Get the free USED AUTO LOAN REQUIREMENT - pioneeronline

Show details

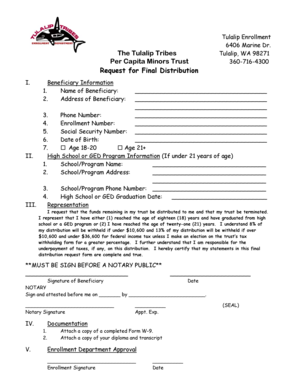

USED AUTO LOAN REQUIREMENT LOAN AMOUNT: LOAN TERM: INTEREST RATE: PROCESSING FEE: Up to $35,000 Maximum term60 months AS PER RATE AND FEE SCHEDULE AS PER RATE AND FEE SCHEDULE LOAN APPLICANTS QUALIFICATIONS:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign used auto loan requirement

Edit your used auto loan requirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your used auto loan requirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit used auto loan requirement online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit used auto loan requirement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out used auto loan requirement

01

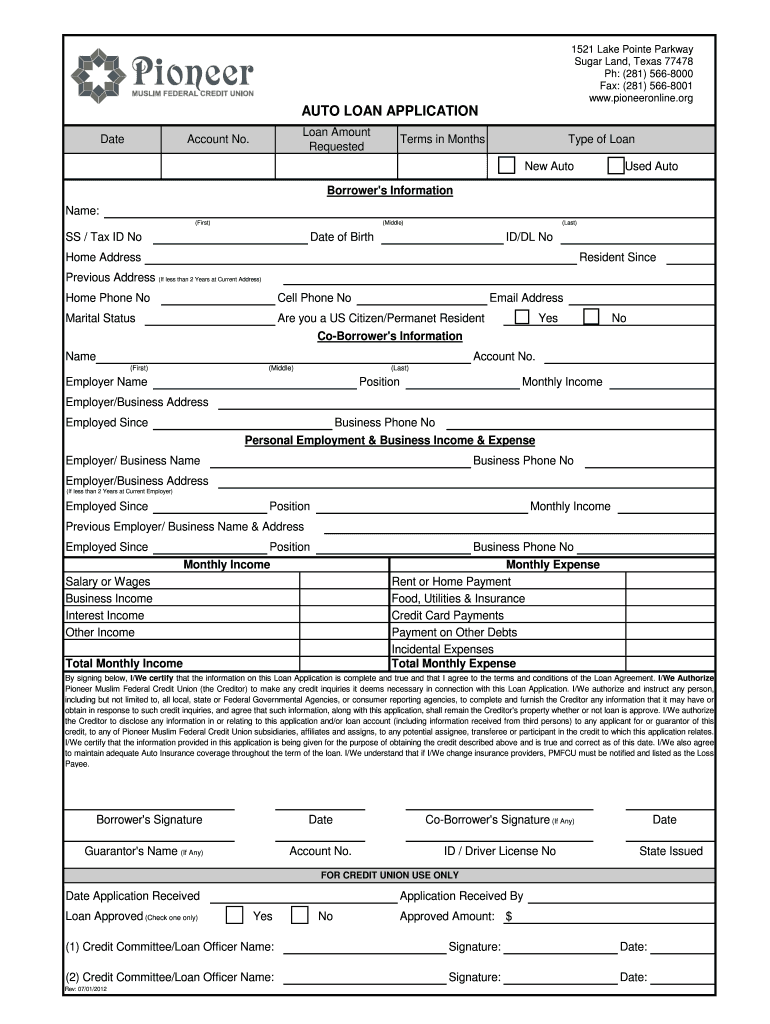

To fill out a used auto loan requirement, start by gathering all the necessary documentation. This typically includes your identification documents, proof of income, proof of residence, and your credit history.

02

Next, you will need to find a reputable financial institution or lender that offers used auto loans. Research different options to find the best interest rates and terms that suit your needs.

03

Once you've selected a lender, visit their website or contact them directly to request an application form for a used auto loan. They will likely have an online form that you can fill out or will send you a physical form via email or mail.

04

Begin the application by providing your personal details, including your name, address, contact information, and social security number. Be sure to double-check the accuracy of these details before submitting them.

05

The application will also require information about the used vehicle you intend to purchase. This may include the make, model, year, mileage, and VIN (Vehicle Identification Number). You may also need to provide details about the seller and the purchase price.

06

Along with the application form, you will typically need to submit the necessary supporting documents. This may include your identification documents, recent pay stubs or proof of income, bank statements, and any other documents requested by the lender.

07

It is crucial to be honest and accurate in filling out the application and providing the required documents. Inaccurate or false information could lead to an automatic rejection of your application and may even have legal consequences.

08

After completing the application and submitting all the necessary documents, you may need to wait for the lender's review and approval. This process can take anywhere from a few hours to a few days, depending on the lender's policies and workload.

09

Once your used auto loan requirement is approved, the lender will provide you with the loan terms and conditions. Review these carefully, including the interest rate, repayment schedule, and any additional fees or charges.

Who needs used auto loan requirement?

01

Individuals who want to purchase a used vehicle but don't have enough cash on hand to cover the full cost.

02

People who prefer monthly installments and spreading out the payment over time.

03

Individuals with a good credit history who can qualify for lower interest rates and better loan terms.

04

Those who want to establish or improve their credit by responsibly paying back a loan.

Remember, each lender may have slightly different requirements and procedures for filling out a used auto loan application. It's essential to consult with the specific lender you plan to work with for precise instructions and guidance throughout the process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send used auto loan requirement to be eSigned by others?

Once you are ready to share your used auto loan requirement, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the used auto loan requirement form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign used auto loan requirement and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete used auto loan requirement on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your used auto loan requirement. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is used auto loan requirement?

Used auto loan requirement refers to the criteria and documents needed in order to obtain a loan for a used vehicle.

Who is required to file used auto loan requirement?

Any individual or organization looking to finance the purchase of a used vehicle through a loan is required to provide the necessary information for the used auto loan requirement.

How to fill out used auto loan requirement?

To fill out the used auto loan requirement, one typically needs to provide personal and financial information, details about the vehicle being purchased, and any other required documentation from the lender.

What is the purpose of used auto loan requirement?

The purpose of the used auto loan requirement is to ensure that the borrower has the means to repay the loan and that the vehicle being financed meets certain criteria set by the lender.

What information must be reported on used auto loan requirement?

The information required on the used auto loan requirement may include personal identification, income verification, credit history, details about the vehicle, and any additional documentation requested by the lender.

Fill out your used auto loan requirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Used Auto Loan Requirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.