Canada Alberta EMP3428 2013 free printable template

Show details

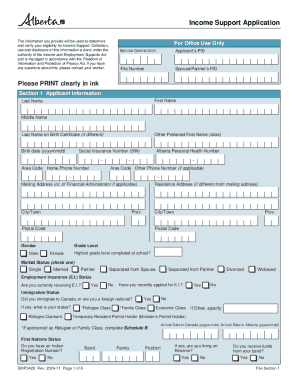

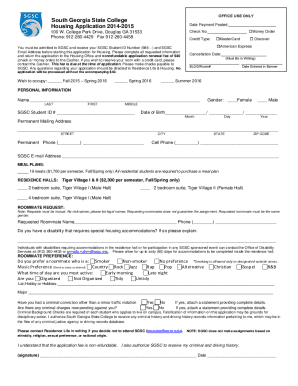

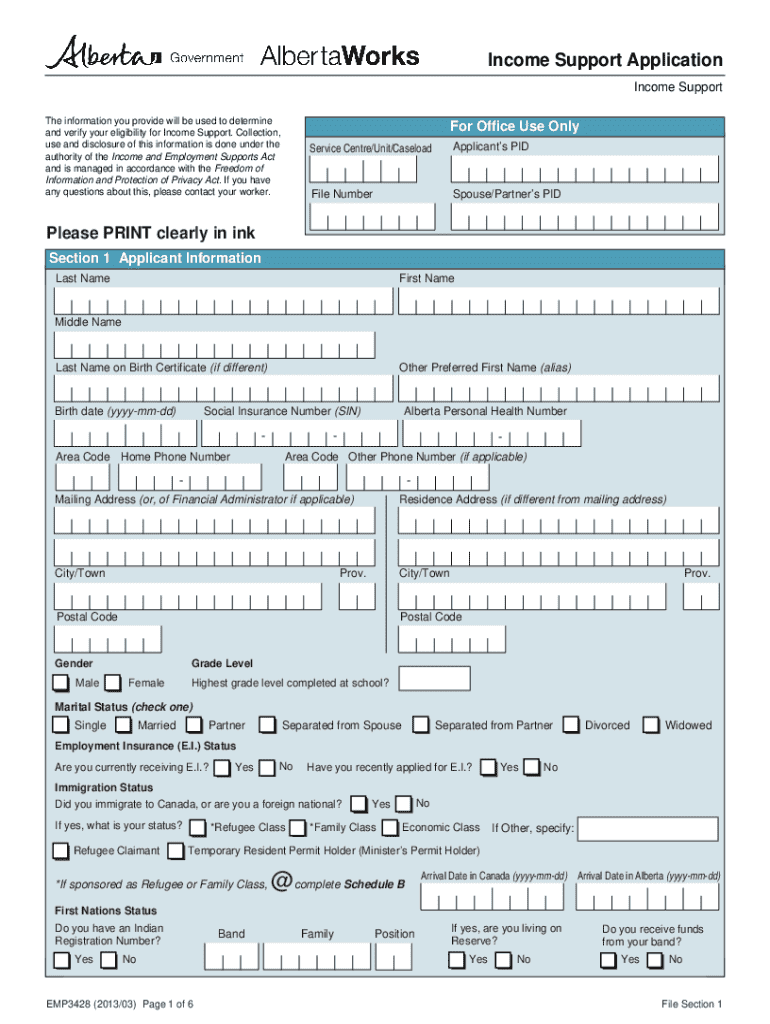

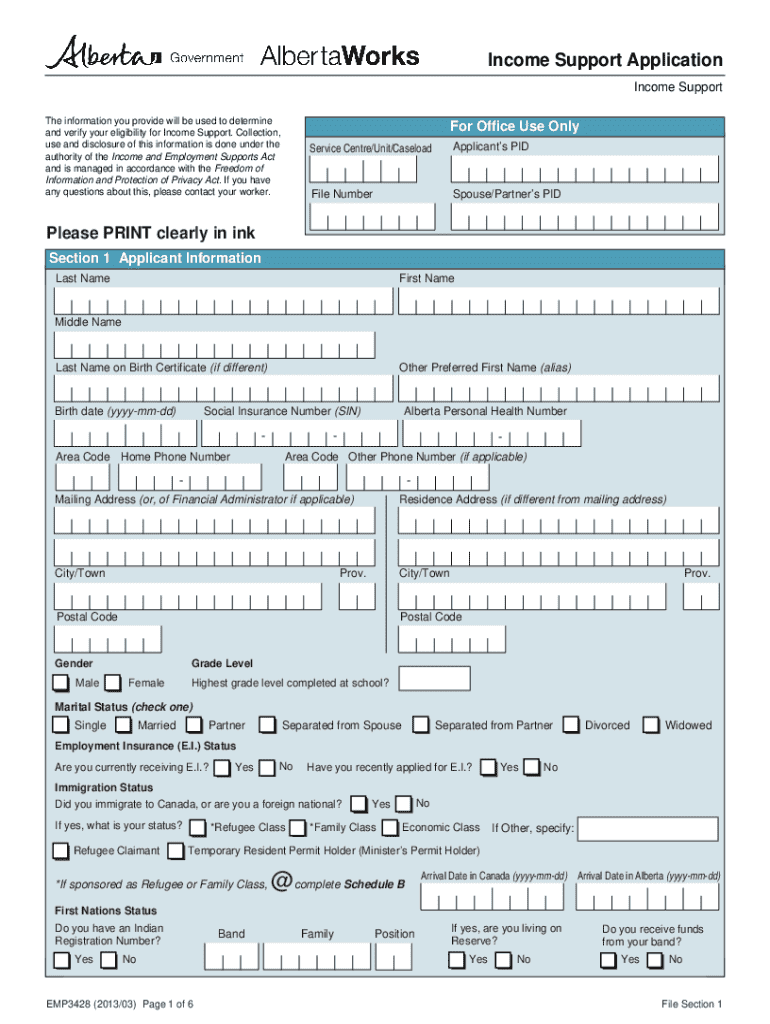

Income Support Application Introduction Alberta Works helps people who can work find and keep jobs and helps individuals and families meet their basic needs. Documents - You will be required to bring in the following information. Further documents may be required. Completed Income Support Application and Schedules if required Completed Direct Deposit Registration Identification ID For you your spouse/partner or financial administrator a document s with name picture signature and birth...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada Alberta EMP3428

Edit your Canada Alberta EMP3428 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada Alberta EMP3428 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada Alberta EMP3428 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada Alberta EMP3428. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada Alberta EMP3428 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada Alberta EMP3428

How to fill out Canada Alberta EMP3428

01

Start by downloading the Canada Alberta EMP3428 form from the official website.

02

Review the instructions provided with the form carefully.

03

Fill out your personal information at the top, including your name, address, and contact information.

04

Complete the financial information section, ensuring all figures are accurate and supported by documentation.

05

Provide details about the specific project or activity you are applying for, including project name and description.

06

Attach any necessary supporting documents as outlined in the form instructions.

07

Review the entire form for completeness and accuracy before submission.

08

Submit the form to the appropriate department or office as indicated in the instructions.

Who needs Canada Alberta EMP3428?

01

Individuals or organizations seeking funding or support for projects in Alberta.

02

Businesses looking to apply for government grants or assistance in Alberta.

03

Non-profits and community organizations needing financial backing for initiatives.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact income support in NL?

1, 2023 (from the news release): Benefit increases are based on the consumer price index for 2022 and benefit rates vary depending on Albertans' needs, household composition and other factors. Examples based on the maximum core monthly benefit rates for single people with no children: $1,685 to $1,787 – AISH.

What is the cost of living relief payment in NL?

Do I qualify for the payment? The one-time cost of living relief cheque of up to $500 is available to residents of the province who have reached the age of 18 years old as of December 31, 2022 and who filed a 2021 Newfoundland and Labrador tax return with an adjusted income of $125,000 or less.

What is income support in NL?

Components of welfare incomes, 2021 Basic social assistanceUnattached single considered employable$9,048Unattached single with a disability$8,196Single parent, one child$13,644Couple, two children$14,22036 more rows

What is the gov nl disability tax credit?

If found eligible for the DTC, an adult can receive approximately $2,000 per year, and if you care for a child with impairments, you can receive about $4,000 per year in credits and benefits.

What is considered low income in NL?

The Low Income Tax Reduction (LITR) is a provincial personal income tax reduction for low income individuals and families. For the 2022 taxation year, the LITR will eliminate provincial income tax for individuals with net income up to $21,196 or for families with net income up to $35,842.

What is considered income support in NL?

Income Support Benefits include basic and non-basic financial supports such as: Basic Benefits: Family and Individual Benefit (to assist with expenses such as food, clothing, personal care, household maintenance and utilities) Shelter (Including rent and mortgage)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada Alberta EMP3428 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your Canada Alberta EMP3428 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in Canada Alberta EMP3428 without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing Canada Alberta EMP3428 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit Canada Alberta EMP3428 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share Canada Alberta EMP3428 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is Canada Alberta EMP3428?

Canada Alberta EMP3428 is a reporting form used by employers in Alberta to report employee payroll information and calculate the provincial remittance of employee deductions.

Who is required to file Canada Alberta EMP3428?

Employers in Alberta who have employees and are required to remit payroll deductions to the provincial government must file the Canada Alberta EMP3428.

How to fill out Canada Alberta EMP3428?

To fill out Canada Alberta EMP3428, employers must provide their business information, report the total payroll amounts, calculate the deductions for each employee, and include the amounts remitted to the provincial government.

What is the purpose of Canada Alberta EMP3428?

The purpose of Canada Alberta EMP3428 is to ensure that employers accurately report payroll information and remit the correct amount of employee deductions to the Alberta government.

What information must be reported on Canada Alberta EMP3428?

Information that must be reported on Canada Alberta EMP3428 includes the employer's details, total payroll amounts, individual employee earnings, and the corresponding deductions for income tax, Canada Pension Plan (CPP), and Employment Insurance (EI).

Fill out your Canada Alberta EMP3428 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Alberta emp3428 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.