Get the free Annual info return requirements worksheet.pdf

Show details

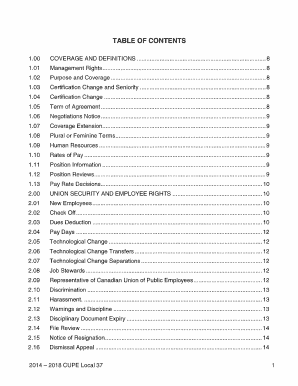

INFORMATION RETURNS ANNUAL REQUIREMENTS FORMS 10))RUP 5HSRUWLQJ 5HTXLUHPHQWV 7D SD HUB HQJDJHG LA D WU DGH RU EXVLQHVV DUH UHTXLUHG WR IL OH LQIRUPDWLRQ UHWXUQV)RUP VH IRU ERIK)HUGO DOG 6WDWH LI BKH

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual info return requirements

Edit your annual info return requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual info return requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual info return requirements online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit annual info return requirements. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual info return requirements

How to Fill Out Annual Info Return Requirements?

01

Understand the purpose: Start by familiarizing yourself with the purpose of the annual info return requirements. These requirements are typically related to reporting specific information about a business or organization's financial activity, such as income, expenses, and deductions.

02

Gather necessary documentation: Ensure you have all the necessary documents and records required to fill out the annual info return. This may include income statements, balance sheets, sales and purchase invoices, payroll records, and any other relevant financial documents.

03

Review the reporting guidelines: Familiarize yourself with the reporting guidelines specific to your jurisdiction. Different countries or regions may have different requirements and forms to be filled out. It is crucial to understand the specific reporting requirements applicable to your situation.

04

Use appropriate software or forms: Determine whether you will be completing the annual info return manually or making use of software or online platforms. Many countries offer electronic filing options to facilitate the process. Consider using software or forms specifically designed for this purpose to ensure accuracy and ease of completion.

05

Provide accurate information: When filling out the annual info return, ensure that all the information provided is accurate and up-to-date. Double-check figures, calculations, and any supporting documents to avoid errors or potential audits in the future.

Who Needs Annual Info Return Requirements?

01

Businesses: Companies, partnerships, sole proprietors, and self-employed individuals are often required to fulfill annual info return requirements. The reporting thresholds and specific obligations may vary depending on the jurisdiction and the type of business.

02

Non-profit organizations: Non-profit organizations, charities, and other similar entities may also need to comply with annual info return requirements. These organizations may have specific reporting obligations to maintain their tax-exempt status or qualify for certain benefits or exemptions.

03

Government entities: Some government entities, including federal, state, or local agencies, may be required to submit annual info returns. These entities are usually accountable for providing detailed financial information in order to ensure transparency and accountability in the use of public funds.

It is important to note that the specific individuals or entities required to fulfill annual info return requirements may vary depending on the country, state, or province of operation. It is advisable to consult with a tax professional or review the relevant tax legislation to determine your specific obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is annual info return requirements?

Annual info return requirements are reports that certain entities must file with the government to provide information about their activities, finances, and operations.

Who is required to file annual info return requirements?

Entities such as non-profit organizations, charities, and certain businesses are required to file annual info return requirements.

How to fill out annual info return requirements?

Annual info return requirements can typically be filled out online or by mail using the specific forms provided by the government.

What is the purpose of annual info return requirements?

The purpose of annual info return requirements is to ensure transparency and accountability of the entities that are required to file them.

What information must be reported on annual info return requirements?

Information such as financial statements, activities conducted, and details of key personnel may be required to be reported on annual info return requirements.

How do I complete annual info return requirements online?

pdfFiller has made it easy to fill out and sign annual info return requirements. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in annual info return requirements without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your annual info return requirements, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit annual info return requirements on an Android device?

You can make any changes to PDF files, like annual info return requirements, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your annual info return requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Info Return Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.