Get the free Your personal financial statement - Community Futures North ...

Show details

FINANCING YOUR BUSINESS 3105-33rd Street Vernon, British Columbia, Canada V1T 9P7 e-mail: info futuresbc.com Tel: (250) 545-2215 Fax: (250) 545-6447 YOUR PERSONAL FINANCIAL STATEMENT Full Name of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your personal financial statement

Edit your your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

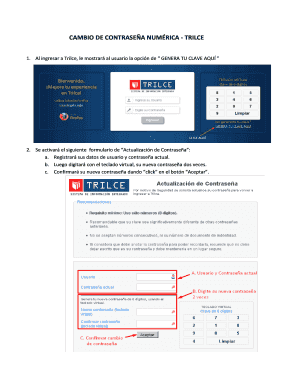

Editing your personal financial statement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit your personal financial statement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your personal financial statement

How to fill out your personal financial statement:

01

Begin by gathering all necessary documents and information, including your bank statements, investment statements, tax returns, and any other records of your assets and liabilities.

02

Organize these documents and create a list of all your assets, such as cash, savings, real estate, vehicles, investments, and valuable possessions, along with their estimated values.

03

Next, list all your liabilities, including mortgages, loans, credit card debts, and any outstanding bills.

04

Calculate your net worth by subtracting your liabilities from your assets. This will provide you with a clear picture of your current financial situation.

05

Besides assets and liabilities, your personal financial statement should also include your income and expenses. Record your sources of income, such as salary, investments, rental income, or any other money coming in regularly.

06

Keep track of your monthly expenses, such as mortgage or rent payments, utilities, insurance, groceries, transportation, entertainment, and other discretionary spending.

07

Review your financial statement regularly and update it whenever there are any significant changes in your assets, liabilities, income, or expenses.

08

Finally, make sure all your information is accurate and complete, as your personal financial statement may be requested by various parties, such as lenders, potential investors, or during a loan application or financial review.

Who needs your personal financial statement?

01

Individuals applying for loans from banks or financial institutions will typically need to provide a personal financial statement to assess their creditworthiness and ability to repay the loan.

02

Entrepreneurs or business owners may need to present a personal financial statement to secure business financing or attract investors.

03

Insurance companies may require a personal financial statement when applying for certain insurance policies that require an evaluation of the applicant's financial stability.

04

Professionals in the financial industry, such as financial advisors or wealth managers, may request a personal financial statement to better understand their clients' financial goals, risk tolerance, and investment strategies.

05

Individuals undergoing divorce or legal proceedings may be required to submit a personal financial statement to assess their financial situation and assist in the division of assets or determination of spousal support.

06

Estate planning professionals may request a personal financial statement to help clients develop an effective estate plan and ensure the distribution of assets aligns with their wishes.

07

Students applying for financial aid may need to provide a personal financial statement to determine eligibility for scholarships, grants, or loans.

08

Lastly, individuals may choose to maintain a personal financial statement for their own benefit, helping them track their financial progress, set goals, and make informed decisions about saving, investing, or budgeting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is your personal financial statement?

A personal financial statement is a document that outlines an individual's financial situation at a specific point in time.

Who is required to file your personal financial statement?

Individuals who hold certain public offices, such as government officials or candidates for public office, are usually required to file a personal financial statement.

How to fill out your personal financial statement?

To fill out a personal financial statement, you will typically need to list your assets, liabilities, income, and expenses. This information should be as accurate as possible.

What is the purpose of your personal financial statement?

The purpose of a personal financial statement is to provide a snapshot of an individual's financial health and help assess their ability to manage money effectively.

What information must be reported on your personal financial statement?

Typically, personal financial statements will include details about assets (such as bank accounts, real estate, and investments), liabilities (such as loans and mortgages), income sources, and expenses.

How can I manage my your personal financial statement directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your your personal financial statement along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit your personal financial statement online?

The editing procedure is simple with pdfFiller. Open your your personal financial statement in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit your personal financial statement on an Android device?

You can make any changes to PDF files, like your personal financial statement, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.