Get the free INDEMNITY BOND for loss of certificate

Show details

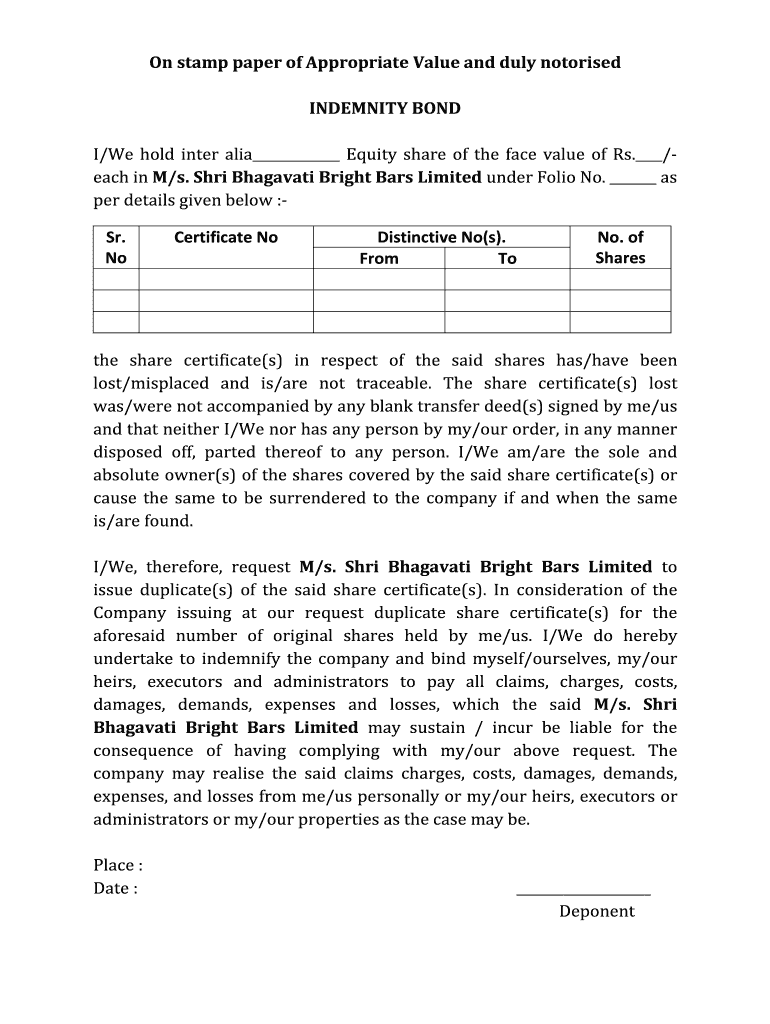

On stamp paper of Appropriate Value and duly motorized INDEMNITY BOND I/We hold inter alia Equity share of the face value of Rs. /each in M/s. Sari Bhagavān Bright Bars Limited under Folio No. as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indemnity bond for loss

Edit your indemnity bond for loss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indemnity bond for loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indemnity bond for loss online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit indemnity bond for loss. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indemnity bond for loss

How to fill out indemnity bond for loss

01

To fill out an indemnity bond for loss, follow these steps:

02

Start by obtaining the necessary form for the indemnity bond. This form can usually be found online or obtained from the relevant authority or institution.

03

Begin by providing your personal information in the designated fields. This may include your full name, address, contact details, and any identifying information required.

04

Next, mention the details of the loss for which the indemnity bond is being filled out. Provide a clear and concise description of the nature of the loss and any relevant information pertaining to it.

05

Proceed to specify the amount of indemnity being sought or provided. This should be mentioned in a clear and unambiguous manner, using the appropriate currency and numerical format.

06

If there are any additional terms or conditions that need to be included in the indemnity bond, make sure to list them accurately. These may include clauses related to liabilities, penalties, or any specific requirements of the relevant authority.

07

Once all the relevant information has been filled out, carefully review the indemnity bond to ensure accuracy and completeness. Double-check all the provided details for any errors or omissions.

08

If required, have the indemnity bond witnessed or notarized by a qualified individual or authority. This helps to ensure the validity and enforceability of the document.

09

Finally, sign and date the indemnity bond in the designated spaces, indicating your agreement to the terms and conditions specified.

10

Keep a copy of the filled-out indemnity bond for your records, and submit the original to the appropriate party or authority as required.

11

Note: It is advisable to seek professional advice or guidance when filling out an indemnity bond, especially if it involves complex legal or financial matters.

Who needs indemnity bond for loss?

01

Indemnity bonds for loss may be required by various individuals or entities, depending on the specific circumstances and legal requirements. Typically, the following parties may need an indemnity bond for loss:

02

- Executors or administrators of estates when distributing assets to beneficiaries to protect against any potential claims or disputes.

03

- Insurance companies when dealing with indemnity claims made by policyholders for various types of losses, such as property damage or personal injury.

04

- Individuals or businesses involved in a contractual agreement that requires one party to indemnify the other in case of specified losses or damages.

05

- Financial institutions or lenders when granting loans or credit facilities, especially in cases where collateral or guarantees are involved.

06

- Local governments or regulatory authorities when issuing licenses or permits, to ensure compliance with applicable laws and regulations.

07

- Courts or legal entities when seeking indemnification for losses incurred due to legal actions or judgments.

08

The specific requirements for an indemnity bond may vary depending on the jurisdiction and the nature of the loss involved. It is always recommended to consult with the relevant authorities or legal professionals to determine if an indemnity bond is necessary in a particular situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send indemnity bond for loss for eSignature?

Once you are ready to share your indemnity bond for loss, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit indemnity bond for loss online?

The editing procedure is simple with pdfFiller. Open your indemnity bond for loss in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my indemnity bond for loss in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your indemnity bond for loss and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is indemnity bond for loss?

An indemnity bond for loss is a legal document where one party agrees to compensate another party in case of any loss, damage or injury.

Who is required to file indemnity bond for loss?

The party responsible for causing the loss or damage is usually required to file an indemnity bond for loss.

How to fill out indemnity bond for loss?

To fill out an indemnity bond for loss, one needs to provide details of the parties involved, description of the loss or damage, and the compensation agreed upon.

What is the purpose of indemnity bond for loss?

The purpose of an indemnity bond for loss is to provide assurance to the affected party that they will be compensated for any loss or damage incurred.

What information must be reported on indemnity bond for loss?

The information that must be reported on an indemnity bond for loss includes details of the parties involved, description of the loss or damage, and the compensation amount.

Fill out your indemnity bond for loss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indemnity Bond For Loss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.