Get the free Guaranty of Accounts Receivable

Show details

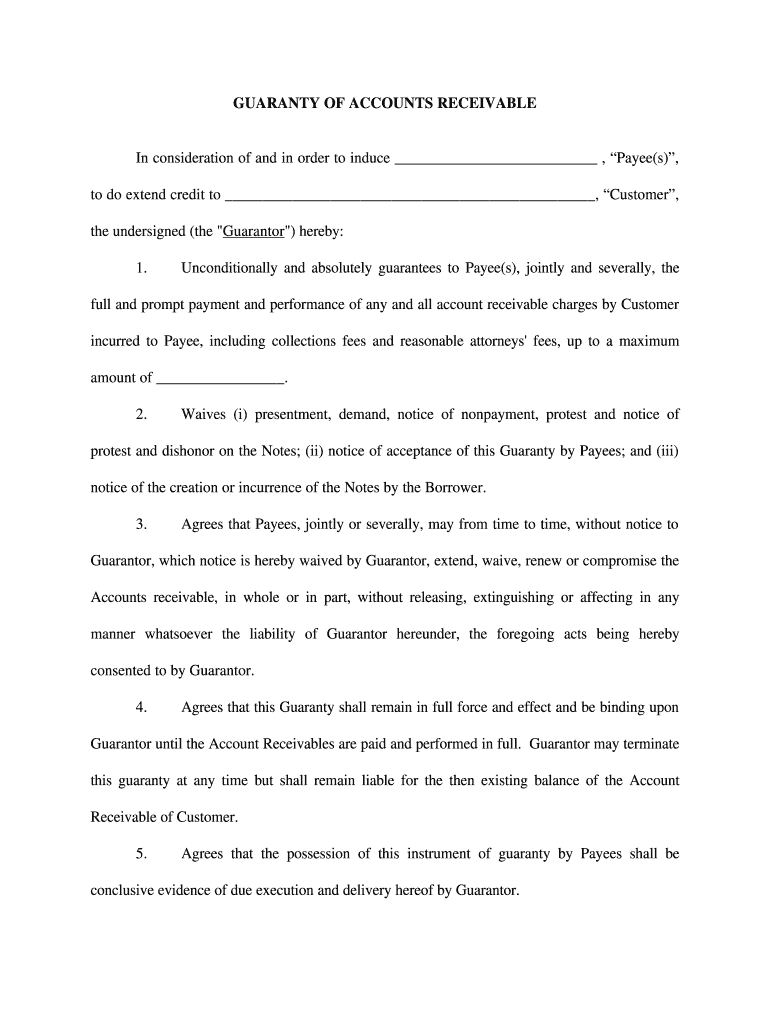

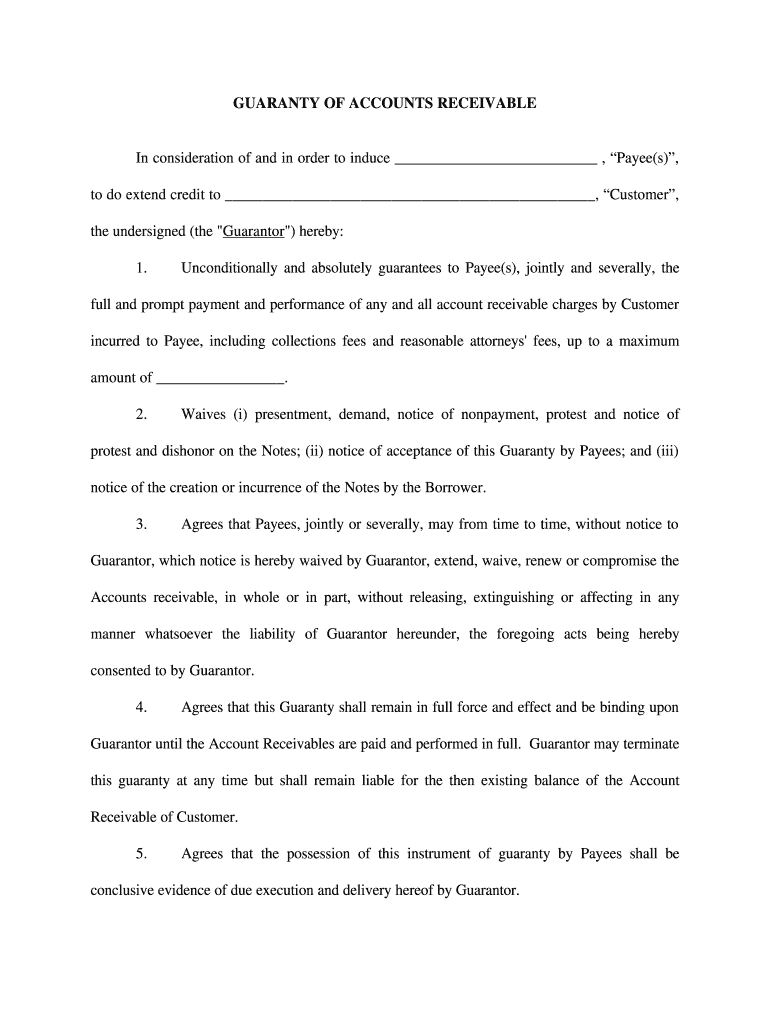

This document serves as a guaranty by the undersigned to ensure the payment and performance of accounts receivable charges incurred by the customer to the payees. It outlines the terms and conditions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guaranty of accounts receivable

Edit your guaranty of accounts receivable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guaranty of accounts receivable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guaranty of accounts receivable online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit guaranty of accounts receivable. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guaranty of accounts receivable

How to fill out Guaranty of Accounts Receivable

01

Start with the title 'Guaranty of Accounts Receivable' at the top of the document.

02

Include the date when the document is being completed.

03

Clearly state the names of the parties involved, including the guarantor and the creditor.

04

Provide a description of the accounts receivable being guaranteed, including the amount and any relevant account details.

05

Specify the terms of the guarantee, such as the duration and conditions under which the guarantee is valid.

06

Include any necessary legal clauses or conditions that might apply.

07

Ensure that all parties sign and date the document to validate the agreement.

Who needs Guaranty of Accounts Receivable?

01

Businesses that want to secure financing using expected accounts receivable as collateral.

02

Creditors looking to lessen their risk when extending credit to businesses.

03

Small and medium-sized enterprises that may need additional guarantees to improve their borrowing capacity.

Fill

form

: Try Risk Free

People Also Ask about

How do you explain accounts receivable?

This expected payment is what finance organizations call “accounts receivable” (AR). Take, for example, a manufacturer that delivers US$10,000 worth of products to a customer with a 30-day payment term. The company's finance department records this invoice on its balance sheet as an AR.

What is an example of an account receivable?

Definition. Trade receivables represent the total amounts that a company has invoiced to customers for goods and services that it has delivered but for which it has not yet received payment. As such, trade receivables are included on the assets side of the balance sheet within current assets.

What are the GAAP rules for accounts receivable?

What is Accounts Receivable Insurance? Accounts receivable insurance – sometimes called A/R insurance or trade credit insurance – provides companies with protection against customers that fail to pay what they owe by securing their accounts receivable.

What is trade receivables in English?

A bill receivable is a separate transaction in Receivables. A bill receivable is a document that a customer formally agrees to pay at some future date (the maturity date). The bill receivable document effectively replaces, for the related amount, the open debit items that are applied to the bill.

What is accounts receivable with English?

Accounts receivable refer to the money a company's customers owe for goods or services they have received but not yet paid for. For example, when customers purchase products on credit, the amount owed gets added to the accounts receivable. It's an obligation created through a business transaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Guaranty of Accounts Receivable?

Guaranty of Accounts Receivable is a financial arrangement where a third party guarantees the collection of receivables, ensuring that a company will receive payment on debts owed to them.

Who is required to file Guaranty of Accounts Receivable?

Typically, businesses that have accounts receivable and seek to secure financing or mitigate risk through guarantees may be required to file a Guaranty of Accounts Receivable.

How to fill out Guaranty of Accounts Receivable?

To fill out a Guaranty of Accounts Receivable, you generally need to include details such as the names of the parties involved, description of the guaranteed accounts, the terms of the guarantee, and any relevant financial information about the receivables.

What is the purpose of Guaranty of Accounts Receivable?

The purpose of a Guaranty of Accounts Receivable is to enhance the likelihood of payment on receivables for businesses, while also providing reassurance to lenders or investors that the receivables will be collected.

What information must be reported on Guaranty of Accounts Receivable?

Information that must be reported generally includes the amount guaranteed, description of the accounts receivable, the parties involved, terms of the guarantee, and any other relevant financial disclosures concerning the receivables.

Fill out your guaranty of accounts receivable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guaranty Of Accounts Receivable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

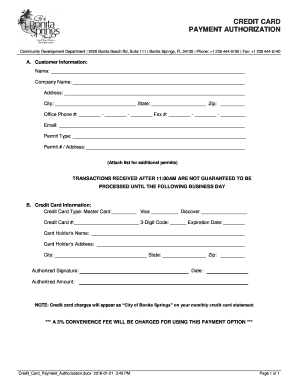

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.