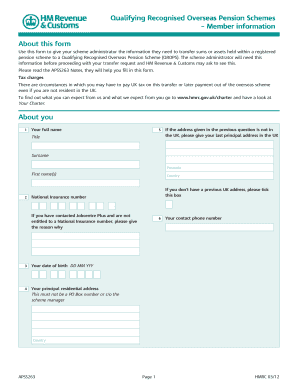

Please read the APSS263 Notes they will help you fill in this form. Tax charges There are circumstances in which you may have to pay UK tax on this transfer or later payment out of the overseas scheme even if you are not resident in the UK. About you Your full name Title If the address given in the previous question is not in the UK please give your last principal address in the UK Surname Postcode First name s Country If you don t have a previou...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hmrc apss263 form

Edit your apss263 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apss263 form 2017-2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing apss263 form 2017-2025 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit apss263 form 2017-2025. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK APSS263 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out apss263 form 2017-2025

How to fill out UK APSS263

01

Obtain the UK APSS263 form from the official government website or your local tax office.

02

Fill in your personal details accurately, including your name, address, and National Insurance number.

03

Provide the details of the income or capital gains for the relevant tax year.

04

Attach any necessary supporting documents, such as payslips or bank statements.

05

Review the form for accuracy and completeness.

06

Sign and date the form to confirm that the information is correct.

07

Submit the completed form according to the provided instructions, either electronically or via mail.

Who needs UK APSS263?

01

Individuals who have received income from self-employment, rental properties, or capital gains.

02

People claiming certain tax reliefs or exemptions associated with their income.

03

Those needing to report their earnings to HM Revenue and Customs (HMRC) for tax assessment.

Fill

form

: Try Risk Free

People Also Ask about

What is a receiving scheme?

receiving scheme means the trustees or administrators of an occupational pension scheme, a Personal Pension Scheme, annuity contract or policy or other pension arrangement which meets the requirements of section 95 1993 Act.

Can I transfer my defined benefit pension?

You can usually transfer a defined benefit pension to a new pension scheme at any time up to one year before the date when you're expected to start taking your pension. When you start taking your pension, you can't usually move your pension elsewhere.

What is apss263?

About this form Use this form to give your scheme administrator the information they need to transfer sums or assets held within a registered pension scheme to a Qualifying Recognised Overseas Pension Scheme (QROPS). You must provide this information to your scheme administrator within 60 days of your transfer request.

What type of pension do I have?

If you know you have a pension but are unsure what type of pension plan it is, the best thing to do is to get in touch with your pension provider. They will be able to give you all the details about your scheme, including what type it is, what charges you pay and how your pension is performing.

Can UK pension be transferred to India?

Submit the transfer forms: You must submit the completed transfer forms to your UK pension provider and the QROPS scheme in India. Your UK pension provider will transfer your pension to the QROPS scheme in India, subject to the approval of HMRC.

What is the difference between QNUPS and QROPS?

A QROPS is always a QNUPS, a QNUPS will not always be a QROPS. A QNUPS does not have to be registered with HMRC, which means no reports will have to be made regarding payments or benefits given to the holder. Funds in a QNUPS will not be subjected to Inheritance Tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send apss263 form 2017-2025 for eSignature?

Once you are ready to share your apss263 form 2017-2025, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an eSignature for the apss263 form 2017-2025 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your apss263 form 2017-2025 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit apss263 form 2017-2025 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share apss263 form 2017-2025 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is UK APSS263?

UK APSS263 is a tax form used in the United Kingdom to report specific information related to pensions under the Annual Allowance regime.

Who is required to file UK APSS263?

Individuals who have accessed their pension benefits in a particular tax year and have exceeded the Annual Allowance limits are required to file UK APSS263.

How to fill out UK APSS263?

To fill out UK APSS263, individuals need to provide details about their pension contributions, benefits accessed, and any applicable relief claimed. The form typically requires personal information, pension scheme details, and calculations of any excess contributions.

What is the purpose of UK APSS263?

The purpose of UK APSS263 is to ensure that individuals accurately report their pension contributions and any potential tax liabilities arising from exceeding the Annual Allowance.

What information must be reported on UK APSS263?

UK APSS263 requires reporting of personal details, pension scheme information, total contributions made, any benefits taken, and calculations of whether contributions exceeded the Annual Allowance.

Fill out your apss263 form 2017-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

apss263 Form 2017-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.