Get the free Payroll / Accounts Payable - cabrini

Show details

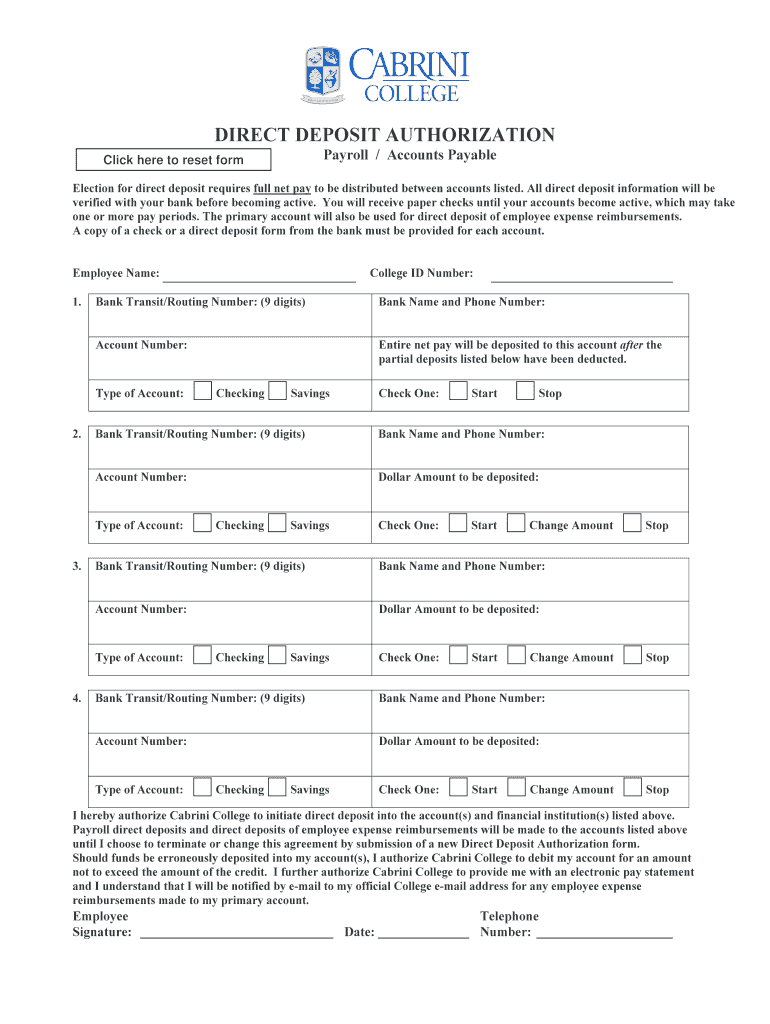

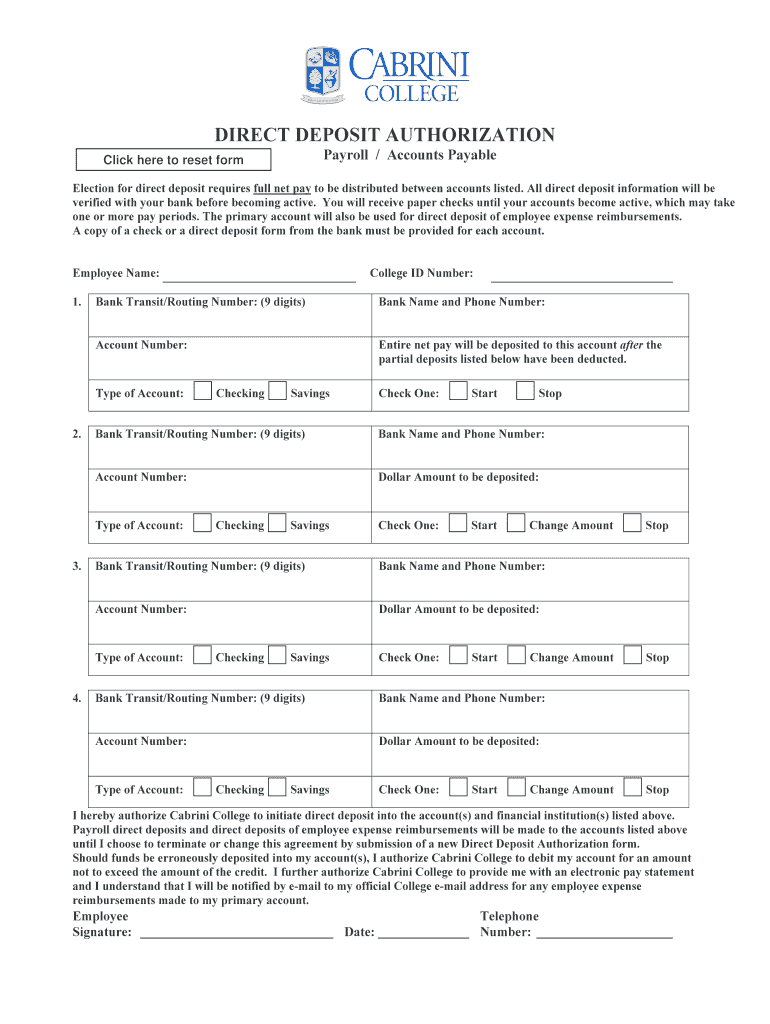

DIRECT DEPOSIT AUTHORIZATION Payroll / Accounts Payable Click here to reset form Election for direct deposit requires full net pay to be distributed between accounts listed. All direct deposit information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll accounts payable

Edit your payroll accounts payable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll accounts payable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payroll accounts payable online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payroll accounts payable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll accounts payable

How to fill out payroll accounts payable:

01

Gather all necessary information: Before starting the process, make sure you have all the required information such as employees' names, salaries, and deductions.

02

Enter employee information: Input each employee's information into the payroll accounts payable system. This includes their names, addresses, Social Security numbers, and any additional information required by your organization.

03

Calculate gross wages: Calculate the gross wages for each employee based on their hourly rate or salary. Ensure accuracy in calculations and take into account any overtime hours or special pay rates.

04

Deduct taxes and withholdings: Determine the applicable federal, state, and local taxes to be withheld from each employee's wages. Also, deduct any other authorized withholdings such as health insurance premiums or retirement contributions.

05

Calculate net pay: Subtract the total deductions from the gross wages to obtain the net pay for each employee. This is the amount that the employee will receive after taxes and other deductions.

06

Issue paychecks or direct deposits: Once the payroll accounts payable calculations are complete, you can generate paychecks or arrange for direct deposits to distribute the employees' net pay.

Who needs payroll accounts payable:

01

Businesses of all sizes: Payroll accounts payable is necessary for businesses of all sizes, whether they have only a few employees or hundreds. It ensures accurate and timely payment to employees and compliance with tax regulations.

02

Human resources departments: HR departments are typically responsible for handling payroll accounts payable. They oversee the payroll process from start to finish, including collecting employee information, calculating wages, and ensuring payments are made correctly.

03

Accountants or bookkeepers: Accountants or bookkeepers often play a role in payroll accounts payable by managing and reconciling the financial transactions associated with payroll. They ensure that the accounts payable records accurately reflect the payroll expenses and liabilities.

In conclusion, understanding how to fill out payroll accounts payable involves gathering necessary information, entering employee data, calculating wages and deductions, issuing payments, and maintaining accurate records. This process is essential for businesses of all sizes and is typically handled by HR departments, accountants, or bookkeepers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get payroll accounts payable?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific payroll accounts payable and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in payroll accounts payable without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing payroll accounts payable and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit payroll accounts payable on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign payroll accounts payable on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is payroll accounts payable?

Payroll accounts payable refers to the amount of money a company owes to its employees for their work and is typically recorded as a liability on the company's balance sheet.

Who is required to file payroll accounts payable?

Employers are required to file payroll accounts payable to accurately track and record the amount they owe to their employees for wages and benefits.

How to fill out payroll accounts payable?

To fill out payroll accounts payable, employers must accurately calculate the wages and benefits owed to employees, record this information in their accounting software, and ensure timely payment.

What is the purpose of payroll accounts payable?

The purpose of payroll accounts payable is to accurately track and record the amount of money a company owes to its employees for wages and benefits, ensuring timely and accurate payment.

What information must be reported on payroll accounts payable?

Payroll accounts payable must include detailed information on employee wages, benefits, deductions, and any other related expenses.

Fill out your payroll accounts payable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Accounts Payable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.