Get the free OW-8-P-SUP-I Annualized Income Installment Method for Individuals State Of Oklahoma ...

Show details

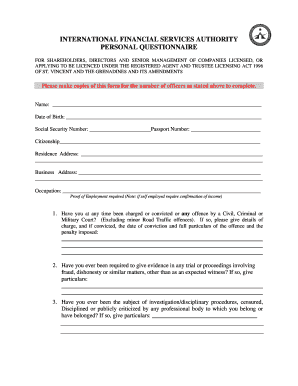

Annualized Income Installment Method for Individuals Name as shown on returnFORMState of OklahomaOW8PSUPI2 0 1 6Social Security NumberEnclose this form and Form OW8P with your return. Check the annualized

We are not affiliated with any brand or entity on this form

Instructions and Help about ow-8-p-sup-i annualized income installment

How to edit ow-8-p-sup-i annualized income installment

How to fill out ow-8-p-sup-i annualized income installment

Instructions and Help about ow-8-p-sup-i annualized income installment

How to edit ow-8-p-sup-i annualized income installment

To edit the ow-8-p-sup-i annualized income installment, use an online platform like pdfFiller. This tool allows you to fill in required fields, make corrections, and ensure your information is accurate before submitting.

How to fill out ow-8-p-sup-i annualized income installment

To fill out the ow-8-p-sup-i annualized income installment accurately, follow these steps:

01

Gather all relevant income information and previous installment payments.

02

Access the form on the IRS website or a reliable tax platform.

03

Fill in your personal information, including name, address, and taxpayer identification number.

04

Calculate your estimated tax liability and enter it in the appropriate sections.

05

Review the completed form for any errors before submission.

Latest updates to ow-8-p-sup-i annualized income installment

Latest updates to ow-8-p-sup-i annualized income installment

Stay informed about any updates to the ow-8-p-sup-i annualized income installment form by regularly checking the IRS website. Updates may include changes to filing requirements or deadlines that could affect your submission.

All You Need to Know About ow-8-p-sup-i annualized income installment

What is ow-8-p-sup-i annualized income installment?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About ow-8-p-sup-i annualized income installment

What is ow-8-p-sup-i annualized income installment?

The ow-8-p-sup-i annualized income installment is a specific IRS tax form used by certain taxpayers to report and calculate their tax liabilities on an annualized basis. This form is particularly relevant for individuals with fluctuating income levels throughout the year.

What is the purpose of this form?

The primary purpose of the ow-8-p-sup-i annualized income installment is to enable taxpayers who do not receive a steady income to estimate and pay their income tax liabilities correctly. This helps avoid overpayment or underpayment penalties.

Who needs the form?

Taxpayers who have non-regular income sources, such as self-employment earnings or investment income, may need to use the ow-8-p-sup-i annualized income installment. Individuals who anticipate owing more than $1,000 in taxes after subtracting withholding and refundable credits should also consider this form.

When am I exempt from filling out this form?

You may be exempt from filling out the ow-8-p-sup-i annualized income installment if you had no tax liability in the previous year or if your expected tax bill for the current year will be less than $1,000. Additionally, if your income derives solely from wages subject to withholding, this form may not be necessary.

Components of the form

The ow-8-p-sup-i annualized income installment includes sections for personal information, income reporting, and calculations for estimated tax payments. Key components include fields for total income, deductions, and credits that adjust the taxpayer's taxable income.

Due date

The due date for filing the ow-8-p-sup-i annualized income installment aligns with the general tax filing deadlines established by the IRS. Usually, individuals must file the form by April 15 for the previous calendar year's taxes, unless an extension is applied.

What are the penalties for not issuing the form?

Failing to submit the ow-8-p-sup-i annualized income installment when required may result in penalties. These can include a percentage of the unpaid taxes or an assessed interest on the amount due, compounding the liability over time.

What information do you need when you file the form?

When filing the ow-8-p-sup-i annualized income installment, ensure you have detailed records of all income sources, previous tax payments, and any relevant deductions or credits. This may include pay stubs, 1099 forms, and documentation of expenses that qualify as deductions.

Is the form accompanied by other forms?

While the ow-8-p-sup-i annualized income installment can be filed independently, taxpayers often need to file additional forms based on their overall tax situation. This could include supporting schedules or attachments that detail income sources and deductions.

Where do I send the form?

The completed ow-8-p-sup-i annualized income installment should be sent to the address specified in the form's instructions. This will typically depend on your state of residence; check the IRS instructions for the correct mailing address.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.