Get the free NEW FUTURES AND OPTIONS ACCOUNT FORMS INFORMATION

Show details

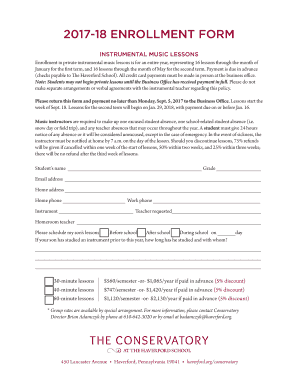

NEW FUTURES AND OPTIONS ACCOUNT FORMS INFORMATION Welcome! Thank you for choosing Far Direct as your futures and options broker. Please refer to the Account Opening Instructions found on Page 2 of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new futures and options

Edit your new futures and options form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new futures and options form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new futures and options online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new futures and options. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new futures and options

How to fill out new futures and options:

01

Read and understand the terms and conditions: Before filling out any application for new futures and options, it is crucial to thoroughly read and comprehend the terms and conditions provided by the institution or platform offering these financial products. It is important to understand the risks involved, the fees associated, and any specific requirements.

02

Gather necessary information: Be prepared to provide personal and financial information such as name, address, contact details, social security number, and employment details. Additionally, you may need to provide information about your investment experience, financial goals, and risk tolerance.

03

Select the appropriate type of futures or options: Depending on your investment objectives and risk appetite, choose the type of futures or options that best suit your needs. Common types include equity futures, commodity futures, index futures, call options, and put options. Research and consider the underlying assets, expiration dates, and strike prices when selecting these instruments.

04

Fill out the application form: Once you have gathered all the necessary information, complete the application form provided by the institution or platform. Double-check your inputs for accuracy and legibility. Ensure that all required fields are filled out correctly and any necessary documentation is attached.

05

Review and understand the risks: Take time to review and understand the risks involved with futures and options trading. These derivatives can be complex financial instruments, and it is essential to be aware of the potential for losses and the volatility of the markets. Seek professional advice if needed.

06

Submit the application: After thoroughly reviewing your application form, attach any required supporting documentation and submit it to the designated institution or platform. Follow their instructions for submission, which may include in-person delivery, mailing, or online submission via their website or trading platform.

Who needs new futures and options:

01

Investors seeking diversification: Individuals looking to diversify their investment portfolios may benefit from including futures and options in their overall strategy. These instruments allow exposure to different asset classes, such as commodities, currencies, or indices, which can potentially reduce risk and enhance returns.

02

Speculators and traders: Futures and options provide opportunities for speculators and short-term traders looking to profit from the price movements in various markets. The leverage and flexibility offered by these instruments make them attractive to those who aim to capitalize on short-term market trends and fluctuations.

03

Hedgers: Businesses or individuals who have exposure to price fluctuations in underlying assets can use futures and options to hedge their positions. By locking in future prices or limiting potential losses through options, hedgers can protect themselves against adverse market movements.

Overall, new futures and options can be beneficial for a wide range of investors and traders, depending on their objectives and risk tolerance. However, it is essential to thoroughly understand the products, associated risks, and seek expert advice if needed before engaging in futures and options trading.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is new futures and options?

New futures and options refer to recently introduced financial instruments for investors to speculate on the future price movements of assets.

Who is required to file new futures and options?

Individuals or entities involved in trading new futures and options are required to file reports with the appropriate regulatory authorities.

How to fill out new futures and options?

To fill out new futures and options, one must provide accurate information about the trade, including the asset, quantity, price, and expiration date.

What is the purpose of new futures and options?

The purpose of new futures and options is to provide investors with tools for managing risk, hedging positions, and speculating on price movements in financial markets.

What information must be reported on new futures and options?

Information that must be reported on new futures and options includes details of the trade, such as the asset type, quantity, price, and expiration date.

How can I get new futures and options?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific new futures and options and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit new futures and options straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit new futures and options.

How do I fill out the new futures and options form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign new futures and options and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your new futures and options online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Futures And Options is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.