Get the free Amount due: $2,289 - IRS Solutions

Show details

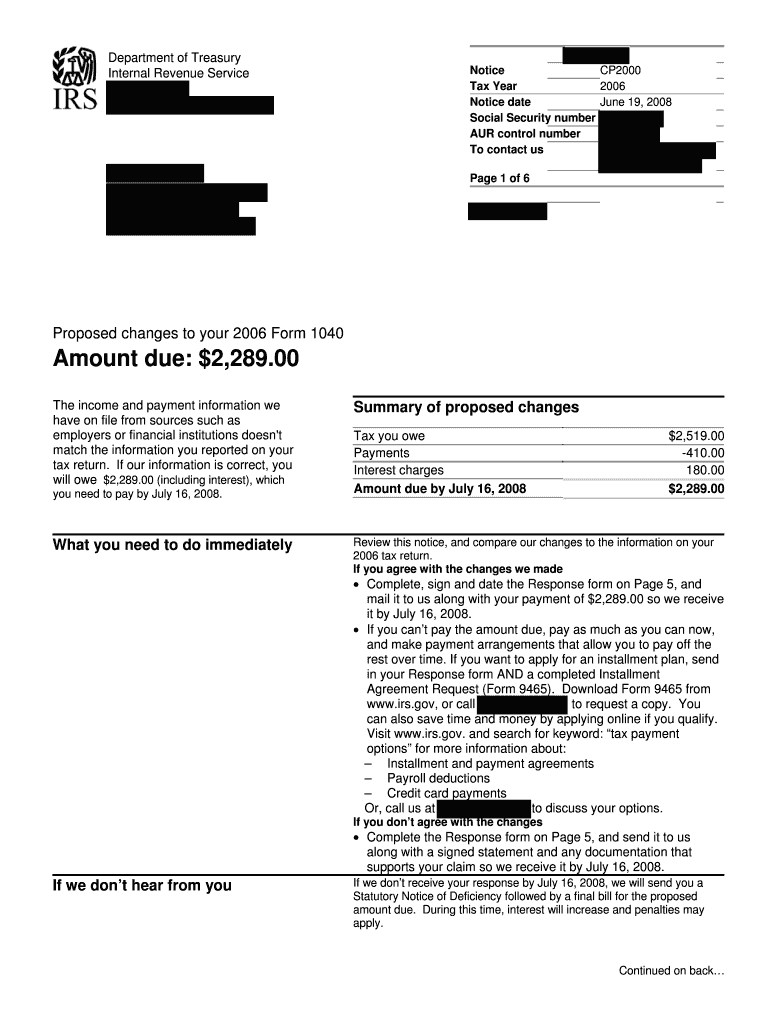

Department of Treasury Internal Revenue Service Notice CP2000 Tax Year 2006 Notice date June 19, 2008, Social Security number AUR control number To contact us Page 1 of 6 Proposed changes to your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign amount due 2289

Edit your amount due 2289 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your amount due 2289 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit amount due 2289 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit amount due 2289. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out amount due 2289

How to fill out amount due 2289

01

Gather all the relevant documents, such as invoices, bills, or statements that pertain to the amount due of 2289.

02

Double-check the accuracy of the amount stated and ensure that it matches the outstanding balance.

03

If there are any specific instructions or forms provided by the recipient of the payment, familiarize yourself with them.

04

Prepare the necessary payment method, whether it be cash, check, online transfer, or credit card.

05

Fill out any required fields or forms related to the payment, such as a payment slip, payment voucher, or online payment form.

06

Enter the amount due of 2289 in the specified section, ensuring that there are no errors or omissions.

07

Provide any additional information that may be necessary for the payment, such as an account number or invoice reference.

08

Review the completed form for accuracy and completeness, making any necessary adjustments.

09

Submit the filled-out payment form along with the payment to the designated recipient, following any specific instructions given.

10

Keep a copy of the payment form and any accompanying documents for your records in case of any future disputes or clarifications.

Who needs amount due 2289?

01

Individuals or businesses who have a outstanding balance of 2289 with a creditor or service provider.

02

Those who have received an invoice, bill, or statement indicating an amount due of 2289.

03

People who wish to settle their financial obligations by making a payment of 2289.

04

Individuals or entities who have entered into a contractual agreement or made a purchase that requires a payment of 2289.

05

Anyone who wants to maintain a good credit history and avoid any penalties or consequences associated with unpaid debts of 2289.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the amount due 2289 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your amount due 2289 in seconds.

Can I create an electronic signature for signing my amount due 2289 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your amount due 2289 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete amount due 2289 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your amount due 2289. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is amount due 2289?

Amount due 2289 is the total amount of money that is owed or payable.

Who is required to file amount due 2289?

The individuals or entities who owe the money indicated in amount due 2289 are required to file it.

How to fill out amount due 2289?

Amount due 2289 can be filled out by providing the necessary information about the owed amount.

What is the purpose of amount due 2289?

The purpose of amount due 2289 is to inform the recipient about the total amount of money owed.

What information must be reported on amount due 2289?

The information required to be reported on amount due 2289 includes the total amount owed, the reason for the amount due, and any relevant details.

Fill out your amount due 2289 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Amount Due 2289 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.