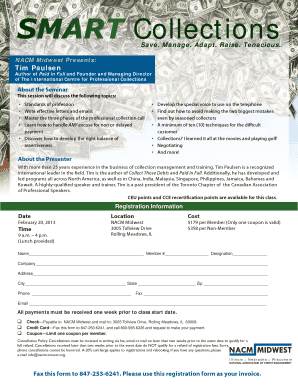

NZ Westpac JN15467 2016-2025 free printable template

Show details

Foreign Tax Residency Form Individual Form purpose Westpac use only In New Zealand, financial institutions are required to identify and report customers that are tax resident in foreign jurisdictions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign westpac foreign tax residency form

Edit your westpac foreign tax residency form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ Westpac JN15467 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NZ Westpac JN15467 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NZ Westpac JN15467. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out NZ Westpac JN15467

How to fill out NZ Westpac JN15467

01

Gather all necessary personal information such as your name, address, and contact details.

02

Provide your date of birth and nationality.

03

Fill out your employment details, including your employer's name and contact information.

04

Specify your income details, including any additional income sources.

05

Complete the section regarding your financial goals and any bank accounts you currently hold.

06

Review the declaration section and confirm all information is accurate.

07

Sign and date the form where indicated.

Who needs NZ Westpac JN15467?

01

Individuals looking to open a bank account with Westpac in New Zealand.

02

New customers who need to provide personal and financial information for identity verification.

03

People applying for specific financial products or services through Westpac.

Fill

form

: Try Risk Free

People Also Ask about

How do I add TFN to Westpac?

What to have by your side: Your mobile phone. Two types of ID: - Australian driver licence. - Medicare card. - Passport. - Australian birth certificate. Your tax file number (TFN) – not compulsory but helpful. Your foreign tax details (if applicable)

How do I contact Westpac customer service?

At Westpac, we welcome your suggestions, compliments and complaints as an opportunity to improve our service, provide feedback to our staff and put things right when we have let you down. Contact us on 132 032 or find out more below.

How do I contact Westpac from overseas?

Call +61 2 9155 7700 (24 hours a day, 7 days a week), or for Black cardholders +61 2 9155 7711. Please note that calls made from mobile phones or hotel rooms may attract additional charges. You can also report a card lost or stolen via the Westpac App.

Does Westpac have online chat?

Contact us in the Westpac App. Sign in, skip the automated questions and talk to the right person not a phone menu. Prefer to chat? We're available 24/7.

How do I contact Westpac?

In Online Banking Go to Services > Preferences > Tax File Number. Select Update Tax File Number. Enter the SMS Code sent to your registered mobile and select Authorise. Select the account you wish to update. Enter your TFN or TFN exemption and select Save. Repeat above steps for all accounts you wish to provide TFN.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NZ Westpac JN15467 for eSignature?

Once you are ready to share your NZ Westpac JN15467, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my NZ Westpac JN15467 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your NZ Westpac JN15467 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit NZ Westpac JN15467 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing NZ Westpac JN15467.

What is NZ Westpac JN15467?

NZ Westpac JN15467 is a specific financial document or reporting form used by Westpac New Zealand for various banking and regulatory purposes.

Who is required to file NZ Westpac JN15467?

Individuals or entities that have banking transactions or relationships with Westpac New Zealand and are subject to reporting requirements may be required to file this document.

How to fill out NZ Westpac JN15467?

To fill out NZ Westpac JN15467, one must provide accurate financial details as specified in the form, ensuring all required fields are completed in accordance with Westpac's guidelines.

What is the purpose of NZ Westpac JN15467?

The purpose of NZ Westpac JN15467 is to collect necessary financial information for compliance, regulatory reporting, or internal banking processes.

What information must be reported on NZ Westpac JN15467?

NZ Westpac JN15467 typically requires reporting of personal identification details, financial transaction information, and other specific data mandated by Westpac for proper processing.

Fill out your NZ Westpac JN15467 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ Westpac jn15467 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.