Get the free Form 1040XN Amended Nebraska Individual Income Tax Return 2016

Show details

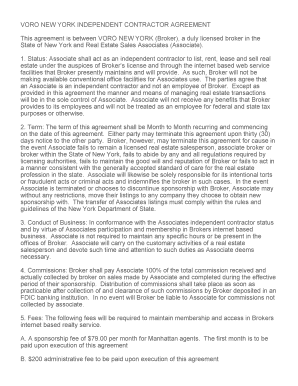

RESETAmended Nebraska Individual Income Tax Return Please Type or Platform 1040XNTaxable Year of Original Return beginning, and ending, Last Nameplate DO NOT WRITE IN THIS SPACEY our First Name and

We are not affiliated with any brand or entity on this form

Instructions and Help about form 1040xn amended nebraska

How to edit form 1040xn amended nebraska

How to fill out form 1040xn amended nebraska

Instructions and Help about form 1040xn amended nebraska

How to edit form 1040xn amended nebraska

To edit form 1040xn amended nebraska, utilize pdfFiller's user-friendly interface. Start by uploading the form into pdfFiller. Then, use the available editing tools to make necessary changes such as correcting figures, altering your address, or updating your filing status. Once edits are complete, ensure to save the form to preserve all changes made.

How to fill out form 1040xn amended nebraska

To fill out form 1040xn amended nebraska, follow these steps:

01

Download the form from the Nebraska Department of Revenue website or access it through pdfFiller.

02

Provide personal information such as your name, Social Security number, and address at the top of the form.

03

Indicate the tax year you are amending and the reason for the amendment in the appropriate sections.

04

Incorporate the correct amounts for your income, adjustments, tax deductions, and any credits.

05

Review your entries and sign the form before submission.

Latest updates to form 1040xn amended nebraska

Latest updates to form 1040xn amended nebraska

Check the Nebraska Department of Revenue’s official website for any recent updates to form 1040xn, including changes in filing guidelines, due dates, and any new legislative impacts that could affect your amended return.

All You Need to Know About form 1040xn amended nebraska

What is form 1040xn amended nebraska?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About form 1040xn amended nebraska

What is form 1040xn amended nebraska?

Form 1040xn amended nebraska is an official tax return form used by residents of Nebraska to amend their previously filed state income tax returns. This form is essential for correcting errors or omissions from original filings, ensuring accurate state tax assessments.

What is the purpose of this form?

The primary purpose of form 1040xn amended nebraska is to allow taxpayers to adjust their reported income, deductions, or credits. This is crucial when new information arises after the initial filing, helping to rectify any discrepancies that could lead to overpayments or underpayments of taxes owed.

Who needs the form?

Taxpayers who have filed a Nebraska income tax return and later discover mistakes or new information that pertains to their tax situation require form 1040xn. This can include individuals, couples, and businesses who need to amend their previously reported tax data.

When am I exempt from filling out this form?

You may be exempt from filling out form 1040xn if there are no errors or omissions in your previous tax return. Additionally, if your amended return results in no change to your tax liabilities, filing the form may not be necessary. Always verify void scenarios with the Nebraska Department of Revenue to ensure compliance.

Components of the form

The components of form 1040xn include sections for personal information, a summary of the original return, details on the changes being made, and calculations for revised taxes owed or refunded. Clear instructions are provided for each section to guide filers through the amendment process.

What are the penalties for not issuing the form?

Failing to issue form 1040xn when required may result in penalties such as interest on any unpaid tax or potential fines. It's essential to rectify any discrepancies promptly to avoid complications with the Nebraska Department of Revenue.

What information do you need when you file the form?

When filing form 1040xn, you will need your original tax return, documentation supporting the changes, including W-2s, 1099s, and any relevant schedules. All associated documents should be included to substantiate your amendments clearly.

Is the form accompanied by other forms?

Depending on the nature of your amendment, form 1040xn may need to be accompanied by additional forms such as schedules or other supporting documentation. Review the specific requirements outlined by the Nebraska Department of Revenue to ensure all necessary documents are included with your submission.

Where do I send the form?

Send completed form 1040xn to the address specified in the instructions on the form or on the Nebraska Department of Revenue's website. Ensure that you mail it to the correct processing office to avoid delays in processing your amended return.

See what our users say