Get the free texas a m commerce 1098 t - tamuc

Show details

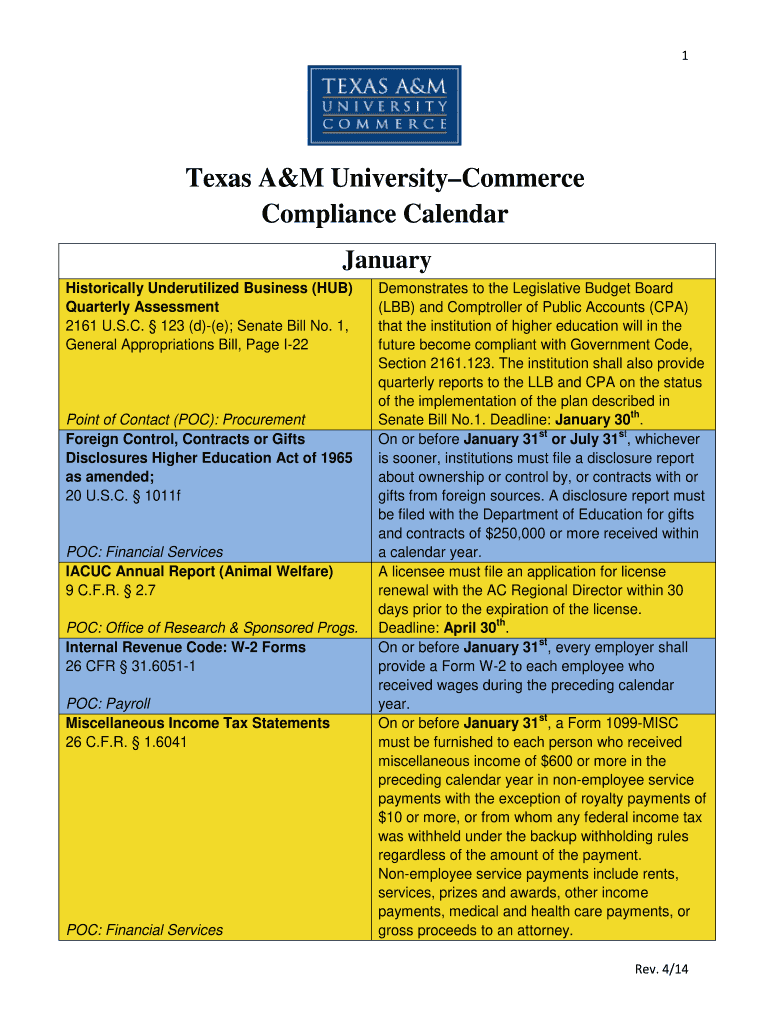

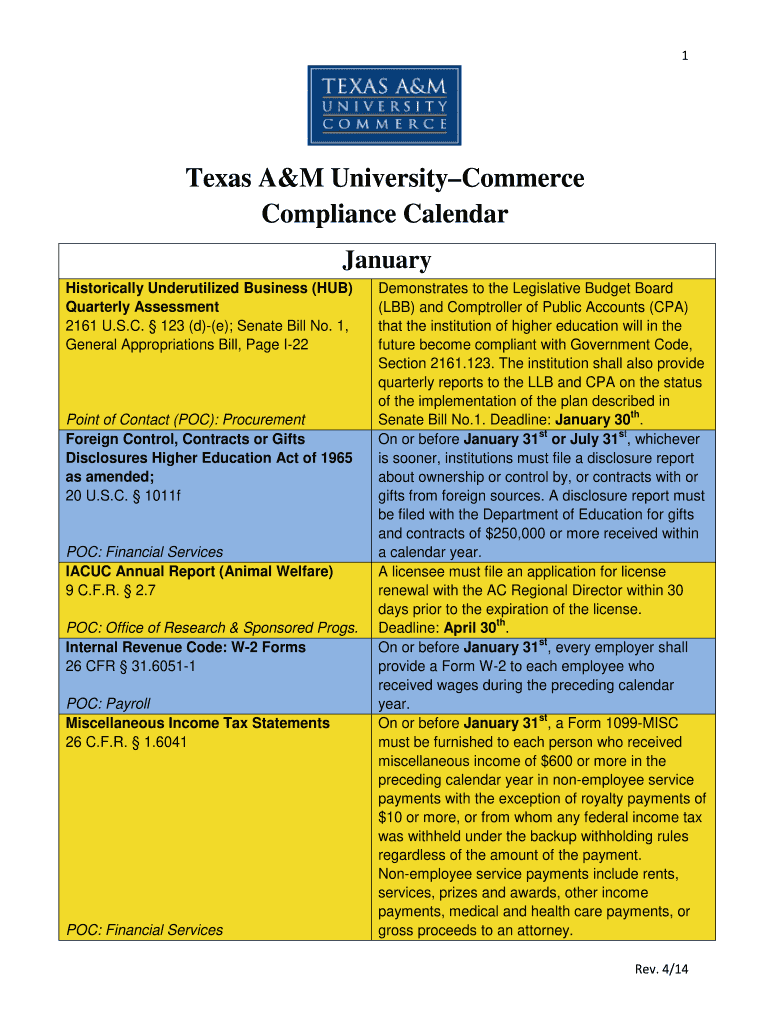

1 Texas A&M University Commerce Compliance Calendar January Historically Underutilized Business (HUB) Quarterly Assessment 2161 U.S.C. 123 (d)-(e); Senate Bill No. 1, General Appropriations Bill,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas a m commerce

Edit your texas a m commerce form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas a m commerce form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas a m commerce online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit texas a m commerce. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out texas a m commerce

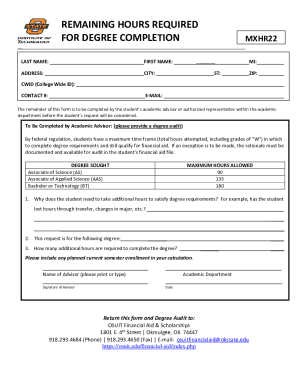

How to fill out tamuc 1098 t:

01

Gather necessary information and documents such as your social security number, address, and financial information.

02

Visit the official TAMUC website and log in to your student portal.

03

Locate and access the section for tax forms or 1098 t.

04

Carefully review the form and make sure all the information is accurate and up to date.

05

Enter the required information in each section of the form, such as tuition expenses, scholarships, and grants received.

06

Double-check all the entered information for any errors or missing details.

07

Save and submit the completed form through the online portal or follow the instructions provided for submitting a physical copy.

08

Keep a copy of the filled-out form for your records.

Who needs tamuc 1098 t:

01

TAMUC 1098 t is mainly needed by students who are pursuing higher education at Texas A&M University-Commerce.

02

It is also required by taxpayers who are eligible for educational tax benefits, such as the American Opportunity Credit or the Lifetime Learning Credit.

03

The form is used to report the qualified expenses paid for education and the scholarships or grants received by the students. It assists in determining eligibility for tax credits or deductions related to education expenses.

Instructions and Help about texas a m commerce

Music Applause Music I'm so excited to be here I wonder who my roommate is mate

Fill

form

: Try Risk Free

People Also Ask about

Where do I find my Tamu 1098-T?

If you've elected online delivery, a standard paper form will not be mailed. Log into Howdy. If you're a former student, go to the "Former Student" tab. In the search engine type keyword “1098” Click 1098T Tax Forms. Click one of the links in the table to view the 1098-T and/or the Detail 1098-T information.

How much is parking at Tamucc?

Faculty/Staff General Parking Permit$ 190.00Garage Parking Permit$ 403.00Reserved Parking Permit$ 575.001 more row

Do you need a parking permit at Tamucc?

Parking registration required when parking on campus. Your license plate will be the key to registration. You can have 2 vehicles linked to your permit, but only 1 is permitted to park on campus.

What is the federal tax ID number for Texas A&M College Station?

Texas APPLICABILITY OF RATES: Texas A&M Research Foundation (EIN: 74-1238434), Engineering Experiment Station (EIN: 74-1974733), Texas Engineering Extension Service (EIN: 74-2270626), Texas Agri-Life Research (formerly known as Texas.

Where do I find my Tamu 1098 T?

If you've elected online delivery, a standard paper form will not be mailed. Log into Howdy. If you're a former student, go to the "Former Student" tab. In the search engine type keyword “1098” Click 1098T Tax Forms. Click one of the links in the table to view the 1098-T and/or the Detail 1098-T information.

How much is the parking pass at Tamuc?

Parking Regulations The cost for permits will be $80/$120 in Fall 2021. Permits expire each August 31. Permits for students, faculty and staff may be purchased in person at the Cashier windows in the McDowell Administration Building.

Who gets to claim the 1098-T?

The IRS Form 1098-T is an information form filed with the Internal Revenue Service. You, or the person who may claim you as a dependent, may be able to claim an education tax credit on IRS Form 1040 for the qualified tuition and related expenses that were actually paid during the calendar year.

Do I file 1098-T if my parents paid?

College students or their parents who paid qualified tuition and college expenses during the tax year will need Form 1098-T from their school if they want to claim certain education credits.

How much does a 1098-T help with taxes?

It is a tax credit of up to $2,500 of the cost of tuition, certain required fees and course materials needed for attendance and paid during the tax year. Also, 40 percent of the credit for which you qualify that is more than the tax you owe (up to $1,000) can be refunded to you.

Who claims the 1098-T student or parent?

If you claim a dependent, only you can claim the education credit. Therefore, you would enter Form 1098-T and the dependent's other education information in your return. If you do not claim a dependent, the student can claim the education credit.

Do you have to report 1098-T on taxes?

While it is a good starting point, the 1098-T, as designed and regulated by the IRS, does not contain all of the information needed to claim a tax deduction or credit. There is no IRS requirement that you must claim the tuition and fees deduction or an education credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the texas a m commerce electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your texas a m commerce in minutes.

How do I edit texas a m commerce on an Android device?

The pdfFiller app for Android allows you to edit PDF files like texas a m commerce. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

How do I complete texas a m commerce on an Android device?

Use the pdfFiller mobile app and complete your texas a m commerce and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is texas a m commerce?

Texas A&M University-Commerce is a public research university located in Commerce, Texas. It is part of the Texas A&M University System and offers a wide range of undergraduate and graduate degree programs.

Who is required to file texas a m commerce?

Individuals who are applying for admission to Texas A&M University-Commerce or currently enrolled students seeking financial aid or scholarships may be required to submit specific forms related to their status.

How to fill out texas a m commerce?

To fill out the application for Texas A&M University-Commerce, prospective students should visit the university's official website, create an account, and complete the online application form along with the required documents.

What is the purpose of texas a m commerce?

The purpose of Texas A&M University-Commerce is to provide higher education, promote research and innovation, and serve the local community and beyond through various educational programs and outreach initiatives.

What information must be reported on texas a m commerce?

Information that must be reported typically includes personal identification details, academic history, test scores (if required), and any relevant financial information for aid applications.

Fill out your texas a m commerce online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas A M Commerce is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.