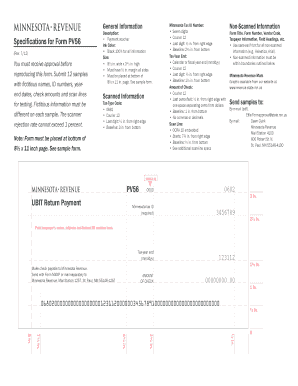

Monroe Group Petty Cash Policy 2008-2025 free printable template

Show details

Petty Cash Policy Statement Monroe Group Ltd. permits properties to maintain a petty cash fund, as described by this policy. Departments are responsible for adequate security and control of their

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign petty cash policy template

Edit your petty cash policy template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petty cash policy template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petty cash policy template online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit petty cash policy template. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out petty cash policy template

01

Start by reviewing the petty cash policy template thoroughly to understand its purpose and requirements.

02

Identify the specific sections or fields within the template that need to be filled out, such as the organization's name, policy objectives, and procedures for requesting and reconciling petty cash.

03

Gather relevant information and data that will be needed to complete the template, such as the maximum amount of petty cash allowed, authorized personnel, and the frequency of cash replenishment.

04

Customize the template according to your organization's specific needs and requirements. This may include modifying existing sections, adding new sections, or deleting sections that are not applicable.

05

Ensure that all necessary information is accurately and clearly documented in the template, providing detailed instructions and guidelines to facilitate adherence to the petty cash policy.

06

Seek input and approval from appropriate stakeholders, such as finance or management personnel, to validate and endorse the filled-out petty cash policy template.

07

Regularly review and update the policy template as needed to reflect any changes in policies, procedures, or organizational requirements.

08

Distribute and communicate the completed petty cash policy template to all relevant personnel who handle or are affected by petty cash transactions.

09

Ensure that employees are trained and educated on the petty cash policy and the proper procedures for requesting, using, and reconciling petty cash.

10

Periodically evaluate the effectiveness and compliance of the petty cash policy by conducting audits or reviews to ensure its proper implementation.

Who needs petty cash policy template?

01

Organizations of various sizes and types, including businesses, nonprofits, or government entities, that handle petty cash transactions.

02

Finance or accounting departments responsible for managing and controlling petty cash funds.

03

Employees or individuals who are designated as custodians or authorized users of petty cash.

04

Auditors or compliance officers who review and assess the adequacy of internal controls and financial processes.

05

Stakeholders or external parties who require assurance that petty cash transactions are properly authorized, documented, and reconciled.

Fill

form

: Try Risk Free

People Also Ask about

What is the main purpose of petty cash?

Overview and Purpose The purpose of a Petty Cash Fund is to allow for the reimbursement or purchase of minor, small-dollar (less than $100), unanticipated business expenses, where the use of alternative means is neither feasible nor cost effective.

What is a petty cash policy?

Petty cash funds are for the purpose of infrequent or emergency departmental purchases. All other purchases must go through the purchase order process via a requisition/request for payment. Under no circumstances can petty cash be used for personal expenses or loans.

What are the limitations and restrictions of a petty cash system?

The purpose of a petty cash fund is to provide cash to business units sufficient to cover minor expenditures. The use of petty cash funds should be limited to reimbursement of staff members and visitors for small expenses, generally not to exceed $50, such as taxi fares, postage, office supplies, etc.

How do you audit a petty cash procedure?

How to Audit Petty Cash Meet the person who serves as the normal custodian of the petty cash -- usually a secretary or manager. Count the currency and coin. Sum all the vouchers and receipts used to justify payments from petty cash or records of transactions adding to the cash. Add the cash total to the voucher total.

How much petty cash is allowed per year?

Petty cash provides convenience for small transactions for which issuing a check or a corporate credit card is unreasonable or unacceptable. The small amount of cash that a company considers petty will vary, with many companies keeping between $100 and $500 as a petty cash fund.

What are the two methods of handling petty cash?

The petty cash fund can be operated in the two ways: ordinary and imprest system of petty cash fund. The office establishes the petty cash fund for paying petty expenses incurred daily. Under ordinary system, the petty cashier is given a certain amount of cash for meeting petty expenses.

Do you have to pay taxes on petty cash?

Typically, all or most of your petty cash purchases will be for business expenses, which means they will be deductible from your business taxes. That is why it's important to keep a record of each expense.

What is the purpose of a petty cash policy?

Therefore, the purpose of a petty cash fund is to provide departments with ready cash for the payment of various small expenditures, such as postage, highway tolls, parking fees, and the like.

How do you write a petty cash procedure?

The procedure for petty cash funding is outlined below: Complete reconciliation form. Complete a petty cash reconciliation form, in which the petty cash custodian lists the remaining cash on hand, vouchers issued, and any overage or underage. Obtain cash. Add cash to petty cash fund. Record vouchers in general ledger.

What are the rules for petty cash?

Petty cash funds are for the purpose of infrequent or emergency departmental purchases. All other purchases must go through the purchase order process via a requisition/request for payment. Under no circumstances can petty cash be used for personal expenses or loans.

What is the maximum amount for petty cash?

General. Petty Cash Fund: An amount of cash, not to exceed $500, held by a department or office to pay for incidental expenses. The fund needs to be replenished periodically (recommended monthly) as incidental expenses are incurred and reduce the amount of funds on hand.

How do you write a petty cash policy?

Establish the total amount of cash needed in the fund at any given time. Write out the procedure on who and what needs prior approval for petty cash spending. Explain how your company documents petty cash spending, such as petty cash vouchers, petty cash books and original receipts.

How do you do petty cash transactions?

For petty cash accounting, you must create a log detailing your transactions. And, you must record a petty cash journal entry when you put money into the petty cash fund and when money leaves the fund. Consider recording petty cash transactions in your books at least once per month.

What are the two main advantages of the petty cash system?

A petty cash fund can be used for office supplies, cards for customers, flowers, paying for a catered lunch for employees, or reimbursing employees for expenses. Petty cash's main advantages are that it's quick, convenient, and easy to understand and use.

What are petty cash procedures?

Petty cash funds should be properly secured at all times. Access to the funds should be restricted to one person (e.g., the petty cash custodian or a specified cashier). Cash on hand and receipts for disbursements made should always equal the assigned amount of the petty cash fund.

How do you create petty cash entries?

To create journal entries that show petty fund purchases, you must debit the corresponding accounts (e.g., Office Supplies account if you purchase supplies) and credit your Petty Cash account. You might debit multiple accounts, depending on how often you update your books for petty cash accounting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete petty cash policy template online?

pdfFiller has made it easy to fill out and sign petty cash policy template. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the petty cash policy template in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your petty cash policy template and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit petty cash policy template on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing petty cash policy template, you need to install and log in to the app.

What is Monroe Group Petty Cash Policy?

The Monroe Group Petty Cash Policy outlines the procedures and guidelines for the management, use, and reimbursement of petty cash funds within the Monroe Group.

Who is required to file Monroe Group Petty Cash Policy?

Employees and departments that handle petty cash funds are required to file Monroe Group Petty Cash Policy.

How to fill out Monroe Group Petty Cash Policy?

To fill out the Monroe Group Petty Cash Policy, employees must provide details of the expense, including the amount, purpose, date, and supporting documentation.

What is the purpose of Monroe Group Petty Cash Policy?

The purpose of the Monroe Group Petty Cash Policy is to ensure proper management and accountability of petty cash funds, prevent misuse, and facilitate minor expense transactions.

What information must be reported on Monroe Group Petty Cash Policy?

The information that must be reported includes the date of the transaction, amount spent, purpose of the expense, name of the individual incurring the expense, and any relevant receipts.

Fill out your petty cash policy template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petty Cash Policy Template is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.