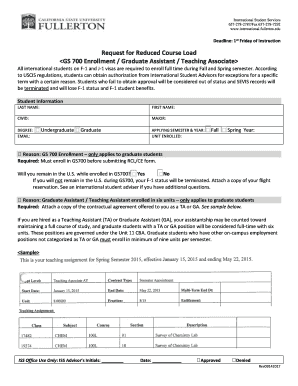

Get the free Private Education Loan Applicant Self-Certification This space for lender use only O...

Show details

SIS Help UW-Green Bay ... http://www.uwgb.edu/housing/on-campus/terms/ contract.asp ... http://www.uwgb.edu/financial-aid/files/pdf/loan-self-certification. PDF.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private education loan applicant

Edit your private education loan applicant form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private education loan applicant form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private education loan applicant online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit private education loan applicant. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

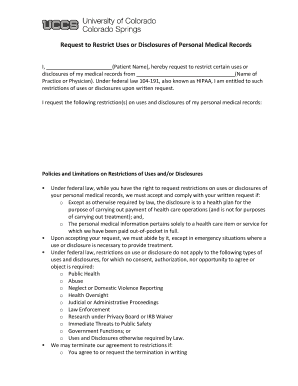

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private education loan applicant

How to fill out a private education loan applicant:

01

Begin by gathering all the necessary documents and information. This may include personal identification, academic transcripts, information about the educational institution, and financial statements.

02

Start filling out the personal information section, including your name, address, contact details, and social security number.

03

Provide details about the educational institution, such as the name, address, and program of study. Include any relevant enrollment dates and expected graduation dates.

04

Explain your educational goals and why you require a private education loan. This section is crucial in demonstrating your commitment to academic success and your understanding of the loan's purpose.

05

Include information about your academic achievements, such as GPA, standardized test scores, and extracurricular activities. These details offer lenders insight into your potential as a successful student.

06

In the financial information section, disclose your income, assets, and any existing debts. This helps lenders assess your ability to repay the loan.

07

Provide accurate information about your cosigner, if applicable. A cosigner is someone who agrees to share the responsibility for loan repayment, usually a parent or guardian with a stable financial situation.

08

Review the application thoroughly to ensure accuracy and completeness. Check for any missing or incorrectly filled sections before submitting.

Who needs a private education loan applicant:

01

Students pursuing higher education: Private education loans can be beneficial for students who need additional funds to cover tuition fees, room and board, textbooks, and other educational expenses.

02

Individuals without sufficient financial aid: Some students may not receive enough financial aid from scholarships, grants, or federal loans to cover their educational costs. In such cases, a private education loan can bridge the financial gap.

03

Nontraditional students: Private education loans can also be suitable for individuals returning to school after a gap or pursuing higher education later in life. These loans offer flexibility and can support their educational journey.

04

Students attending institutions without federal loan eligibility: Some educational institutions may not qualify for federal loans. In such cases, private education loans can be a viable option to finance education.

Remember, it's crucial to carefully consider and compare different loan options, terms, and interest rates before deciding on a private education loan. Student borrowers should aim to minimize their debt by exploring scholarships, grants, and federal aid options first.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is private education loan applicant?

Private education loan applicant is an individual who is applying for a loan from a private lending institution to cover education expenses.

Who is required to file private education loan applicant?

Any individual who is seeking a private education loan is required to fill out a private education loan applicant form.

How to fill out private education loan applicant?

To fill out a private education loan applicant form, the individual must provide personal information, details about the educational institution, loan amount requested, and any other required information.

What is the purpose of private education loan applicant?

The purpose of the private education loan applicant form is to gather information about the individual applying for a private educational loan.

What information must be reported on private education loan applicant?

The private education loan applicant form typically requires personal information, educational institution details, loan amount requested, and other relevant information.

Can I create an eSignature for the private education loan applicant in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your private education loan applicant and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the private education loan applicant form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign private education loan applicant and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out private education loan applicant on an Android device?

Complete private education loan applicant and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your private education loan applicant online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Education Loan Applicant is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.