1098 T Form 2015

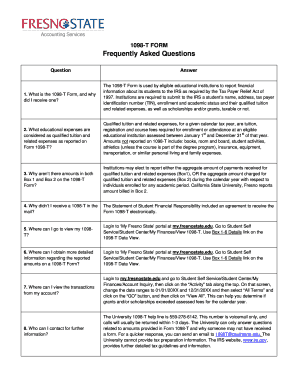

What is 1098 t form 2015?

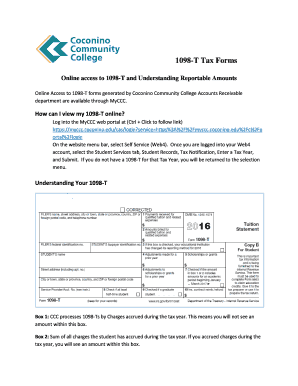

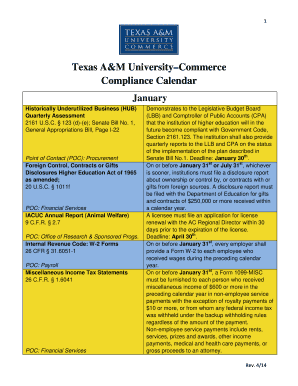

The 1098 t form 2015 is a document issued by educational institutions to eligible students for the purpose of reporting tuition payments. It serves as a record of the amount of qualified educational expenses paid by the student during the tax year.

What are the types of 1098 t form 2015?

There are two types of 1098 t form 2015 that can be issued to students: 1. Form 1098-T (Tuition Statement): This form is provided to students who are enrolled in eligible educational institutions and contains information regarding tuition expenses paid and scholarships or grants received. 2. Form 1098-T (Tuition Statement) Replacement: This form is issued when the original Form 1098-T needs to be corrected or reissued.

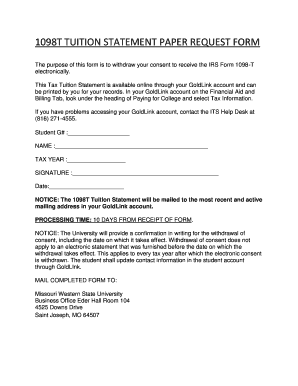

How to complete 1098 t form 2015

Completing the 1098 t form 2015 is a straightforward process. Follow these steps: 1. Enter the student's personal information, including name, address, and social security number. 2. Provide details of the educational institution, such as name, address, and taxpayer identification number. 3. Report the amounts paid for qualified tuition and related expenses in the respective boxes. 4. Indicate any scholarships or grants received by the student. 5. Review the form for accuracy and make any necessary corrections. 6. Sign and date the form. 7. Retain a copy for your records and provide a copy to the student.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.