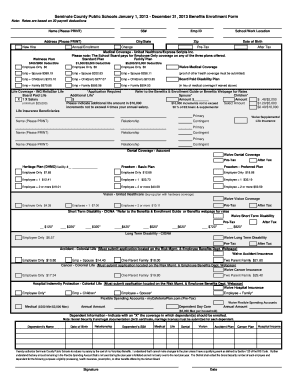

Wells Fargo Company 401k Plan Loan free printable template

Get, Create, Make and Sign wells fargo 401k payoff form

How to edit wells fargo loan payoff form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 401k loan payment form

How to fill out Wells Fargo & Company 401(k) Plan Loan

Who needs Wells Fargo & Company 401(k) Plan Loan?

Video instructions and help with filling out and completing wells fargo payoff 401k loan form trial

Instructions and Help about wells fargo 401k loan form online

So besides your house if you're a homeowner then likely your retirement plan at work your 401k your company savings plan is probably your biggest chunk of your wealth and even though I won't say their name often on this channel fidelity reported that at the end of 2016 that the average 401k balance was at a new high of 92 thousand five hundred dollars now ideally you'd like to just let that money ride and make as much off of it as possible, but things happen now no advisor is going to tell you to go and take money out of your 401k because it's not the fact that you're taking the money out it's the fact that you the money you took out is missing out on the growth over those years it can't compound if you've got it in your bank account and not in the market now in a perfect world yes you'd leave it there it would grow you would retire with a billion dollars and spend your golden years however you want, but things usually happen when you least expect it which means you're the least prepared for it so lets talk about this Music first thing you should know is that there's actually a couple different ways that you can take money out of a 401k there's the loan which were going to focus on today there is a hardship distribution and then there's just a straight-up withdrawal now if you absolutely have to take money out of your 401k then you're probably going to want to choose the loan option you'll be able to take out as much as 50 of your vested balance or as much as 50000 but remember it's a loan now if you were to just simply take the money out and make a withdrawal then you're going to lose 20 right off the top plus another 10 as a tax penalty it's just a lot of percents you don't want that to happen so let's avoid withdrawing the money all right lets get into this there are three times that I think it's okay for you to take money out of your 401k, but first I want you to just double-check make sure you have no other access to any kind of emergency fund money that you're hiding from the missus anything before you go and take a loan out of your 401k but if you have to there's three times okay, so the first reason would be if something immediate happens where you need the money, and you just weren't expecting, and you need a lot of money, and you need it quick a perfect example with this would be the high deductibles that you might have to pay on your health care plan now if you have a high deductible health care plan then you really should probably consider a health savings account so that you could start building up money to pay for that deductible inevitably when you're going to have to use it but what if you are saving, and you just didn't save enough and all of a sudden something happens to you or a family member, and you need to pay that high deductible then its cool go to your 401k if you have no other money borrow the money from that we don't want you getting in any credit problems just because you can't pay a deductible right the second reason...

People Also Ask about wells fargo retirement loan payoff form

What is the phone number for Wells Fargo 401k loan?

Can I cash out my 401k to pay off my 401k loan?

How do I pay off my 401k loan from my 401k?

What happens to 401k loan when you cash out?

How do I close my 401k loan?

Can you withdraw from 401k to pay off 401k loan?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit wells fargo payoff 401k from Google Drive?

Can I sign the wells fargo payoff 401k electronically in Chrome?

How do I edit wells fargo payoff 401k on an Android device?

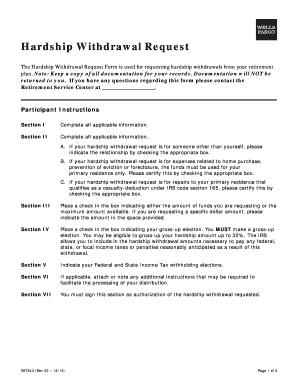

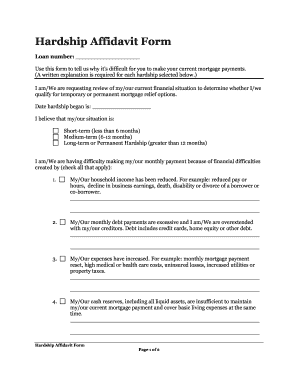

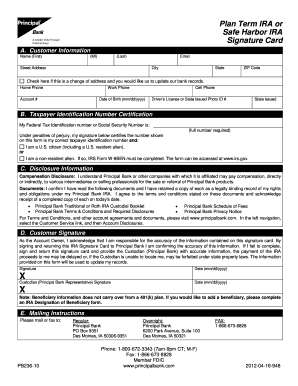

What is Wells Fargo & Company 401(k) Plan Loan?

Who is required to file Wells Fargo & Company 401(k) Plan Loan?

How to fill out Wells Fargo & Company 401(k) Plan Loan?

What is the purpose of Wells Fargo & Company 401(k) Plan Loan?

What information must be reported on Wells Fargo & Company 401(k) Plan Loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.