Get the free Beneficial Ownership Filings: Filing - Stonegate Bank

Show details

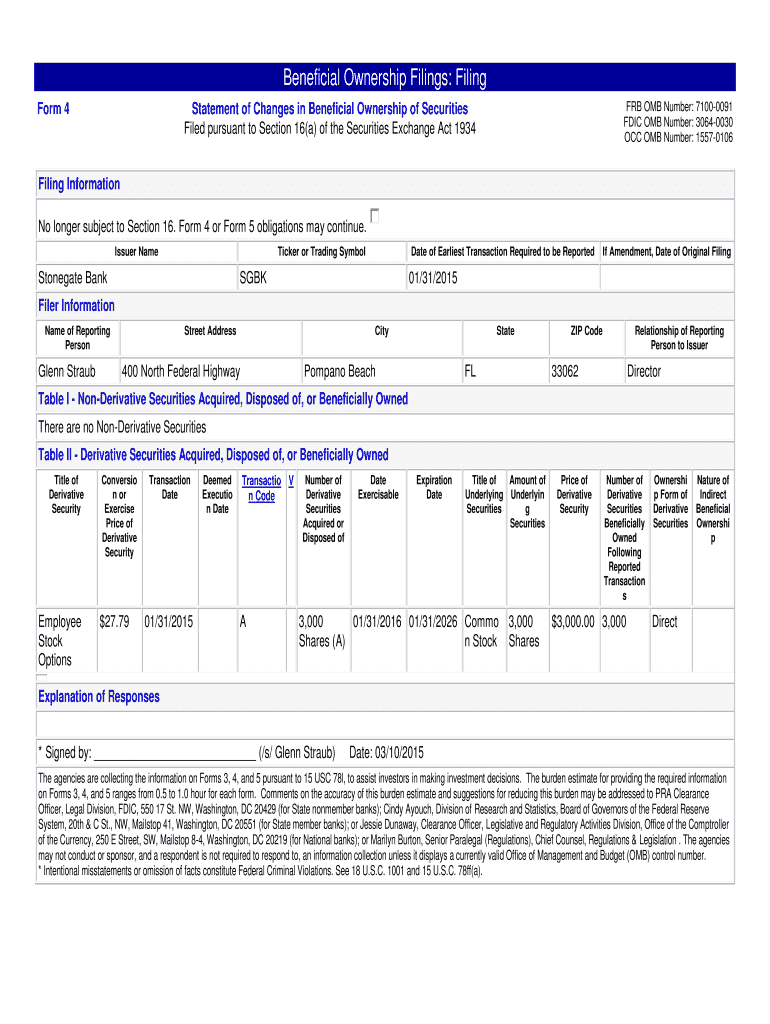

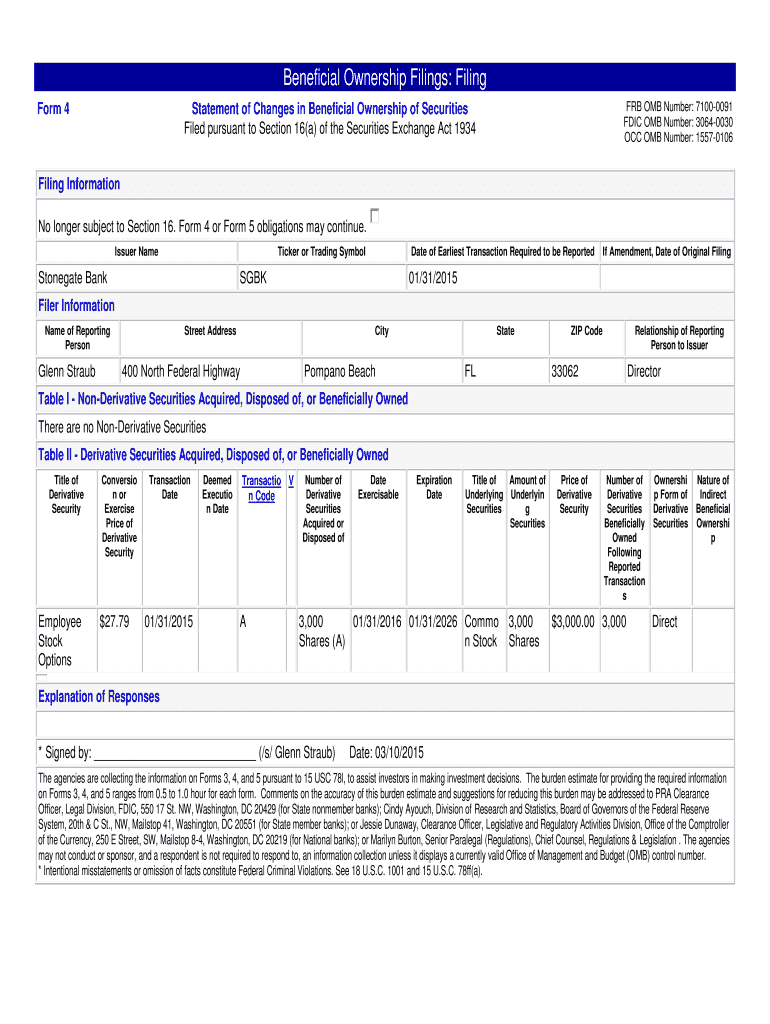

Beneficial Ownership Filings: Filing Form 4 FRB OMB Number: 71000091 FDIC OMB Number: 30640030 OCC OMB Number: 15570106 Statement of Changes in Beneficial Ownership of Securities Filed pursuant to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign beneficial ownership filings filing

Edit your beneficial ownership filings filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your beneficial ownership filings filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit beneficial ownership filings filing online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit beneficial ownership filings filing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficial ownership filings filing

How to fill out beneficial ownership filings filing

01

Start by gathering all the necessary information and documentation such as identification details, contact information, and ownership percentage.

02

Identify the legal entity or entities for which you are required to file beneficial ownership information.

03

Access the appropriate beneficial ownership filings form or platform provided by the relevant authority or governmental agency.

04

Carefully fill out the form by providing accurate and complete information for each beneficial owner, including their full name, residential address, date of birth, and citizenship.

05

Provide additional details such as the nature of the ownership interest, the percentage of ownership, and any relevant supporting documentation.

06

Review the completed form for any errors or omissions before submitting it.

07

Submit the beneficial ownership filings form through the designated method or platform, ensuring that all required attachments or supporting documents are included.

08

Retain copies of the submitted filings and any acknowledgments or receipts for future reference or compliance purposes.

09

Ensure that any changes or updates to the beneficial ownership information are promptly reported and reflected in future filings.

Who needs beneficial ownership filings filing?

01

Beneficial ownership filings filing is typically required for entities that fall under certain regulatory or legal frameworks.

02

This may include but is not limited to corporations, limited liability companies (LLCs), trusts, partnerships, or other legal entities involved in financial activities.

03

The specific requirements and thresholds for beneficial ownership filings may vary depending on the jurisdiction and applicable regulations.

04

Financial institutions, such as banks and investment firms, often have legal obligations to collect and report beneficial ownership information.

05

Regulatory bodies, tax authorities, and anti-money laundering agencies are among the entities that may require beneficial ownership filings.

06

Compliance with beneficial ownership filings helps promote transparency, prevent money laundering, and combat illicit financial activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my beneficial ownership filings filing in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your beneficial ownership filings filing and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I make edits in beneficial ownership filings filing without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing beneficial ownership filings filing and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my beneficial ownership filings filing in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your beneficial ownership filings filing right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is beneficial ownership filings filing?

Beneficial ownership filings filing is a process through which individuals or entities disclose their ownership interests in a company or asset.

Who is required to file beneficial ownership filings filing?

Individuals or entities who have ownership interests in a company or asset are required to file beneficial ownership filings filing.

How to fill out beneficial ownership filings filing?

Beneficial ownership filings filing can be filled out by providing accurate information about the ownership interests in the company or asset in the required forms.

What is the purpose of beneficial ownership filings filing?

The purpose of beneficial ownership filings filing is to promote transparency and prevent money laundering and other illegal activities by disclosing the true owners of companies or assets.

What information must be reported on beneficial ownership filings filing?

Information such as the name, address, and ownership percentage of the beneficial owners must be reported on beneficial ownership filings filing.

Fill out your beneficial ownership filings filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficial Ownership Filings Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.