Get the free us anti money laundering filled form

Show details

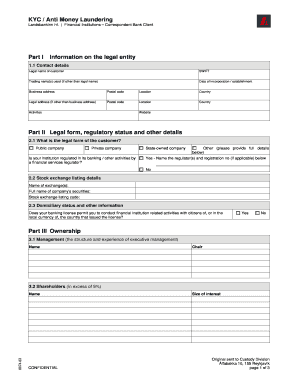

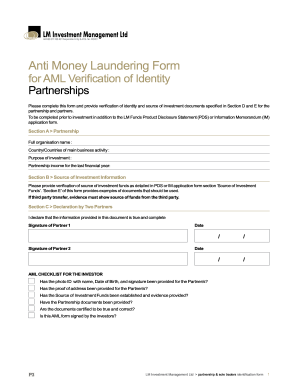

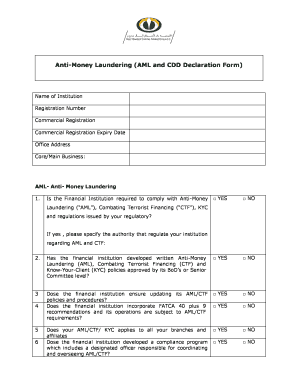

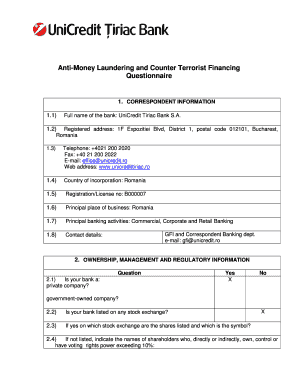

Antimony laundering from This form provides confirmation of verification of identity of a private individual for business introduced Nucleus Client Relations by an FCA regulated firm. Please fill

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us anti money laundering

Edit your us anti money laundering form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us anti money laundering form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us anti money laundering online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit us anti money laundering. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us anti money laundering

How to fill out US anti-money laundering:

01

Understand the guidelines: Familiarize yourself with the laws and regulations related to anti-money laundering (AML) in the United States. This includes the Bank Secrecy Act (BSA) and the USA PATRIOT Act.

02

Conduct risk assessment: Evaluate your business or organization's specific risks and vulnerabilities to money laundering. This involves evaluating customer profiles, transaction patterns, and geographic locations that may pose higher risks.

03

Develop written policies and procedures: Create a comprehensive AML program that outlines your organization's policies and procedures for detecting and preventing money laundering. This should include customer due diligence (CDD), Know Your Customer (KYC) requirements, and reporting suspicious activities.

04

Appoint a compliance officer: Designate an individual within your organization who will be responsible for overseeing and implementing the AML program. This person should have sufficient knowledge and authority to effectively manage compliance efforts.

05

Train employees: Provide training to employees on AML laws, regulations, and internal policies. This will help them recognize and report suspicious activities, understand their role in AML compliance, and ensure consistent adherence to the AML program.

06

Implement customer due diligence measures: Establish a process for verifying the identity of customers and conducting ongoing monitoring of their transactions. This may include collecting customer identification information, conducting background checks, and periodically reviewing and updating customer records.

07

Monitor transactions: Implement a robust system for monitoring and analyzing transactions to detect unusual or suspicious activities. This may involve using automated systems, data analytics, and risk-based monitoring techniques.

08

Report suspicious activities: Establish procedures for reporting suspicious transactions or activities to the appropriate authorities. This typically involves filing Suspicious Activity Reports (SARs) with the Financial Crimes Enforcement Network (FinCEN) or other designated agencies.

09

Conduct periodic reviews and audits: Regularly assess the effectiveness of your AML program through internal audits and independent reviews. This will help identify any weaknesses or gaps in your program and allow for necessary improvements.

Who needs US anti-money laundering:

01

Financial institutions: Banks, credit unions, broker-dealers, mutual funds, insurance companies, and other financial institutions are subject to AML requirements in the United States. They play a crucial role in preventing money laundering and terrorist financing.

02

Non-financial businesses: Certain non-financial businesses, such as casinos, money services businesses (MSBs), dealers in precious metals, stones, or jewels, and virtual currency exchanges or administrators, are also required to comply with AML regulations. This is to prevent illicit funds from entering legitimate businesses.

03

Professionals and advisors: Lawyers, accountants, real estate agents, and other professionals who engage in high-value transactions or provide services to clients involved in financial activities are also subject to AML obligations. They are expected to conduct due diligence, report suspicious activities, and comply with AML regulations.

It is important to note that the specific requirements and obligations for AML compliance may vary depending on the type of business or organization. Compliance should be tailored to meet the specific needs and risks of your industry.

Fill

form

: Try Risk Free

People Also Ask about

What documents are required for anti money laundering?

Below is a list of acceptable documents Valid passport with full MRZ (machine readable zone). Valid photo card driving licence (full and provisional). Valid national identity card with MRZ. Valid firearms certificate/shotgun licence. Valid biometric residence permit.

What is the full form of anti money laundering?

Anti Money Laundering (AML), also known as anti-money laundering, is the execution of transactions to eventually convert illegally obtained money into legal money.

What are the 3 stages of AML?

Key stages such as 'placement', where illegal funds are introduced into the financial system, 'layering', which involves complex transactions to hide the source of funds, and 'integration', where 'clean' money is reintegrated into the economy, are often overlapped or conducted simultaneously.

What are the 3 stages of anti money laundering?

These three stages of money laundering are: Placement. Layering. Integration/extraction.

How do I get an anti money laundering certificate in USA?

How to get an AML certification Earn a degree. Typically, AML specialists have at least a bachelor's degree in finance, economics, financial management or a similar discipline. Earn AML or banking experience. Prepare for your ACAMS exam. Pass the ACAMS or equivalent exam. Apply for AML positions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit us anti money laundering online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your us anti money laundering to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the us anti money laundering in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your us anti money laundering.

How do I edit us anti money laundering on an iOS device?

You certainly can. You can quickly edit, distribute, and sign us anti money laundering on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is US anti-money laundering?

US anti-money laundering (AML) refers to the regulations and laws designed to prevent individuals and organizations from disguising illegally obtained funds as legitimate income. It involves various measures and practices implemented by financial institutions to detect and report potential money laundering activities.

Who is required to file US anti-money laundering?

Entities that are required to file under US anti-money laundering regulations include banks, credit unions, mortgage companies, money services businesses, securities firms, and casinos, among others. Any institution that deals with large cash transactions or financial services is subject to AML rules.

How to fill out US anti-money laundering?

To fill out US anti-money laundering reports, such as Suspicious Activity Reports (SARs) or Currency Transaction Reports (CTRs), an institution must provide detailed information regarding the transaction, including the parties involved, the amount of the transaction, the nature of the suspicious activity, and any other relevant details that may assist law enforcement.

What is the purpose of US anti-money laundering?

The purpose of US anti-money laundering laws is to protect the financial system from being used to disguise illicit funds. It aims to detect and prevent money laundering activities, enhance law enforcement's ability to track down criminals, and promote a transparent and trustworthy financial environment.

What information must be reported on US anti-money laundering?

Information that must be reported under US anti-money laundering regulations includes details about the transaction, the parties involved, the reason for suspicion, amounts transferred, and any supporting documentation that can help clarify the nature of the transaction or the suspicious activity.

Fill out your us anti money laundering online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Anti Money Laundering is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.