Get the free Fiscal Year 2018, 2019, & 2020 Application for CDBG and ... - sccgov

Show details

COUNTY OF SANTA CLARA Fiscal Year 2018, 2019, & 2020 Application for CBG and HOME Funding Threadier Funding Cycle Community Development Block Grant Program Home Investment Partnership Program NOVA

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal year 2018 2019

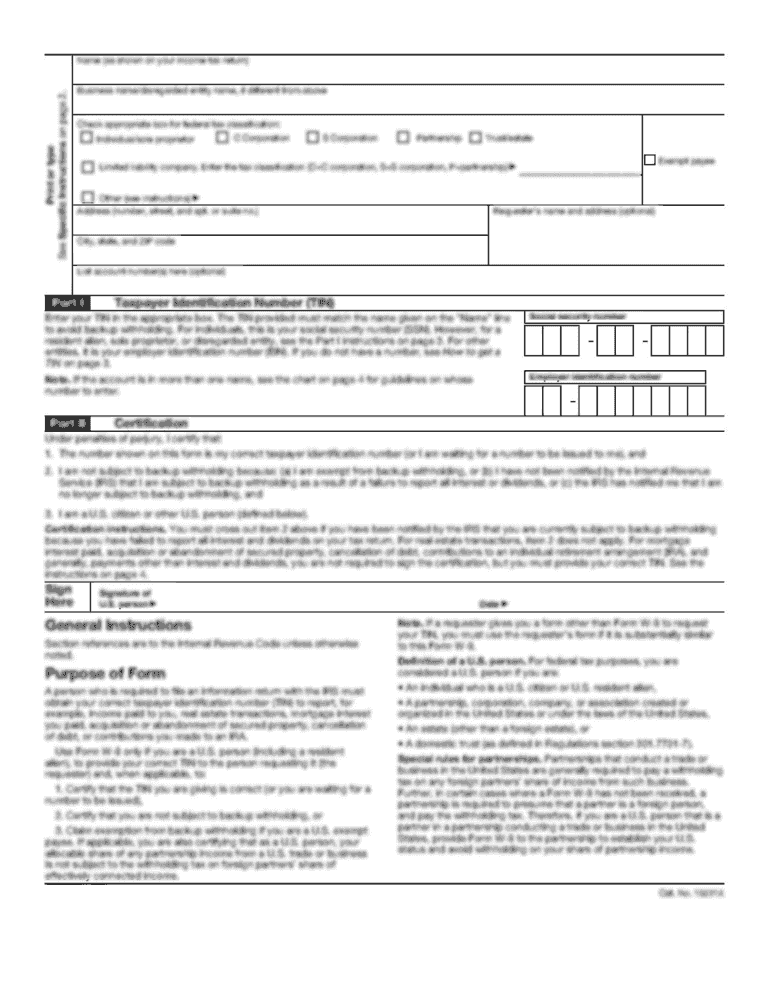

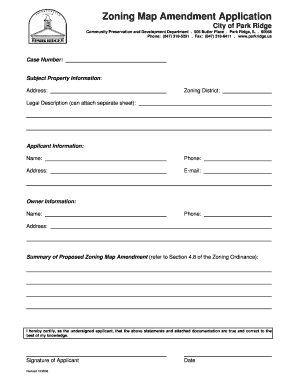

Edit your fiscal year 2018 2019 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal year 2018 2019 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiscal year 2018 2019 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fiscal year 2018 2019. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal year 2018 2019

How to fill out fiscal year 2018 2019

01

Start by gathering all the necessary financial documents for the fiscal year 2018-2019, including income statements, balance sheets, and tax records.

02

Review the previous year's financial data to understand any trends or patterns that can help in the filling process.

03

Organize the financial documents in a systematic manner, ensuring that they are properly labeled and sorted for easy reference.

04

Identify the applicable financial reporting standards and guidelines for the fiscal year 2018-2019, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

05

Carefully fill out the necessary financial statements, such as the income statement and balance sheet, using the gathered financial data and following the established reporting guidelines.

06

Double-check all the entered information for accuracy and make any necessary adjustments or corrections.

07

Prepare supporting schedules or disclosures required for specific financial statement items, such as notes to the financial statements or statement of cash flows.

08

Ensure that the completed fiscal year 2018-2019 financial statements comply with all relevant regulations and reporting requirements.

09

Submit the filled-out financial statements and any accompanying documents to the appropriate authorities or stakeholders, such as the company's shareholders, board of directors, or regulatory agencies.

10

Keep a copy of the completed fiscal year 2018-2019 financial statements for future reference and auditing purposes.

Who needs fiscal year 2018 2019?

01

Businesses and corporations who wish to maintain transparent financial records and report their financial performance to stakeholders and regulatory authorities.

02

Investors and shareholders who are interested in understanding the financial health and performance of a company for investment or decision-making purposes.

03

Financial analysts and auditors who need accurate and reliable financial statements to assess the financial position, profitability, and compliance of an entity.

04

Government agencies and regulatory bodies that require businesses to submit annual financial statements for monitoring and oversight purposes.

05

Non-profit organizations and charitable institutions that need to demonstrate financial accountability and transparency to donors and governing bodies.

06

Banks and lending institutions that assess a company's financial statements to determine creditworthiness and loan eligibility.

07

Entrepreneurs and start-ups who need to track their financial performance and make informed business decisions based on the fiscal year's financial data.

08

Small businesses and self-employed individuals who need to meet their tax obligations by reporting accurate income and expenses for the fiscal year.

09

Legal entities involved in mergers, acquisitions, or other business transactions that require comprehensive financial information for due diligence and valuation purposes.

10

Academic institutions and researchers who analyze financial data for studies, reports, and forecasting purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fiscal year 2018 2019 for eSignature?

When you're ready to share your fiscal year 2018 2019, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit fiscal year 2018 2019 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your fiscal year 2018 2019, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit fiscal year 2018 2019 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing fiscal year 2018 2019, you need to install and log in to the app.

What is fiscal year amp application?

The fiscal year amp application is a form that businesses use to report their financial information for a specific period of time.

Who is required to file fiscal year amp application?

All businesses are required to file a fiscal year amp application to report their financial information.

How to fill out fiscal year amp application?

To fill out the fiscal year amp application, businesses need to provide detailed financial information such as income, expenses, assets, and liabilities.

What is the purpose of fiscal year amp application?

The purpose of the fiscal year amp application is to provide the government and other stakeholders with an accurate picture of a business's financial health.

What information must be reported on fiscal year amp application?

Businesses must report detailed financial information such as income, expenses, assets, and liabilities on the fiscal year amp application.

Fill out your fiscal year 2018 2019 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Year 2018 2019 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.