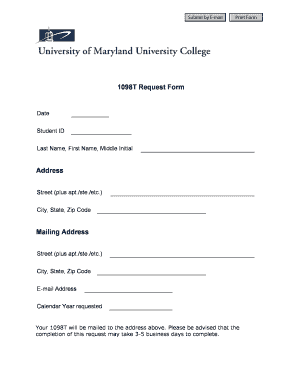

What Is A 1098-t

What is a 1098-T?

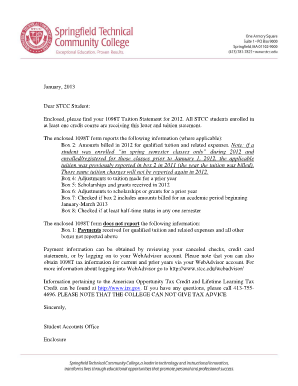

A 1098-T form is a tax document issued by educational institutions to eligible students who have made qualified tuition payments during the tax year. It provides important information required for claiming education-related tax credits and deductions on your federal income tax return.

What are the types of a 1098-T?

There are three types of 1098-T forms:

Type This type reports payments received for qualified tuition and related expenses.

Type This type reports amounts billed for qualified tuition and related expenses.

Type This type reports both payments received and amounts billed, giving a comprehensive overview of the student's financial transactions.

How to complete a 1098-T

To complete a 1098-T form, follow these steps:

01

Obtain the necessary information from your educational institution, including your student identification number.

02

Review your records and gather all the relevant financial information, such as tuition payments made and amounts billed.

03

Fill in the required fields on the form, ensuring accuracy and completeness.

04

Double-check your entries and make any necessary corrections.

05

Submit the completed form to your educational institution within the designated deadline.

06

Keep a copy for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

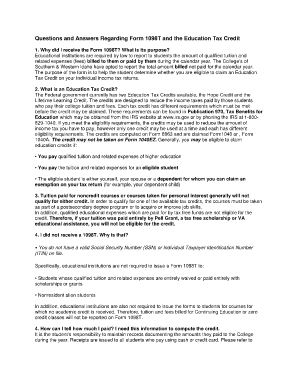

Do you get all the money back from a 1098-T?

Yes, tuition paid with loan money (but not scholarships) counts toward the tuition credits. This is because loans eventually have to be paid back, so it really is YOUR money that paid the tuition. But, you do not get a “refund” of what you paid. The amounts you paid are used to calculate an education credit.

What is a 1098-T for dummies?

What is the IRS Form 1098-T? The Form 1098-T is a statement that colleges and universities are required to issue to certain students. It provides the total dollar amount paid by the student for what is referred to as qualified tuition and related expenses (or “QTRE”) in a single tax year.

How much do you get back in taxes for 1098-T?

A form 1098-T, Tuition Statement, is used to help figure education credits (and potentially, the tuition and fees deduction) for qualified tuition and related expenses paid during the tax year. The Lifetime Learning Credit offers up to $2,000 for qualified education expenses paid for all eligible students per return.

Can I fill out my own 1098-T?

0:32 2:10 Learn How to Fill the Form 1098-T Tuition Statement - YouTube YouTube Start of suggested clip End of suggested clip Contact information including the student's name street address city state. And zip code if you haveMoreContact information including the student's name street address city state. And zip code if you have a service provider. Account number provide that number in the bottom left box on the form 1098.

Does IRS get a copy of 1098-T?

Eligible post-secondary institutions are required to send Form 1098-T to tuition-paying students by January 31 and file a copy with the IRS by February 28. Schools use Box 1 of the form to report the payments received.

Is it worth it to file a 1098-T?

When you're ready to file your federal income tax return, make sure you have your Form 1098-T on hand — if you received one. It can help you calculate two potentially valuable education credits — the American opportunity tax credit and the lifetime learning credit.

Related templates