Get the free Schedule CT-1040AW Part-Year Resident Income Allocation

Show details

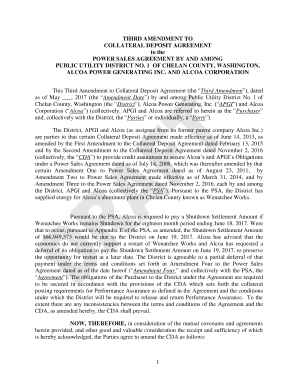

Department of Revenue Services State of Connecticut 2013 Schedule CT-1040AW Part-Year Resident Income Allocation (Rev. 12/13) Part-year residents must complete this schedule before completing Schedule

We are not affiliated with any brand or entity on this form

Instructions and Help about schedule ct-1040aw part-year resident

How to edit schedule ct-1040aw part-year resident

How to fill out schedule ct-1040aw part-year resident

Instructions and Help about schedule ct-1040aw part-year resident

How to edit schedule ct-1040aw part-year resident

To edit schedule ct-1040aw part-year resident, you can utilize tools available in pdfFiller. Begin by uploading your current form to the platform. After the upload, use the editing features to make necessary adjustments, ensuring all entered data is accurate and up to date. Once you have completed editing, you can save or print your revised document directly from the interface.

How to fill out schedule ct-1040aw part-year resident

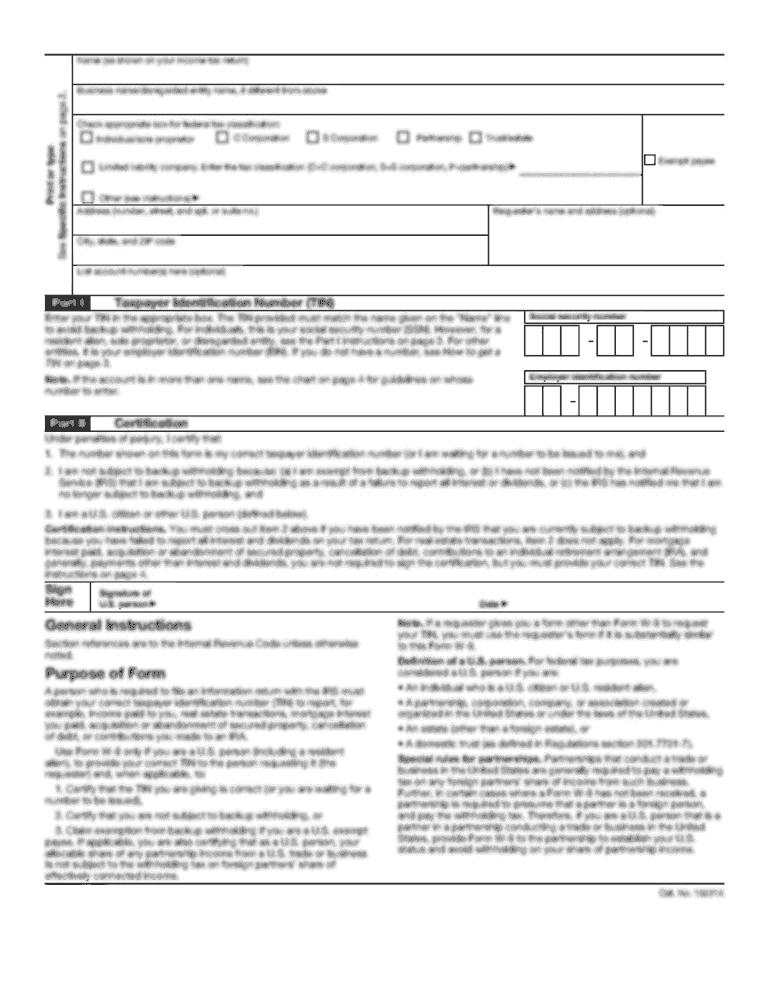

Filling out schedule ct-1040aw part-year resident involves several key steps:

01

Gather your personal information, including your Social Security number and address.

02

Determine your income sources and amounts for the part-year residency period.

03

Follow the specific sections of the form to report your income accurately.

04

Ensure you correctly calculate your tax liability based on the income reported.

05

Review your entries for accuracy before final submission.

Latest updates to schedule ct-1040aw part-year resident

Latest updates to schedule ct-1040aw part-year resident

It is essential to stay informed about the latest updates to schedule ct-1040aw part-year resident, as tax laws and forms may be revised annually. Regularly check the official IRS website or state tax authority resources to ensure compliance with the most recent regulations and deadlines.

All You Need to Know About schedule ct-1040aw part-year resident

What is schedule ct-1040aw part-year resident?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About schedule ct-1040aw part-year resident

What is schedule ct-1040aw part-year resident?

Schedule ct-1040aw part-year resident is a tax form used by individuals who have lived in Connecticut for only part of the tax year. This form is essential for accurately reporting income and calculating tax liability while accounting for the income earned during the period of residency.

What is the purpose of this form?

The purpose of schedule ct-1040aw part-year resident is to ensure that part-year residents report their income accurately and pay taxes corresponding to the period they resided in Connecticut. This ensures fair taxation based on the time spent within the state.

Who needs the form?

Individuals who moved into or out of Connecticut during the tax year must complete schedule ct-1040aw part-year resident. This includes those who became residents or ceased to be residents of the state, thereby having a portion of the year where they were neither fully in nor out of Connecticut.

When am I exempt from filling out this form?

You may be exempt from filling out schedule ct-1040aw part-year resident if you were a full-year resident in another state and had no Connecticut income during the tax year. Additionally, if you qualify for certain exemptions such as specific military statuses, you may not be required to submit this form.

Components of the form

Schedule ct-1040aw part-year resident typically includes sections for personal information, a breakdown of income earned while residing in Connecticut, and deductions applicable to part-year residents. Each section is designed to facilitate accurate reporting and calculation of tax owed.

What are the penalties for not issuing the form?

Failure to file schedule ct-1040aw part-year resident when required can result in fines and interest on any taxes owed. Penalties may increase if the omission is considered willful neglect. It is crucial to file the form to avoid such financial repercussions.

What information do you need when you file the form?

When filing schedule ct-1040aw part-year resident, you will need personal identification details, income statements such as W-2s or 1099s, and information about any deductions you intend to claim. Accurate records of your residency dates and income earned during your stay in Connecticut are also necessary for proper completion.

Is the form accompanied by other forms?

Schedule ct-1040aw part-year resident may need to be submitted alongside other tax forms, such as the Connecticut Form CT-1040. This ensures all income and deductions are comprehensively reported and evaluated by the tax authorities.

Where do I send the form?

After completing schedule ct-1040aw part-year resident, the form should be sent to the Connecticut Department of Revenue Services. The mailing address is usually provided on the form itself, so ensure to check for the most current submission guidelines and addresses.

See what our users say