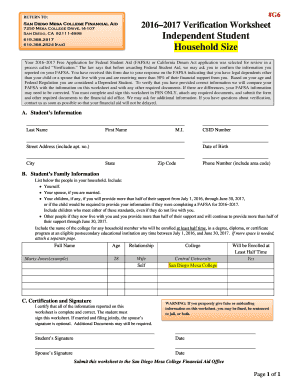

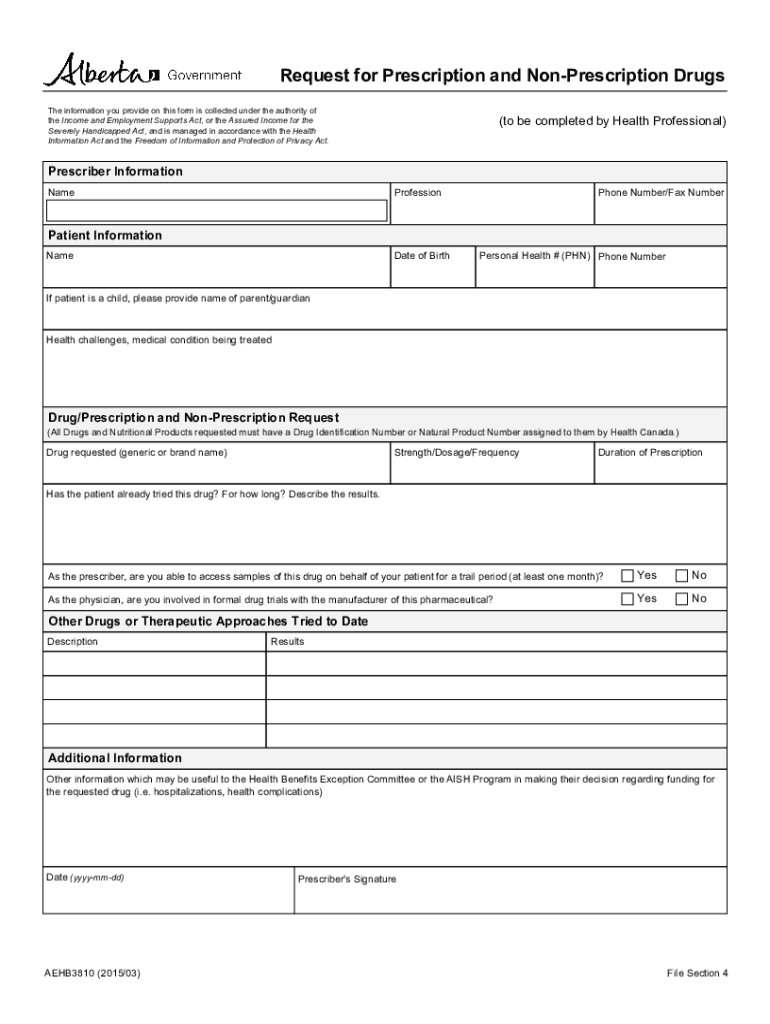

Canada AEHB3810 2015 free printable template

Show details

The information you provide on this form is collected under the authority of ... Severely Handicapped Act, and is managed in accordance with the Health ... (All Drugs and Nutritional Products requested...

We are not affiliated with any brand or entity on this form

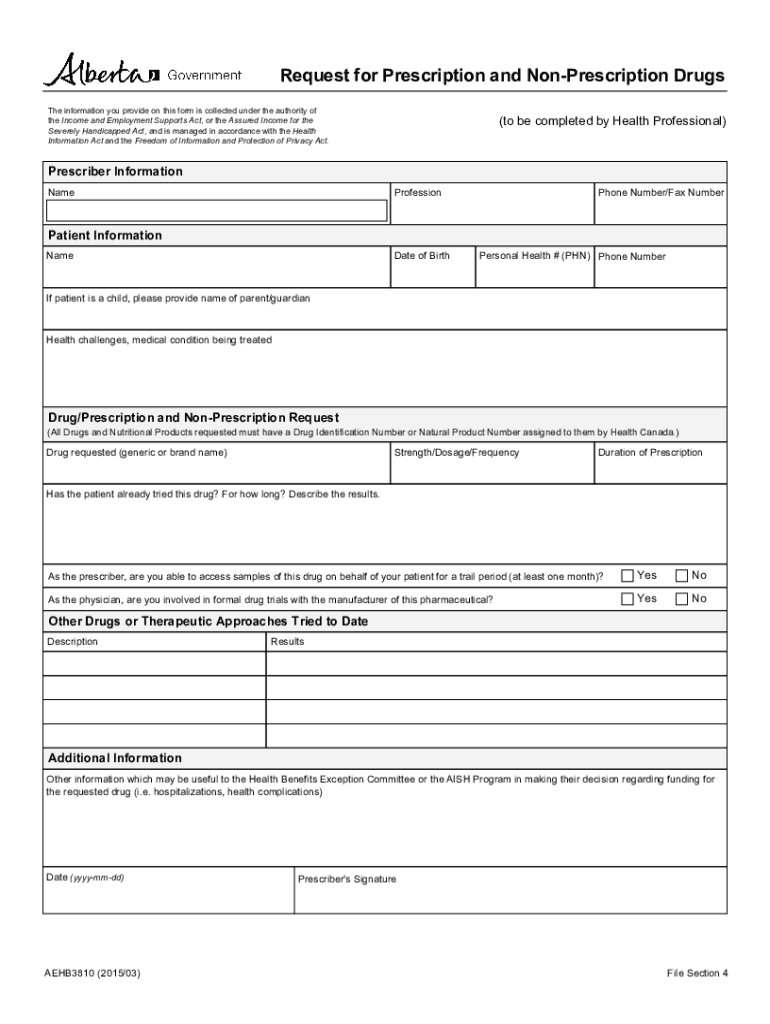

Get, Create, Make and Sign Canada AEHB3810

Edit your Canada AEHB3810 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada AEHB3810 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada AEHB3810 online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada AEHB3810. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada AEHB3810 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada AEHB3810

How to fill out Canada AEHB3810

01

Obtain the Canada AEHB3810 form from the official website or your local Canada Customs office.

02

Fill in your personal details including your name, address, and contact information in the designated sections.

03

Provide relevant information about the goods you are importing or exporting, including their value, description, and quantity.

04

Specify the purpose of filing the form and any applicable exemptions or exceptions.

05

Review all entered information for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed form as instructed, either electronically or in person.

Who needs Canada AEHB3810?

01

Individuals or businesses that are importing or exporting goods to or from Canada.

02

Customs brokers and agents who represent individuals or companies in customs matters.

03

Anyone seeking to claim exemptions or exceptions on imported/exported goods.

Fill

form

: Try Risk Free

People Also Ask about

Can you get an FP57 form online?

The HC5(W) form cannot be ordered online - call 0300 330 1343 and we'll post the form to you. To claim a prescription refund, ask your pharmacist for a 'FP57' refund receipt when you pay, you cannot get one later.

Can you take a prescription form to any pharmacy?

Getting your prescription If you already have your prescription, this can be taken to any community pharmacy you choose. You'll have to wait for it to be dispensed or you can return later to pick it up.

What is a PF57 form for diabetics?

If you take diabetes medicine, you're entitled to free prescriptions for all your medicines. To claim your free prescriptions, you'll need to apply for an exemption certificate. This is known as a PF57 form.

How do I get a prescription exemption form?

Ask your doctor for an FP92A form to apply for a medical exemption certificate. Your GP will sign the form to confirm that your statement is correct. At your GP's discretion, a member of the practice who has access to your medical records can also sign the form.

How do I claim back a prescription charge?

How can I claim a refund on a prescription charge? Ask the pharmacist, hospital or doctor for the refund form (FP57) when you pay for your prescription. You cannot get one later. You must apply for a refund within 3 months of paying the prescription charge.

What is a prescription form?

A prescription is an order that is written by you, the physician (or future physician), to tell the pharmacist what medication you want your patient to take.

Where do I get a FP57 form from?

You can only get an FP57 from the pharmacy or dispensary which dispenses your prescription. You must contact Primary Care Support England (PCSE) to request these. You can do this via the portal on the PCSE website.

What is an FP57 refund receipt?

An FP57 is a receipt which can be obtained from a pharmacy or dispensary to enable you to claim a refund of any prescriptions you have paid for. FP57 receipts can only be obtained at the time of purchase. Copyright © 2023. All rights reserved.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada AEHB3810 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing Canada AEHB3810, you can start right away.

How do I fill out the Canada AEHB3810 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign Canada AEHB3810. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit Canada AEHB3810 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign Canada AEHB3810 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is Canada AEHB3810?

Canada AEHB3810 is a specific tax form used in Canada for the reporting of income earned by employees of registered charities and certain non-profit organizations.

Who is required to file Canada AEHB3810?

Organizations that employ individuals in roles funded or subsidized by government sources or charities as well as charities themselves that pay employees are required to file Canada AEHB3810.

How to fill out Canada AEHB3810?

To fill out Canada AEHB3810, you need to provide details such as the employee's name, social insurance number, employment period, and income earned. Follow the form instructions carefully to ensure accurate reporting.

What is the purpose of Canada AEHB3810?

The purpose of Canada AEHB3810 is to provide the Canada Revenue Agency with information regarding the earnings of employees in the charity and non-profit sector, ensuring compliance with tax regulations.

What information must be reported on Canada AEHB3810?

Information that must be reported on Canada AEHB3810 includes the employee's personal information, total income paid, period of employment, and deductions made for employment purposes.

Fill out your Canada AEHB3810 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada aehb3810 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.