Get the free Foreign Vendor Information Form - bgsu

Show details

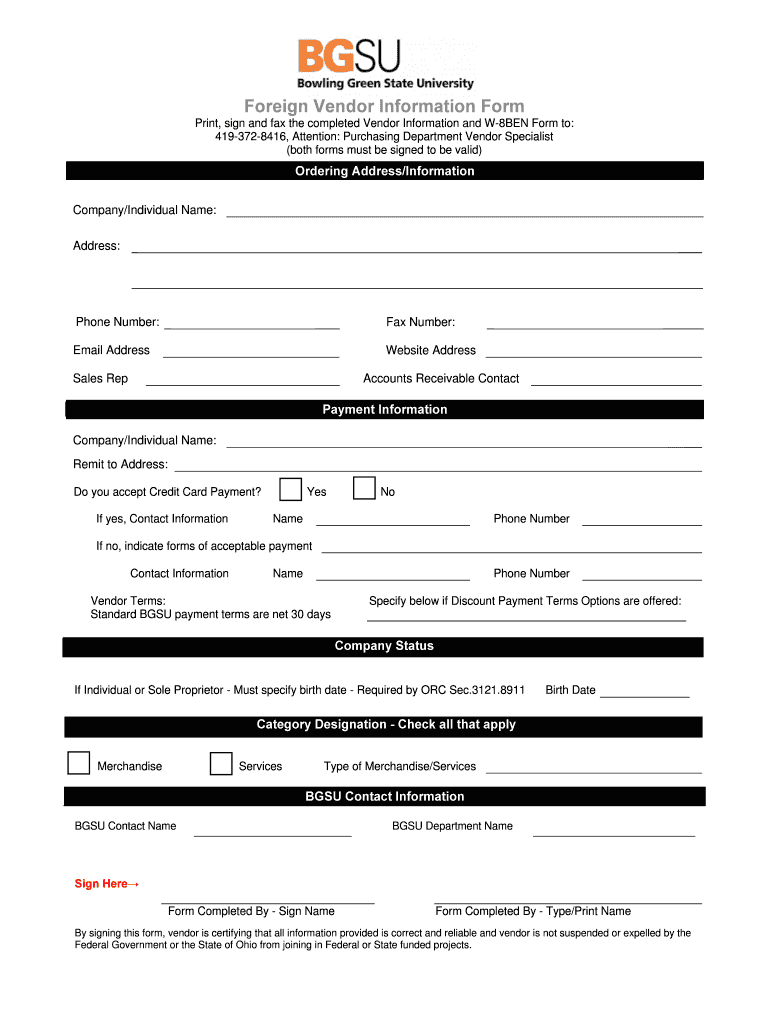

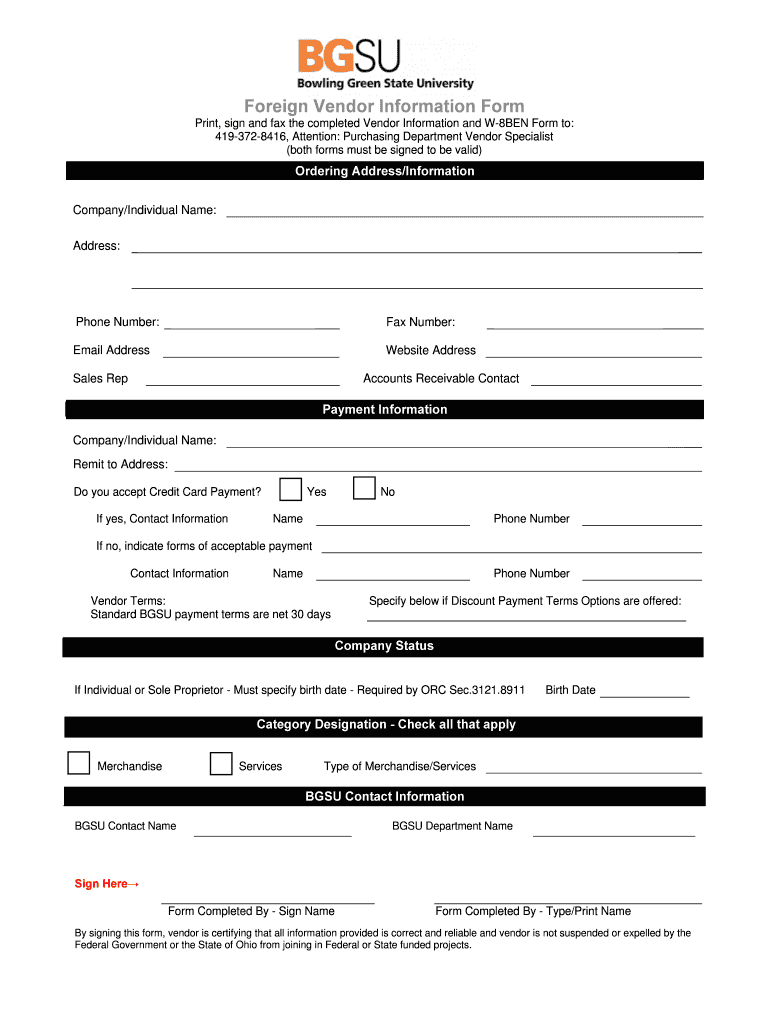

Foreign Vendor Information Form Print, sign and fax the completed Vendor Information and W-8BEN Form to: 419-372-8416, Attention: Purchasing Department Vendor Specialist (both forms must be signed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign vendor information form

Edit your foreign vendor information form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign vendor information form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing foreign vendor information form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit foreign vendor information form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign vendor information form

How to fill out foreign vendor information form:

01

Gather necessary documents: Before starting the form, make sure you have all the required documents at hand. This may include the vendor's identification, tax identification number, proof of address, and any other relevant information.

02

Start with basic information: Begin by filling out the basic information section of the form. This typically includes the vendor's legal name, contact details, and business address. Make sure to provide accurate information to avoid any future complications.

03

Provide vendor's tax information: In this section, you will need to provide the vendor's tax identification number or any other relevant tax information. This is important for tax compliance purposes and helps establish the vendor's legitimacy.

04

Specify the vendor's services or products: Indicate the type of services or products the foreign vendor provides. This may include a description of their offerings, the industry they operate in, and any certifications or licenses they hold.

05

Include banking details: If necessary, include the vendor's banking details such as their bank account number and routing number. This is important for payment purposes and ensures smooth financial transactions.

06

Declare any potential conflicts of interest: If there are any conflicts of interest or relationships between the vendor and your organization, it is crucial to disclose them in this section. Transparency and honesty are vital when filling out this form.

07

Review and submit: Once you have completed all the required sections of the form, take a moment to review the information you have provided. Ensure accuracy and make any necessary corrections before submitting the form.

Who needs foreign vendor information form?

01

Organizations engaging with foreign vendors: Any organization that wishes to engage with foreign vendors, whether for purchasing goods or services, typically requires the completion of a foreign vendor information form. This helps verify the vendor's identity, compliance with tax regulations, and ensures a transparent business relationship.

02

Accounts payable or procurement departments: Within an organization, the accounts payable or procurement departments are usually responsible for managing vendor-related information. They need the foreign vendor information form to properly document and maintain accurate records of all vendors, including those from abroad.

03

Legal and compliance teams: Legal and compliance teams play a critical role in ensuring that all vendor activities adhere to legal and regulatory requirements. The foreign vendor information form assists them in conducting due diligence, assessing potential risks, and maintaining compliance within the organization's operations.

Overall, filling out the foreign vendor information form is necessary for establishing transparent and compliant relationships with foreign vendors, facilitating smooth business transactions, and mitigating potential risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in foreign vendor information form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing foreign vendor information form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for the foreign vendor information form in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your foreign vendor information form in seconds.

How do I complete foreign vendor information form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your foreign vendor information form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is foreign vendor information form?

The foreign vendor information form is a document used to collect information about vendors who are located outside of the country.

Who is required to file foreign vendor information form?

Any individual or business that has paid a foreign vendor for goods or services and is required to report this information to the appropriate authorities.

How to fill out foreign vendor information form?

The form can typically be filled out online or submitted via mail, and requires information such as the vendor's name, address, tax identification number, and amount paid.

What is the purpose of foreign vendor information form?

The purpose of the form is to ensure that payments made to foreign vendors are reported accurately and that any necessary tax withholding is applied.

What information must be reported on foreign vendor information form?

The form typically requires information such as the vendor's name, address, tax identification number, and the amount paid to the vendor.

Fill out your foreign vendor information form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Vendor Information Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.