Get the free Grogan v HMRC-PTA - taxandchancery_ut decisions tribunals gov

Show details

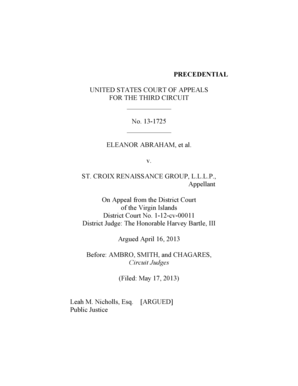

FTC/40/2009 and FTC/41/2009 Application for permission to appeal refused UPPER TRIBUNAL TAX AND CHANCERY CHAMBER NIGEL GROAN Appellant and THE COMMISSIONERS FOR HER MAJESTY S REVENUE AND CUSTOMS Respondents

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign grogan v hmrc-pta

Edit your grogan v hmrc-pta form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your grogan v hmrc-pta form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit grogan v hmrc-pta online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit grogan v hmrc-pta. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out grogan v hmrc-pta

How to fill out grogan v hmrc-pta

01

Read the case of Grogan v HMRC-PTA thoroughly to understand the details and context.

02

Start by examining the facts of the case and identifying the legal issues at hand.

03

Review relevant statutes, regulations, and case law that pertain to the subject matter of Grogan v HMRC-PTA.

04

Create an outline or structure for your analysis of the case, focusing on key points and arguments made by both parties.

05

Analyze the reasoning and findings of the court in Grogan v HMRC-PTA, paying attention to any dissenting opinions or alternative interpretations.

06

Utilize legal research tools and databases to explore scholarly articles, commentaries, and precedents that discuss or reference Grogan v HMRC-PTA.

07

Evaluate how Grogan v HMRC-PTA impacts and influences current legal principles or practices in the relevant area of law.

08

Write a comprehensive and clear summary of the case, including the background, legal arguments, court's decision, and any significant implications.

09

Ensure proper citation and attribution of sources when referencing Grogan v HMRC-PTA in any written work or legal analysis.

Who needs grogan v hmrc-pta?

01

Lawyers, legal researchers, and law students who are studying or working in the field of tax law.

02

Individuals involved in tax disputes or issues that relate to the matters addressed in Grogan v HMRC-PTA.

03

Tax consultants or professionals seeking to understand the legal principles or interpretations surrounding specific tax-related topics.

04

Judges and legal professionals who may need to reference Grogan v HMRC-PTA in their work or judgments.

05

Academics or scholars researching the development and application of tax law in relevant jurisdictions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the grogan v hmrc-pta form on my smartphone?

Use the pdfFiller mobile app to fill out and sign grogan v hmrc-pta. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out grogan v hmrc-pta on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your grogan v hmrc-pta, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit grogan v hmrc-pta on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute grogan v hmrc-pta from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is grogan v hmrc-pta?

Grogan v HMRC-PTA is a tax form used to report certain transactions to HM Revenue and Customs.

Who is required to file grogan v hmrc-pta?

Any individual or entity involved in the specified transactions is required to file grogan v HMRC-PTA.

How to fill out grogan v hmrc-pta?

You can fill out grogan v HMRC-PTA by providing detailed information about the transactions and submitting the form to HM Revenue and Customs.

What is the purpose of grogan v hmrc-pta?

The purpose of grogan v HMRC-PTA is to ensure transparency in specified transactions and to help prevent tax evasion.

What information must be reported on grogan v hmrc-pta?

Information such as the nature of the transactions, parties involved, and amounts exchanged must be reported on grogan v HMRC-PTA.

Fill out your grogan v hmrc-pta online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grogan V Hmrc-Pta is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.