Get the free SHORT TERM LOAN APPLICATION APPLICATION MUST BE COMPLETE AND LEGIBLE Please refer to...

Show details

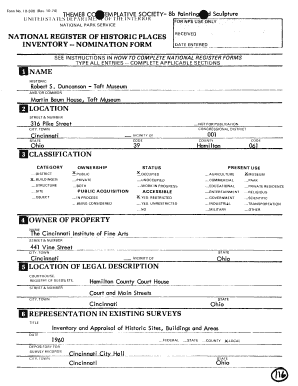

SHORT TERM LOAN APPLICATION MUST BE COMPLETE AND LEGIBLE Please refer to back of application for short-term loan qualifications. Student must complete Student Data, Employment, References and Loan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short term loan application

Edit your short term loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short term loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing short term loan application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit short term loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short term loan application

How to fill out a short term loan application:

01

Start by gathering all the necessary documents and information. This may include proof of income, identification documents, bank statements, and any other required documentation.

02

Carefully read through the application form before filling it out. Take note of any specific instructions or requirements mentioned on the form.

03

Begin by filling in your personal information accurately. This typically includes your full name, address, contact information, and social security number.

04

Provide details about your employment status, such as your current job title, employer's name and contact information, and the duration of your employment.

05

If applicable, provide information about any other sources of income you may have, such as freelance work or rental income.

06

Specify the loan amount you are requesting and the desired repayment term. Make sure to consider your financial capabilities and choose a repayment term that works best for you.

07

If required, provide details about any collateral you are willing to offer against the loan. Collateral can be an asset that the lender can claim in case of default on the loan.

08

Answer any additional questions or sections on the form that specifically relate to your financial situation or loan purpose. These may include questions about your monthly expenses, existing debts, or the reason for needing the loan.

09

Before submitting the application, review all the information filled in to ensure its accuracy. Any mistakes or inconsistencies may delay or even reject your application.

10

If applicable, sign and date the application form as per the instructions provided.

Who needs a short term loan application:

01

Individuals facing unexpected financial emergencies, such as medical expenses or car repairs, may need a short term loan to cover these expenses quickly.

02

Small business owners who require immediate funds for inventory restocking, equipment purchase, or operational expenses may also need a short term loan.

03

Students may need a short term loan to cover tuition fees, textbooks, or other educational expenses until they receive their financial aid or scholarships.

04

Individuals with poor credit scores who may not qualify for traditional loans from banks or credit unions may seek short term loans as an alternative solution.

05

Startups or entrepreneurs looking for capital to fund their new business venture or bridge the gaps between investments may need short term loans.

In conclusion, filling out a short term loan application requires careful attention to detail and providing accurate information about personal and financial matters. Short term loans can be beneficial for various individuals and situations, providing quick financial aid when needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is short term loan application?

A short term loan application is a request for a loan with a repayment period typically lasting less than a year.

Who is required to file short term loan application?

Individuals or businesses seeking a short term loan are required to file the application.

How to fill out short term loan application?

To fill out a short term loan application, one must provide personal or business financial information, loan amount requested, and intended use of funds.

What is the purpose of short term loan application?

The purpose of a short term loan application is to apply for financial assistance for a short term period.

What information must be reported on short term loan application?

Information such as personal or business financial statements, credit history, and loan amount requested must be reported on the short term loan application.

How can I modify short term loan application without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your short term loan application into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send short term loan application for eSignature?

When your short term loan application is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit short term loan application on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing short term loan application, you can start right away.

Fill out your short term loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short Term Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.