Get the free A 501 (c)(3) Charitable Organization in Support of Academic Excellence

Show details

A 501 (c)(3) Charitable Organization in Support of Academic Excellence Position Opening PROGRAM COORDINATOR AND CONTRACTS SPECIALIST (Joint Special Populations Advisory Committee & Auxiliary) (1 FTE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a 501 c3 charitable

Edit your a 501 c3 charitable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a 501 c3 charitable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

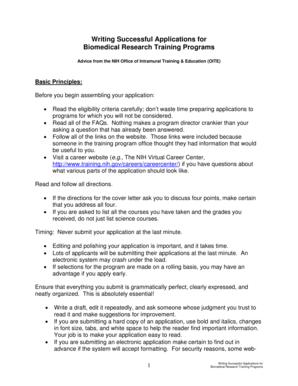

Editing a 501 c3 charitable online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit a 501 c3 charitable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a 501 c3 charitable

How to fill out a 501 c3 charitable

01

To fill out a 501 c3 charitable form, follow these steps:

02

Gather all the necessary information and documents such as organization name, address, contact details, mission statement, and financial information.

03

Visit the official website of the Internal Revenue Service (IRS) and download Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code.

04

Carefully read the instructions provided with the form to understand the requirements and eligibility criteria.

05

Fill out the form accurately and completely. Provide all requested information, including details about your organization's activities, governance, and financials. Be sure to attach any necessary schedules or additional documentation as required.

06

Review the completed form and double-check for any errors or omissions. Ensure all necessary signatures are obtained.

07

Prepare a check or money order for the application fee and include it with the form. As of 2021, the fee for Form 1023 is $600 for most organizations, but the fee may vary.

08

Make a copy of the completed form, along with any checks or money orders, for your records.

09

Mail the original form and payment to the address provided in the instructions. Consider using a trackable mailing method to ensure delivery.

10

Wait for a response from the IRS. Processing times can vary, but you can check the status of your application online or contact the IRS for updates.

11

Once your organization is approved, you will receive a determination letter from the IRS confirming your 501(c)(3) status. Keep this letter in a safe place, as it may be required for future reference or for obtaining certain benefits.

Who needs a 501 c3 charitable?

01

Various entities and organizations may need a 501(c)(3) charitable status, including:

02

Nonprofit organizations: Nonprofits that engage in charitable, religious, educational, scientific, literary, or other specified activities often pursue 501(c)(3) status to qualify for tax-exempt status and to receive tax-deductible donations.

03

Charitable foundations: Foundations that provide grants or donations to charitable causes or conduct charitable activities may require the 501(c)(3) status to fulfill their mission and attract donors.

04

Public charities: Public charities, such as community organizations, educational institutions, and certain health organizations, may seek 501(c)(3) status to gain tax benefits and credibility in their fundraising efforts.

05

Donor-advised funds: Donor-advised funds are managed by public foundations or charitable organizations, and individuals or corporations contribute funds to them. These funds may require 501(c)(3) status to accept tax-deductible donations.

06

Religious organizations: Churches, synagogues, mosques, and other religious organizations often pursue 501(c)(3) status to gain certain legal protections, tax benefits, and eligibility for grants and donations.

07

Social welfare organizations: Certain civic leagues, labor organizations, and local associations may apply for 501(c)(3) status to achieve tax-exempt status for their activities related to promoting social welfare.

08

Educational institutions: Schools, colleges, universities, and educational organizations may require 501(c)(3) status to be eligible for tax benefits, grants, and educational funding programs.

09

It's important to consult with legal or tax professionals to determine if obtaining a 501(c)(3) charitable status is appropriate and necessary for a specific entity or organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find a 501 c3 charitable?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the a 501 c3 charitable in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit a 501 c3 charitable in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your a 501 c3 charitable, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit a 501 c3 charitable on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign a 501 c3 charitable on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is a 501 c3 charitable?

A 501 c3 charitable organization is a tax-exempt nonprofit organization that falls under section 501(c)(3) of the Internal Revenue Code.

Who is required to file a 501 c3 charitable?

Nonprofit organizations that qualify for tax-exempt status under section 501(c)(3) of the Internal Revenue Code are required to file a Form 1023 or 1023-EZ to apply for recognition of exemption.

How to fill out a 501 c3 charitable?

To fill out a 501 c3 charitable, organizations need to complete either Form 1023 or Form 1023-EZ with the required information about their activities, finances, and governance.

What is the purpose of a 501 c3 charitable?

The purpose of a 501 c3 charitable organization is to operate for religious, charitable, scientific, literary, or educational purposes, and to benefit the public in some way.

What information must be reported on a 501 c3 charitable?

Information reported on a 501 c3 charitable includes details about the organization's mission, activities, finances, governance structure, and compliance with tax laws.

Fill out your a 501 c3 charitable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A 501 c3 Charitable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.