Get the free Retirement Income Fund Life Income Fund Application - Equitable Life

Show details

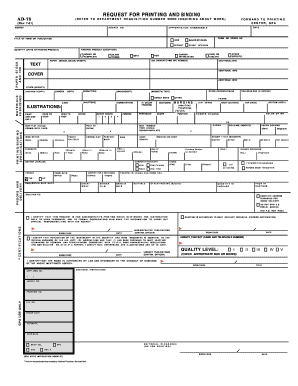

Head Office One West mount Road North P.O. Box 1603 STN. Waterloo, Ontario N2J 4C7 TF 1.800.265.4556 T 519.886.5210 F 519.883.7404 Retirement INCOME FUND LIFE INCOME FUND F I N A N C I A L S O L U

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement income fund life

Edit your retirement income fund life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement income fund life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement income fund life online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit retirement income fund life. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement income fund life

How to fill out retirement income fund life

01

Start by gathering all necessary documents such as identification, social security number, and financial statements.

02

Research different retirement income fund life options available to you and compare their features, benefits, and fees.

03

Evaluate your current financial situation and determine how much income you will need during retirement.

04

Consult with a financial advisor or retirement specialist to understand the implications and benefits of different retirement income fund life options.

05

Fill out the application form for the chosen retirement income fund life option, providing accurate and complete information.

06

Review the filled-out application form thoroughly to ensure all information is correct.

07

Attach any required supporting documents to the application form, such as proof of income or investment history.

08

Double-check that you have included all necessary signatures and authorizations on the application form.

09

Submit the completed application form and supporting documents to the designated retirement fund provider or financial institution.

10

Follow up with the provider to ensure your application is processed and any additional requirements are fulfilled.

Who needs retirement income fund life?

01

Individuals who want to secure a regular income stream during their retirement years.

02

Those who do not have a defined benefit pension plan or adequate retirement savings.

03

Individuals who want to have control over their retirement savings and investment decisions.

04

People who anticipate a longer lifespan and need to ensure their retirement income lasts.

05

Individuals who want the flexibility to withdraw funds from their retirement savings as needed.

06

Those who wish to pass on assets or funds to heirs or beneficiaries.

07

People who desire protection against market volatility and the potential for investment losses.

08

Individuals who want to potentially benefit from tax advantages and deferral of taxes on their retirement savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find retirement income fund life?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific retirement income fund life and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit retirement income fund life online?

With pdfFiller, the editing process is straightforward. Open your retirement income fund life in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the retirement income fund life in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your retirement income fund life in seconds.

What is retirement income fund life?

A retirement income fund life is a financial product designed to provide retirees with a steady stream of income during their retirement years.

Who is required to file retirement income fund life?

Retirees who have invested in a retirement income fund are required to file a retirement income fund life.

How to fill out retirement income fund life?

To fill out a retirement income fund life, retirees must provide information about their investments, withdrawals, and any other relevant financial details.

What is the purpose of retirement income fund life?

The purpose of a retirement income fund life is to ensure retirees have a reliable source of income to support their living expenses in retirement.

What information must be reported on retirement income fund life?

Retirees must report details of their investments, withdrawals, and other financial information on the retirement income fund life form.

Fill out your retirement income fund life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Income Fund Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.