Get the free PERSONAL FINANCIAL STATEMENT - hvfcu

Show details

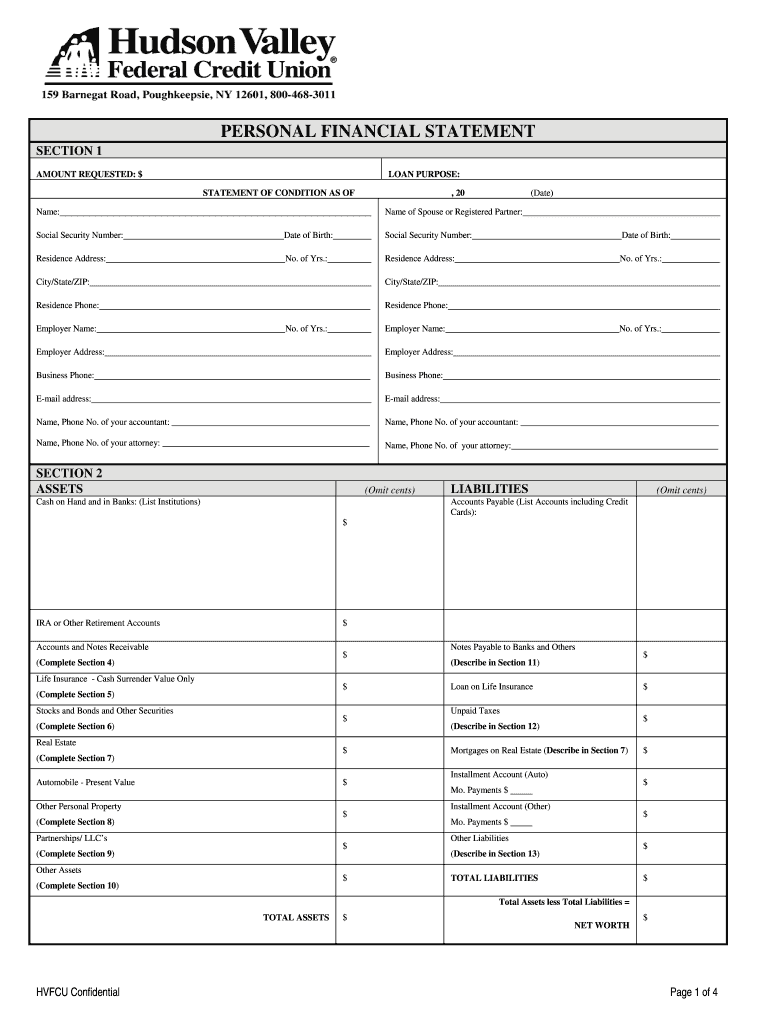

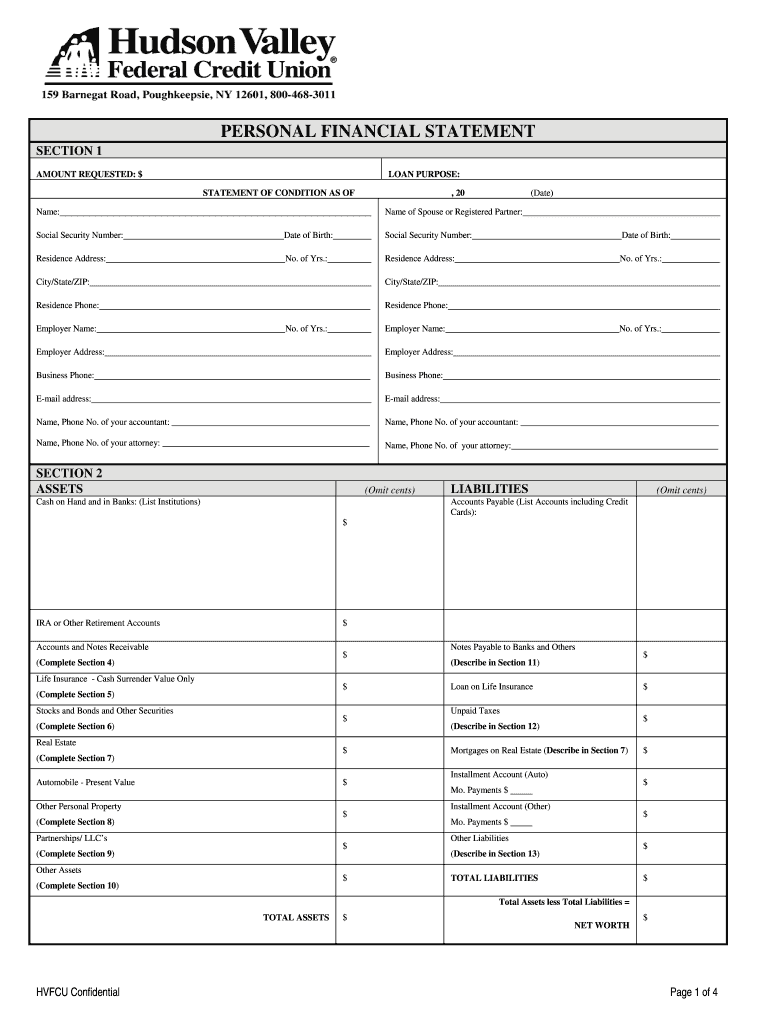

PERSONAL FINANCIAL STATEMENT SECTION 1 AMOUNT REQUESTED: $ LOAN PURPOSE: STATEMENT OF CONDITION AS OF, 20 Names: (Date) Name of Spouse or Registered Partner: Social Security Number: Date of Birth:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal financial statement

Edit your personal financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal financial statement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal financial statement. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal financial statement

How to fill out a personal financial statement:

01

Begin by gathering all necessary financial documents, such as bank statements, tax returns, investment statements, and loan statements.

02

Organize these documents by category, such as income, expenses, assets, and liabilities.

03

Calculate your total income for a certain period, including wages, dividends, rental income, and any other sources of income.

04

List all your monthly expenses, including bills, rent/mortgage payments, insurance premiums, transportation costs, and any other recurring expenses.

05

Calculate your net worth by subtracting your total liabilities (such as loans, credit card debt, and mortgages) from your total assets (such as cash, investments, real estate, and vehicles).

06

Fill out the personal financial statement form, either in paper or electronically, by entering the relevant figures and information in each section.

07

Make sure to accurately report all your assets, liabilities, income, and expenses, and provide supporting documentation if required.

08

Review your completed financial statement for any errors or omissions before finalizing and signing it.

09

Keep a copy of the personal financial statement for your records and submit it to the appropriate party, such as a bank, lender, or financial advisor, if necessary.

Who needs a personal financial statement:

01

Individuals applying for a mortgage loan or other types of financing often need to provide a personal financial statement to the lender.

02

Business owners and entrepreneurs may require a personal financial statement when seeking investors or applying for business loans.

03

Individuals going through divorce proceedings may need to submit a personal financial statement to help determine fair division of assets and liabilities.

04

High net worth individuals or those with complex financial positions may use a personal financial statement to assess their overall financial health, track progress, and create future financial plans.

05

Students applying for financial aid or scholarships may be asked to submit a personal financial statement to demonstrate their financial need.

06

Individuals working with financial advisors or wealth managers may be required to provide a personal financial statement to assist with financial planning and investment strategies.

07

Executors of estates may need to prepare a personal financial statement as part of their duties to provide an accurate assessment of the deceased person's assets and liabilities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find personal financial statement?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the personal financial statement. Open it immediately and start altering it with sophisticated capabilities.

How do I complete personal financial statement on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your personal financial statement. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete personal financial statement on an Android device?

Use the pdfFiller mobile app to complete your personal financial statement on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is personal financial statement?

A personal financial statement is a document that provides an individual's financial information, including assets, liabilities, income, and expenses.

Who is required to file personal financial statement?

Individuals who hold certain positions or roles, such as elected officials, government employees, or individuals involved in public service may be required to file a personal financial statement.

How to fill out personal financial statement?

To fill out a personal financial statement, individuals typically list all their assets and liabilities, including bank accounts, investments, debts, and other financial information.

What is the purpose of personal financial statement?

The purpose of a personal financial statement is to provide transparency and disclosure of an individual's financial situation, in order to prevent conflicts of interest or unethical behavior.

What information must be reported on personal financial statement?

Information that must be reported on a personal financial statement typically includes assets, liabilities, income sources, debts, and any financial interests in businesses or organizations.

Fill out your personal financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.