Get the free ROTH CONVERSION &

Show details

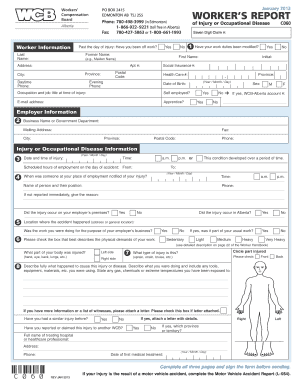

ROTH CONVERSION & CHARACTERIZATION REQUEST PO Box 7080 San Carlos, CA 940707080 www.IRAServices.com General Phone: (800) 2488447 Fax: (605) 3850050 Complete Section 2 for Roth Conversion requests.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign roth conversion amp

Edit your roth conversion amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your roth conversion amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing roth conversion amp online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit roth conversion amp. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out roth conversion amp

How to fill out roth conversion amp

01

Gather all the necessary information and documents related to your Roth conversion.

02

Ensure that you are eligible for a Roth conversion by understanding the requirements.

03

Contact your financial institution or retirement account administrator to initiate the Roth conversion.

04

Fill out the necessary forms provided by your financial institution or retirement account administrator.

05

Specify the amount you wish to convert from your traditional IRA or eligible retirement account to a Roth IRA.

06

Provide any additional information required, such as your current tax situation or beneficiary designation.

07

Review and double-check all the information provided in the forms before submitting them.

08

Submit the completed forms to your financial institution or retirement account administrator.

09

Keep a copy of the completed forms and any confirmation or acknowledgement received.

10

Monitor the progress of your Roth conversion and follow up with your financial institution if necessary.

11

Understand the tax implications of the Roth conversion and consult with a tax professional if needed.

12

Evaluate the benefits and drawbacks of a Roth conversion for your specific financial situation.

Who needs roth conversion amp?

01

Individuals who expect to be in a higher tax bracket during retirement may benefit from a Roth conversion.

02

Those who have already paid taxes on their traditional IRA contributions may consider a Roth conversion.

03

People who want to potentially reduce their future tax obligations and enjoy tax-free qualified distributions may opt for a Roth conversion.

04

Individuals who have a long time horizon for the invested funds to grow tax-free may find value in a Roth conversion.

05

Those who want to leave a tax-free inheritance to their heirs may choose a Roth conversion.

06

People who want more flexibility in managing their retirement income and withdrawals may benefit from a Roth conversion.

07

Those who anticipate changes in tax laws or personal circumstances in the future may consider a Roth conversion.

08

Individuals who wish to diversify their retirement savings and hedge against potential tax rate increases may opt for a Roth conversion.

09

Those who have maxed out their other retirement account options may find a Roth conversion as an additional tax-efficient investment vehicle.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute roth conversion amp online?

pdfFiller has made filling out and eSigning roth conversion amp easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the roth conversion amp in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your roth conversion amp in seconds.

How do I edit roth conversion amp straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing roth conversion amp, you can start right away.

What is roth conversion amp?

Roth conversion amp is a form used to convert funds from a traditional IRA or employer-sponsored retirement plan into a Roth IRA.

Who is required to file roth conversion amp?

Individuals who have converted funds from a traditional IRA or employer-sponsored retirement plan into a Roth IRA are required to file roth conversion amp.

How to fill out roth conversion amp?

To fill out roth conversion amp, you need to provide information about the amount of funds converted, the account numbers, and details of the conversion.

What is the purpose of roth conversion amp?

The purpose of roth conversion amp is to report the conversion of funds from a traditional IRA or employer-sponsored retirement plan into a Roth IRA to the IRS.

What information must be reported on roth conversion amp?

Information such as the amount of funds converted, account numbers, and details of the conversion must be reported on roth conversion amp.

Fill out your roth conversion amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Roth Conversion Amp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.