Brighthouse Financial L-12030-B 2017-2025 free printable template

Show details

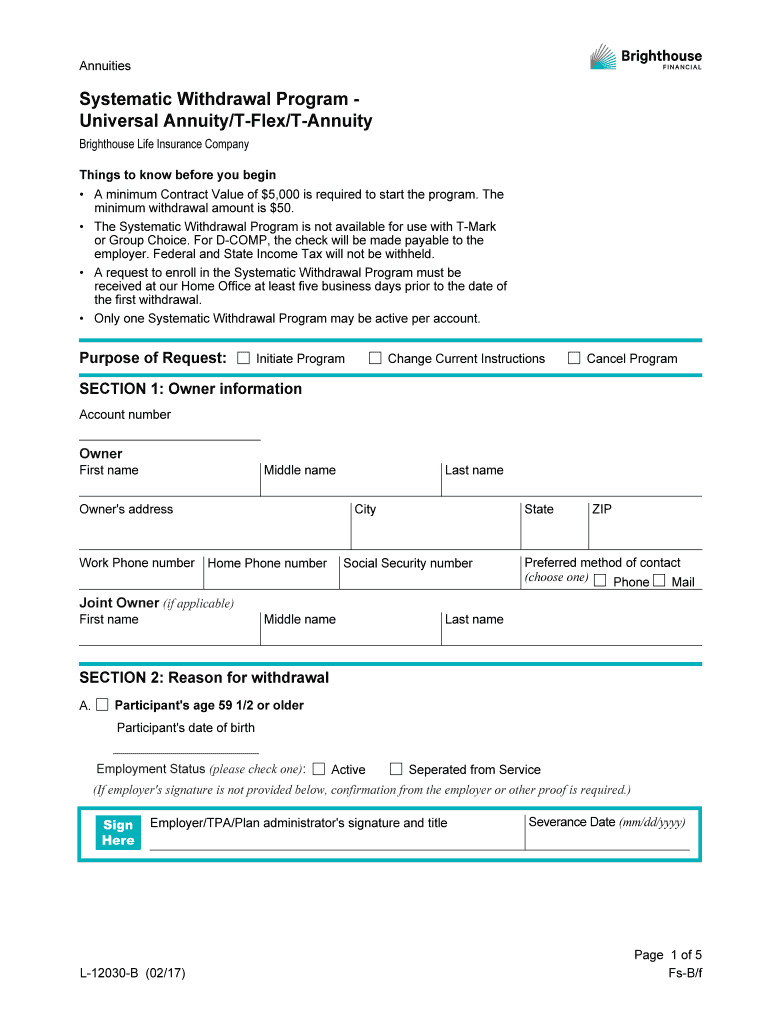

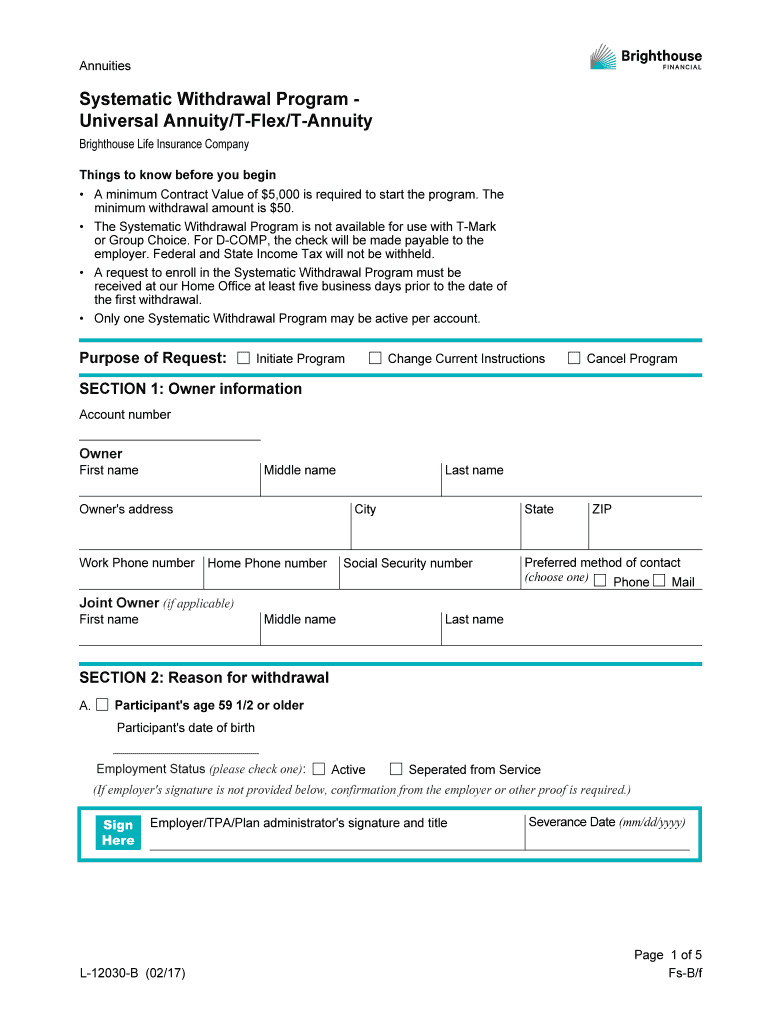

Annuities Systematic Withdrawal Program Universal Annuity/Flex/Annuity Bright house Life Insurance Company Things to know before you begin A minimum Contract Value of $5,000 is required to start the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign systematic withdrawal plan letter

Edit your systematic withdrawal plan letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your systematic withdrawal plan letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit systematic withdrawal plan letter online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit systematic withdrawal plan letter. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out systematic withdrawal plan letter

How to fill out Brighthouse Financial L-12030-B

01

Obtain the Brighthouse Financial L-12030-B form from the official website or customer service.

02

Fill in your personal information including name, address, and contact details in the designated fields.

03

Provide the relevant financial details required by the form, such as income and expense statements.

04

Specify your policy information, including policy numbers and types.

05

Review the terms and conditions that apply to the form and ensure you understand them.

06

Sign and date the form at the designated area to certify the information provided.

07

Submit the completed form as instructed, either online or via mail, ensuring you keep a copy for your records.

Who needs Brighthouse Financial L-12030-B?

01

Individuals who have insurance policies with Brighthouse Financial and need to file a claim or update their information.

02

Beneficiaries of Brighthouse Financial policyholders who need to manage claims or benefits.

03

Financial advisors assisting clients with Brighthouse Financial products.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a systematic withdrawal plan?

Example of Systematic Withdrawal Plan Here, an individual has invested Rs. 50,000 for tenure of 1 year along with a systematic withdrawal of Rs. 1,000 per month. Interest rate stands at 10%. As such, total return of investments after the end of the tenor stands at Rs. 4,565.

How do I apply for a systematic withdrawal plan?

The investor chooses to invest a lump sum or make periodic investments in the mutual fund. The investor selects the SWP option and specifies the amount and frequency of withdrawals. The mutual fund sells units of the fund to meet the withdrawal request and the investor receives the money in their account.

How do I stop systematic withdrawal plan?

Here are the steps to cancel your SWP: Login to your Scripbox account & click on “Investment Calendar” Select the offering & date for which you have created the SWP (withdrawal) Select “cancel all” Click “Cancel All”

How does systematic withdrawal plan work?

SWP generates cash-flows (income) by redeeming units from the scheme at the specified interval. The number of units redeemed to generate this cash-flow depends on SWP amount and the scheme NAV on the withdrawal date. Example - Investor invests lump sum Rs 10.00 lakhs in a mutual fund scheme.

What is a systematic withdrawal request?

Systematic withdrawals are variable meaning that if you select a monthly payment based on a percentage of your balance, your monthly payment is expected to go up or down, due to market fluctuations.

What is systematic withdrawal from 401k?

A systematic withdrawal plan (SWP) allows for pre-planned cash flows generated by investments as income. Retirees are most often reliant on SWPs for retirement income generated from investments accumulated in retirement accounts like IRAs or 401(k) plans or through annuitizing assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find systematic withdrawal plan letter?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific systematic withdrawal plan letter and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit systematic withdrawal plan letter online?

The editing procedure is simple with pdfFiller. Open your systematic withdrawal plan letter in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete systematic withdrawal plan letter on an Android device?

Use the pdfFiller mobile app to complete your systematic withdrawal plan letter on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is Brighthouse Financial L-12030-B?

Brighthouse Financial L-12030-B is a form used for reporting certain financial information related to insurance products issued by Brighthouse Financial.

Who is required to file Brighthouse Financial L-12030-B?

Insurance agents or financial representatives who sell Brighthouse Financial products may be required to file Brighthouse Financial L-12030-B as part of the regulatory reporting process.

How to fill out Brighthouse Financial L-12030-B?

To fill out Brighthouse Financial L-12030-B, gather the necessary financial information, complete each section accurately, and ensure that all required signatures are provided before submitting the form.

What is the purpose of Brighthouse Financial L-12030-B?

The purpose of Brighthouse Financial L-12030-B is to ensure compliance with financial regulations and provide necessary disclosures related to insurance products.

What information must be reported on Brighthouse Financial L-12030-B?

Information that must be reported on Brighthouse Financial L-12030-B includes policyholder details, financial performance metrics, and any relevant transaction data pertaining to Brighthouse Financial products.

Fill out your systematic withdrawal plan letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Systematic Withdrawal Plan Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.