PA PA-1000 RC 2016 free printable template

Show details

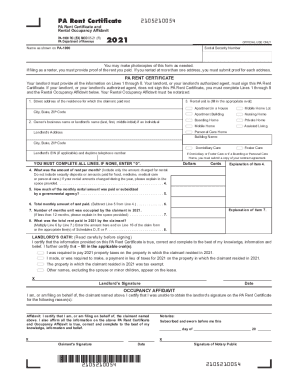

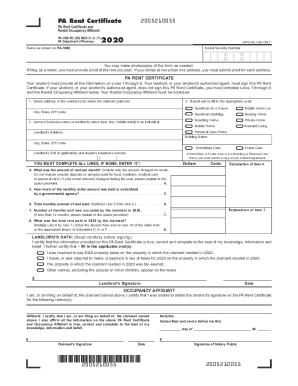

1605210051 PA Rent Certificate START PA Rent Certificate and Rental Occupancy Affidavit PA-1000 RC (08-16) PA Department of Revenue OFFICIAL USE ONLY 2016 Name as shown on PA-1000 Social Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA PA-1000 RC

Edit your PA PA-1000 RC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA PA-1000 RC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA PA-1000 RC online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PA PA-1000 RC. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA PA-1000 RC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA PA-1000 RC

How to fill out PA PA-1000 RC

01

Gather all necessary personal and financial information.

02

Download the PA PA-1000 RC form from the official Pennsylvania Department of Revenue website.

03

Start by filling out your personal information, including your name, address, and Social Security number.

04

Provide details about your income sources, including wages, interest, dividends, and any other taxable income.

05

Complete the sections about deductions and credits you may qualify for.

06

Review the completed form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the form by mail or electronically as per the instructions provided.

Who needs PA PA-1000 RC?

01

Residents of Pennsylvania who are required to report their income and file state taxes.

02

Individuals seeking to claim specific credits or deductions available in Pennsylvania.

03

Taxpayers who have received a notice from the Pennsylvania Department of Revenue regarding this form.

Fill

form

: Try Risk Free

People Also Ask about

When can I file my 2021 rent rebate in pa?

Yes, there is time to file an application through the remainder of the year. The deadline to apply for rebates on rent and property taxes paid in 2021 was extended to Dec. 31, 2022. The department strongly encourages eligible claimants to use myPATH to file their applications online.

How much is the rent rebate in pa?

If you earned $0-$8,000 in 2022, the maximum rebate is $650. If you earned $8,001-$15,000 in 2022, the maximum rebate is $500. If you earned $15,001-$18,000 in 2022, the maximum rebate is $300. If you earned $18,001-$35,000 in 2022, the maximum rebate is $250.

How do I qualify for rent rebate in pa?

The rebate program benefits eligible Pennsylvanians age 65 and older; widows and widowers age 50 and older; and people with disabilities age 18 and older. The income limit is $35,000 a year for homeowners and $15,000 annually for renters, and half of Social Security income is excluded.

When can you apply for rent rebate in pa?

Check if you qualify for Pennsylvania's Property Tax/Rent Rebate Program. The deadline to apply is Friday, June 30, 2022.

Is it too late to file for rent rebate in pa?

This year, Pennsylvania has extended the filing deadline for the Property Tax or Rent Rebate Claim to December 31, 2022. Typically the deadline is June 30th. Here's what you need to know about taking advantage of this extension.

Does pa rent certificate need to be notarized?

Your Rental Occupancy Affidavit must be notarized.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my PA PA-1000 RC in Gmail?

PA PA-1000 RC and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I sign the PA PA-1000 RC electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your PA PA-1000 RC and you'll be done in minutes.

Can I edit PA PA-1000 RC on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as PA PA-1000 RC. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is PA PA-1000 RC?

PA PA-1000 RC is a form used for reporting specific financial information regarding certain tax credits, deductions, and payments in the Commonwealth of Pennsylvania.

Who is required to file PA PA-1000 RC?

Individuals and businesses in Pennsylvania who are claiming specific tax credits or deductions are required to file the PA PA-1000 RC.

How to fill out PA PA-1000 RC?

To fill out PA PA-1000 RC, taxpayers must gather all relevant financial information, report their income, deductions, and credits accurately, and follow the provided instructions on the form.

What is the purpose of PA PA-1000 RC?

The purpose of PA PA-1000 RC is to ensure that taxpayers accurately report their tax credits and deductions, enabling the state to assess and process tax liabilities correctly.

What information must be reported on PA PA-1000 RC?

PA PA-1000 RC requires reporting information such as taxpayer identification, income details, claimed deductions, tax credits, and any payments made.

Fill out your PA PA-1000 RC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA PA-1000 RC is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.