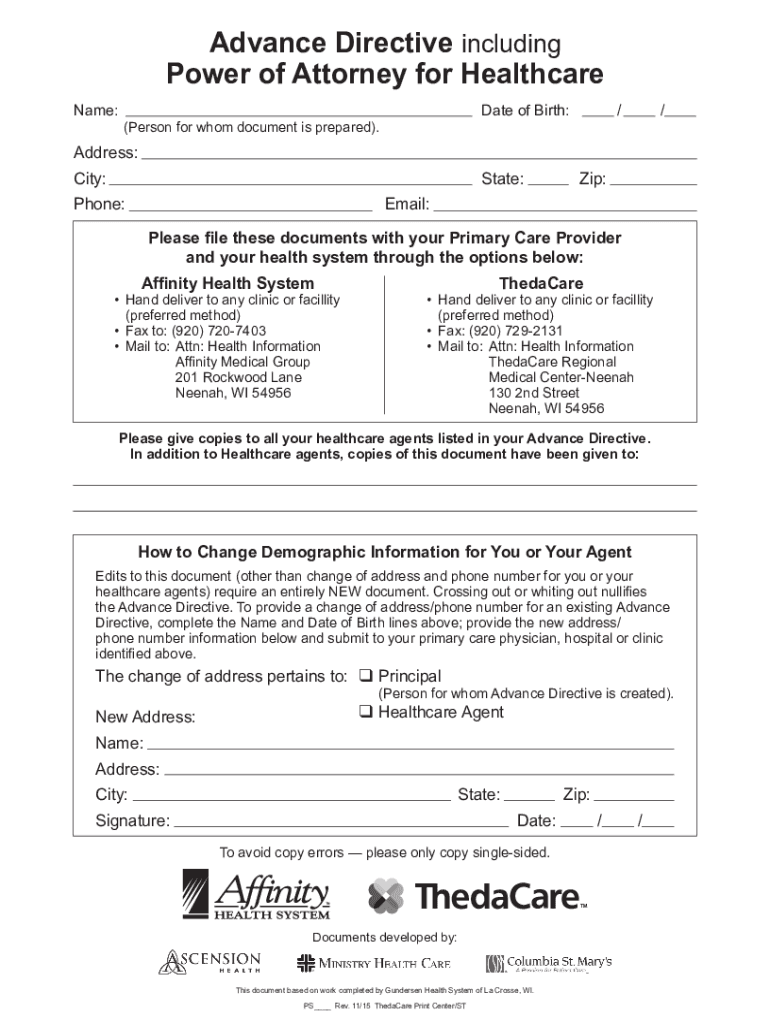

WI F-00085 2015 free printable template

Get, Create, Make and Sign WI F-00085

How to edit WI F-00085 online

Uncompromising security for your PDF editing and eSignature needs

WI F-00085 Form Versions

How to fill out WI F-00085

How to fill out WI F-00085

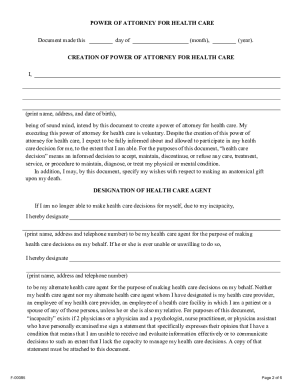

Who needs WI F-00085?

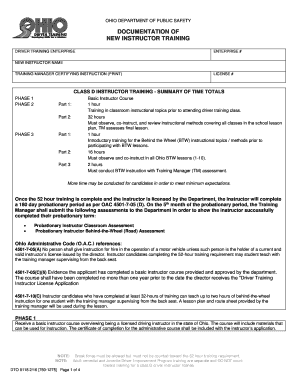

Instructions and Help about WI F-00085

Um it's secretary Smith I want to ask you just threw out a lot of statistics because you have your own actuaries in Wisconsin making their own estimates go through that one more time just very briefly how many people are you projecting will lose the current coverage they have what proportion of people in Wisconsin will see an increase in their insurance premiums and how many people are you projecting we'll go from there private current coverage they enjoy into the exchange those are basically three questions I wanted to get it because that you can do that pretty fast as I appreciate you compressed your testimony in 25 minutes yes sir, and again we've only been on the job three weeks, so these are the actuaries that the previous administration Emma critic administration yes sir and had done the work there, so we estimate that a couple of different things one again sort of the break point there are people who will get additional benefits, and they will outweigh any additional cost to them there are others who will get additional costs and additional benefits, but the costs will outweigh the benefits if you have the break point seems to be around about three hundred and fifty percent of poverty that if you are a below that or more benefits than costs above that more cost than benefits given that the median family income in household income in Wisconsin is around four hundred percent then that suggests the majority will have greater costs than they will in benefits the number of people who are moving out of their current coverage is about four hundred and seventy-five thousand individuals those include people who are in the individual market though who are already again have health insurance coverage people who are currently on Medicaid better at higher income levels who will move off of Medicaid which would be savings to the state, but then those are federal dollars that are being paid for that and then a small migration out of the employer market, but those are the individuals you know and in Wisconsin total populations about 55 million people so close to ten percent of people will have their current insurance coverage disrupted

People Also Ask about

Does a POA need to be recorded in Wisconsin?

Does a power of attorney have to be notarized in Wisconsin?

Does a health care Power of Attorney need to be notarized in Wisconsin?

How to activate Power of Attorney for health care in Wisconsin?

What is Power of Attorney for health care Wisconsin?

How do I activate my power of attorney in Wisconsin?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in WI F-00085?

How do I edit WI F-00085 on an Android device?

How do I complete WI F-00085 on an Android device?

What is WI F-00085?

Who is required to file WI F-00085?

How to fill out WI F-00085?

What is the purpose of WI F-00085?

What information must be reported on WI F-00085?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.