MA Form 121A 2013 free printable template

Show details

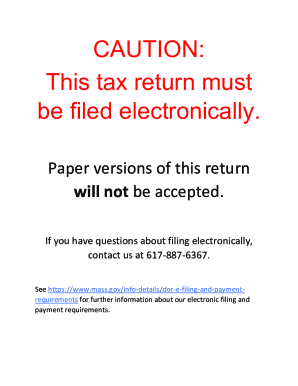

2013 Form 121A Urban Redevelopment Excise Return Massachusetts General Laws, Chapter 121A, section 10, as amended for the calendar year 2013. Name of taxpayer Mailing address City/Town Massachusetts

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA Form 121A

Edit your MA Form 121A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA Form 121A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA Form 121A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA Form 121A

How to fill out MA Form 121A

01

Begin by downloading MA Form 121A from the Massachusetts Department of Revenue website.

02

Fill in your personal information, including your name, address, and Social Security number at the top of the form.

03

Specify the tax year for which you are filing the form.

04

Indicate your filing status by checking the appropriate box (e.g., single, married, etc.).

05

Fill out the income section with the relevant income amounts from your tax documents.

06

Detail any deductions or exemptions you are claiming in the designated sections.

07

Calculate your total tax liability based on the provided calculations in the form.

08

Review all the information for accuracy and completeness.

09

Sign and date the form at the bottom before submitting it.

Who needs MA Form 121A?

01

MA Form 121A is needed by individuals who are filing their state income tax return in Massachusetts, particularly those claiming specific credits or deductions.

Fill

form

: Try Risk Free

People Also Ask about

Does Pennsylvania Medicaid require prior authorization?

Prior authorization is not required for emergency or urgent care. Out-of-network physicians, facilities and other health care providers must request prior authorization for all procedures and services, excluding emergent or urgent care, as identified below.

What triggers a prior authorization?

The prior authorization process begins when a service prescribed by a patient's physician is not covered by their health insurance plan. Communication between the physician's office and the insurance company is necessary to handle the prior authorization.

What is the phone number for PA medical assistance prior authorization?

The provider may call the provider inquiry unit to request information on the authorization or to check the status of a request. In either scenario, the number to call is 1-800-537-8862.

What documentation is required for Medicaid in Pennsylvania?

A copy of applicant's Social Security card. Health Insurance Information: Copies of Medical Insurance card(s) including Medicare and any supplemental health care and/or prescription drug coverage for applicant. Invoices for these policies demonstrating the premium costs and frequency of payment.

Who files for prior authorization?

Who is responsible for obtaining prior authorization? The healthcare provider is usually responsible for initiating prior authorization by submitting a request form to a patient's insurance provider.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MA Form 121A?

MA Form 121A is a Massachusetts tax form used for reporting and calculating tax credits for low-income individuals and families.

Who is required to file MA Form 121A?

Individuals who claim certain tax credits in Massachusetts, particularly those based on income eligibility, are required to file MA Form 121A.

How to fill out MA Form 121A?

To fill out MA Form 121A, taxpayers must provide personal information, report income, and follow the instructions for calculating the specific tax credits available to them.

What is the purpose of MA Form 121A?

The purpose of MA Form 121A is to allow eligible taxpayers to report their income and claim tax credits that can reduce their tax liability in Massachusetts.

What information must be reported on MA Form 121A?

Information that must be reported on MA Form 121A includes the taxpayer's personal details, income sources, household composition, and any applicable tax credits.

Fill out your MA Form 121A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA Form 121a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.