Get the free Estate Planning Checklist - 3F RE (1) - Shilanski & Associates Inc.

Show details

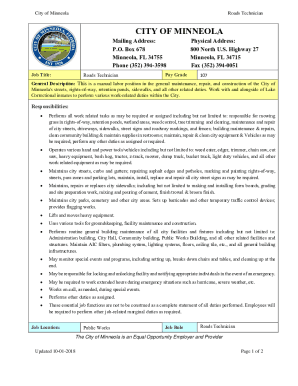

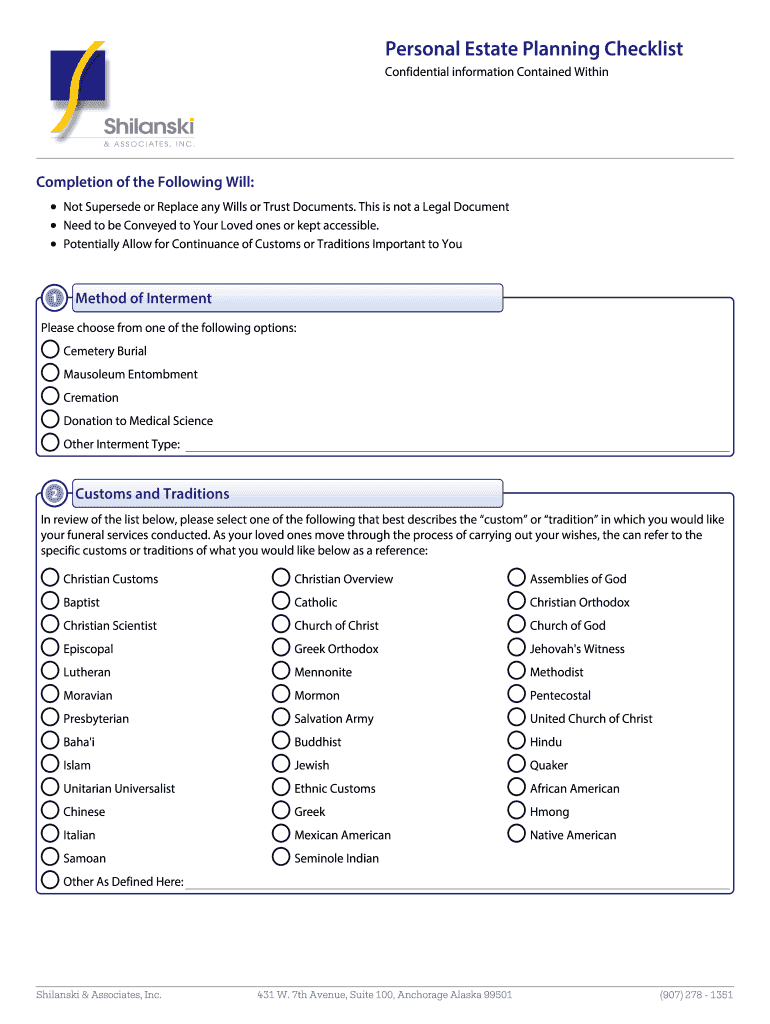

Personal Estate Planning Checklist Confidential information Contained Within Completion of the Following Will: Not Supersede or Replace any Wills or Trust Documents. This is not a Legal Document Need

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate planning checklist

Edit your estate planning checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate planning checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate planning checklist online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit estate planning checklist. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate planning checklist

How to fill out estate planning checklist

01

Start by gathering all necessary documents, such as identification papers, property deeds, and financial statements.

02

Make a list of all your assets, including bank accounts, investments, and real estate.

03

Consider your wishes for the distribution of your assets and write them down.

04

Designate beneficiaries for your assets and specify any conditions or restrictions.

05

Appoint an executor to handle your estate and make sure they are aware of their responsibilities.

06

Review your insurance policies and update them if necessary.

07

Create a power of attorney document to designate someone to make decisions on your behalf if you become incapacitated.

08

Draft a healthcare directive to outline your medical preferences if you are unable to communicate them later.

09

Consult with a qualified estate planning attorney to review your checklist and ensure all necessary legal documents are in place.

10

Regularly review and update your estate planning checklist as needed, especially after major life events or changes in your financial situation.

Who needs estate planning checklist?

01

Anyone who has assets, regardless of the size, can benefit from an estate planning checklist.

02

Individuals who want to ensure their assets are distributed according to their wishes after their death.

03

Parents who want to make arrangements for the guardianship of their minor children.

04

People who want to minimize estate taxes and other costs associated with the settlement of their estate.

05

Those who want to avoid any potential conflicts or disputes among family members or beneficiaries.

06

Individuals with specific healthcare preferences or concerns that need to be documented.

07

Business owners who want to plan for the succession of their business.

08

Individuals who want to protect their assets from creditors or legal claims.

09

People who want to provide for charitable donations or leave a legacy through their estate.

10

Elderly individuals who want to plan for long-term care and ensure their financial security.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get estate planning checklist?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the estate planning checklist in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I sign the estate planning checklist electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your estate planning checklist in seconds.

Can I edit estate planning checklist on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share estate planning checklist on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is estate planning checklist?

An estate planning checklist is a list of tasks and documents that help individuals plan for the distribution of their assets and the management of their affairs after they pass away.

Who is required to file estate planning checklist?

Anyone who has assets and wants to ensure they are distributed according to their wishes should create an estate planning checklist.

How to fill out estate planning checklist?

To fill out an estate planning checklist, gather information on your assets, debts, beneficiaries, and any wishes you have for their distribution. Consult with an attorney or financial planner for guidance.

What is the purpose of estate planning checklist?

The purpose of an estate planning checklist is to ensure that your assets are distributed according to your wishes, minimize taxes and fees, and provide for the care of any dependents.

What information must be reported on estate planning checklist?

Information that must be reported on an estate planning checklist includes assets such as real estate, bank accounts, investments, retirement accounts, life insurance policies, debts, and beneficiaries.

Fill out your estate planning checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Planning Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.