Get the free Contractors39 bExcise Tax Returnb - State of South Dakota - state sd

Show details

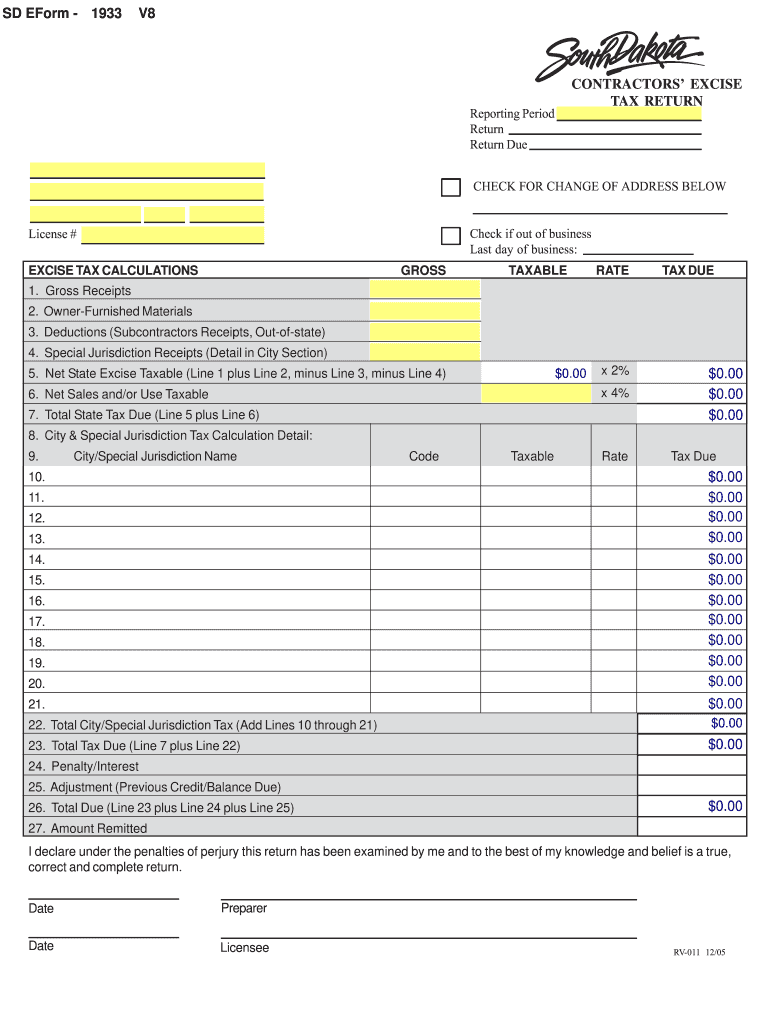

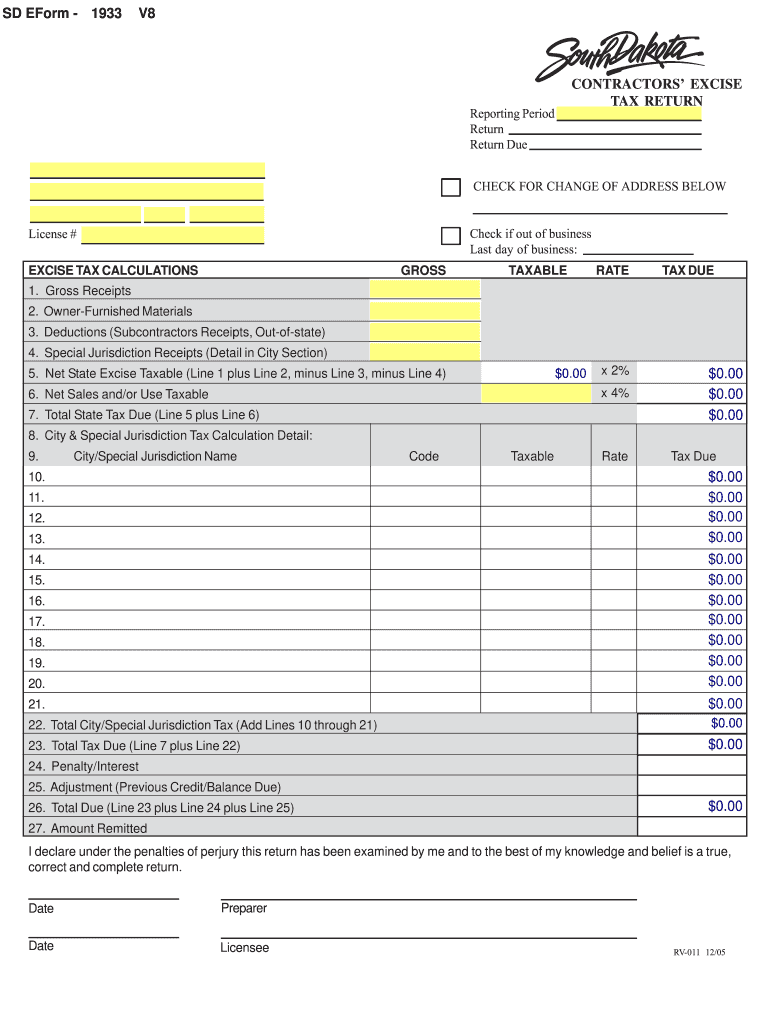

SDE Form 1933 V8 Complete and use the button at the end to print for mailing. HELP CONTRACTORS EXCISE TAX RETURN Reporting Period Return Due F CHECK FOR CHANGE OF ADDRESS BELOW Check if out of business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contractors39 bexcise tax returnb

Edit your contractors39 bexcise tax returnb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contractors39 bexcise tax returnb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contractors39 bexcise tax returnb online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit contractors39 bexcise tax returnb. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contractors39 bexcise tax returnb

How to fill out contractors' excise tax return:

01

Gather necessary information: Before starting the tax return process, make sure to collect all the relevant information, including your personal details, income and expenses related to your contracting business, and any supporting documents such as invoices, receipts, and financial statements.

02

Determine which IRS form to use: Contractors typically use Form 720, "Quarterly Federal Excise Tax Return," to report and pay their excise taxes. Make sure to download the most recent version of the form from the IRS website.

03

Complete the personal information section: Fill out your name, address, Social Security number or Employer Identification Number (EIN), and other required details on the top section of the form. Double-check for accuracy to avoid any delays or errors.

04

Report excise tax liabilities: Review the instructions provided with Form 720 to identify the specific excise taxes applicable to your contracting business. Common excise taxes for contractors include those related to fuel, transportation, communication, and environmental activities. Enter the required information in the appropriate boxes on the form.

05

Calculate the tax amount: Use the provided instructions to calculate the excise tax amount owed for each taxable category. Ensure accuracy in your calculations to prevent any discrepancies with the IRS.

06

Include any tax credits or deductions: Determine if you are eligible for any tax credits or deductions that can offset the excise tax amount. Common examples include fuel tax credits or environmental incentives. Follow the instructions to complete the relevant sections on the form.

07

Report any previous overpayments or underpayments: If you have overpaid or underpaid your excise taxes in the past, adjust the amount accordingly on the form. This will help reconcile any discrepancies and ensure accurate tax reporting.

08

Double-check for completeness: Before submission, carefully review the entire form to ensure all required information has been provided accurately. Verify that all calculations are correct and that no essential details have been overlooked.

09

Sign and submit the form: Once you are satisfied with the information provided, sign and date the form in the appropriate section. Keep a copy for your records and submit the completed form to the IRS by the designated due date.

Who needs contractors' excise tax return?

01

Contractors engaged in activities subject to excise taxes: If you are involved in certain contracting activities that are subject to federal excise taxes, such as the sale of specific goods or services, you are required to file a contractors' excise tax return.

02

Contractors reaching the filing threshold: The IRS sets specific thresholds for reporting and paying excise taxes. If your contracting business has reached or exceeded these thresholds, you must file a contractors' excise tax return.

03

Contractors with specific excise tax liabilities: Different categories of contractors may have different excise tax liabilities based on their business activities. It is essential to review the IRS guidelines to determine if your contracting business falls within the scope of excise tax requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is the excise tax in South Dakota?

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects.

What is a contractors excise tax South Dakota?

Contractor's excise tax is imposed on the gross receipts of all prime contractors engaged in construction services or realty improvement projects in South Dakota (SDCL 10-46A). The gross receipts would include the tax collected from the consumer.

How do I pay my SD excise tax?

Returns may be filed either on paper returns or electronically through our online Filing and Tax Payment portal. Returns are due by the 20th of the month. Payments if you file on paper returns are also due on the 20th of the month. Payments submitted electronically are due by the 25th of the month.

How is an excise tax different from a sales tax?

Sales tax applies to almost anything you purchase while excise tax only applies to specific goods and services. Sales tax is typically applied as a percentage of the sales price while excise tax is usually applied at a per unit rate.

What is South Dakota sales and excise tax?

The South Dakota sales tax and use tax rates are 4.5%.

What is the vehicle excise tax in South Dakota?

Motor vehicles registered in the State of South Dakota are subject to the 4% motor vehicle excise tax. Mobile / Manufactured homes are subject to the 4% initial registration fee. All fees are assessed from purchase date regardless of when an applicant applies for title and registration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send contractors39 bexcise tax returnb for eSignature?

When you're ready to share your contractors39 bexcise tax returnb, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How can I get contractors39 bexcise tax returnb?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the contractors39 bexcise tax returnb. Open it immediately and start altering it with sophisticated capabilities.

How do I execute contractors39 bexcise tax returnb online?

pdfFiller has made filling out and eSigning contractors39 bexcise tax returnb easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is contractors' excise tax return?

Contractors' excise tax return is a form used by contractors to report and pay taxes on certain construction activities.

Who is required to file contractors' excise tax return?

Contractors who engage in construction activities that are subject to excise tax are required to file contractors' excise tax return.

How to fill out contractors' excise tax return?

Contractors can fill out the excise tax return by providing information on their construction activities, gross receipts, and calculating the tax due.

What is the purpose of contractors' excise tax return?

The purpose of contractors' excise tax return is to report and pay taxes on construction activities that are subject to excise tax.

What information must be reported on contractors' excise tax return?

Contractors must report information on their construction activities, gross receipts, and calculate the tax due on their excise tax return.

Fill out your contractors39 bexcise tax returnb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

contractors39 Bexcise Tax Returnb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.