Get the free DONAT ION F O R M

Show details

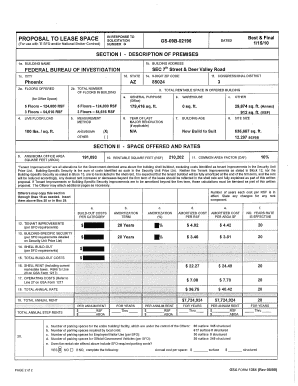

DONATE ION F O R M THE DAVID NATHAN EMERSON FOUNDATION PL EASE MA I L C OM P LE TE D FORM TO YOU R I N FORMATION The David Nathan Meyer son Foundation 4441 Buena Vista Dallas, TX 75205 Name: Street

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donat ion f o

Edit your donat ion f o form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donat ion f o form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donat ion f o online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit donat ion f o. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donat ion f o

How to fill out donat ion f o

01

Start by finding a reputable organization or charity that accepts donations.

02

Decide on the type of donation you want to make. It could be monetary, material goods, or a combination of both.

03

Contact the organization to inquire about their donation process and any specific requirements.

04

Gather all the necessary information and documentation that may be required for the donation, such as proof of ownership for material goods.

05

If making a monetary donation, choose the preferred payment method and provide the necessary details.

06

Follow the instructions provided by the organization to properly fill out the donation form, ensuring accuracy and completeness.

07

Double-check all the details provided in the form before submitting it.

08

If applicable, keep a copy of the completed donation form for your records.

09

Submit the donation form through the designated channels, whether it's online, by mail, or in person.

10

Wait for confirmation or receipt from the organization to acknowledge your donation.

Who needs donat ion f o?

01

Individuals or families facing financial hardships or crises may need donation assistance to meet their basic needs.

02

Charitable organizations and non-profits rely on donations to support their programs and services.

03

Non-governmental organizations (NGOs) working in areas affected by natural disasters or conflicts need donations to provide aid and relief to those affected.

04

Educational institutions often welcome donations to improve facilities, offer scholarships, or fund research.

05

Research organizations and foundations may need donations to further scientific advancements and medical research.

06

Animal shelters and rescues depend on donations to care for abandoned or mistreated animals.

07

Artistic and cultural institutions may seek donations to preserve heritage, fund exhibitions, or support artists and performers.

08

Environmental organizations require donations to protect ecosystems, fight climate change, and promote sustainability.

09

Healthcare organizations often rely on donations to improve medical facilities, provide access to care for the underprivileged, or support research and development.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit donat ion f o in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your donat ion f o, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my donat ion f o in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your donat ion f o and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the donat ion f o form on my smartphone?

Use the pdfFiller mobile app to complete and sign donat ion f o on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is donation fo?

Donation fo is a form used to report information about donations made to charitable organizations.

Who is required to file donation fo?

Any individual or organization that makes donations to charitable organizations may be required to file donation fo.

How to fill out donation fo?

Donation fo can be filled out by providing information about the donor, recipient organization, amount of donation, and purpose of the donation.

What is the purpose of donation fo?

The purpose of donation fo is to provide transparency and accountability in reporting donations made to charitable organizations.

What information must be reported on donation fo?

Information such as donor details, recipient organization details, amount of donation, and purpose of donation must be reported on donation fo.

Fill out your donat ion f o online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donat Ion F O is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.