Get the free General residence homestead exemption - Denton Central Appraisal ...

Show details

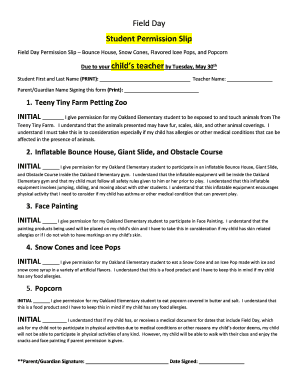

Denton Central Appraisal District PO Box 50746 Denton, TX 76206-0746 (940) 349-3800 NEW HOMESTEAD EXEMPTION APPLICATION RULES Dear Property Owner: Please complete the following application for Residence

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general residence homestead exemption

Edit your general residence homestead exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general residence homestead exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing general residence homestead exemption online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit general residence homestead exemption. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out general residence homestead exemption

How to fill out general residence homestead exemption:

01

Gather the necessary documents: Before starting the process, make sure to have the required documents such as proof of ownership (deed or contract), your social security number, and your Texas driver's license or state ID.

02

Download the application form: Visit the website of your local appraisal district or tax office to find and download the general residence homestead exemption application form.

03

Complete the application form: Fill out the application form carefully, providing accurate information about your property, including the address, your name, and the type of property. Make sure to answer all the questions accurately according to your situation.

04

Include necessary supporting documents: Check the application form instructions to see if any additional documents are required. Common supporting documents include proof of residency, such as utility bills, and proof of age, such as a driver's license or birth certificate for those over 65 years old.

05

Submit the application: Once you have completed the form and gathered all the necessary documents, submit the application to your local appraisal district or tax office. Make sure to follow their instructions regarding submission methods, such as mailing, dropping off in person, or submitting online if available.

06

Follow up: After submitting your application, keep track of its progress. If there are any issues or additional information needed, the appraisal district or tax office will reach out to you. It is important to respond promptly and provide any requested documentation.

07

Renew annually: Homestead exemptions typically need to be renewed annually or as specified by your local appraisal district or tax office. Make sure to stay informed about any renewal requirements and submit the necessary paperwork within the specified timeframe.

Who needs general residence homestead exemption?

01

Homeowners: The general residence homestead exemption is available for homeowners who use their property as their primary residence. It offers certain tax benefits and helps reduce the property tax burden.

02

Texas residents: The general residence homestead exemption is specific to the state of Texas. Therefore, individuals who own and reside in properties within Texas may be eligible for this exemption.

03

Primary residence owners: To qualify for the general residence homestead exemption, the property must be your primary residence. This means it is the place where you live and intend to return to when you are away, rather than a second home or investment property.

04

Certain individuals over 65 years old: In Texas, individuals over the age of 65 may be eligible for additional property tax exemptions, including the general residence homestead exemption. These exemptions can help reduce the tax burden on senior homeowners.

05

Disabled individuals: Depending on the circumstances, disabled individuals may also be eligible for the general residence homestead exemption. Requirements and eligibility criteria may vary, so it is important to check with your local appraisal district or tax office for specific guidelines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find general residence homestead exemption?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the general residence homestead exemption. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out the general residence homestead exemption form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign general residence homestead exemption and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete general residence homestead exemption on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your general residence homestead exemption. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is general residence homestead exemption?

General residence homestead exemption is a tax exemption that reduces the taxable value of a property designated as a homestead.

Who is required to file general residence homestead exemption?

Homeowners who use their property as their primary residence are required to file for general residence homestead exemption.

How to fill out general residence homestead exemption?

To fill out general residence homestead exemption, homeowners need to complete an application form provided by their local taxing authority.

What is the purpose of general residence homestead exemption?

The purpose of general residence homestead exemption is to provide property tax relief to homeowners who use their property as their primary residence.

What information must be reported on general residence homestead exemption?

Homeowners must report their personal information, property address, and proof of primary residence on the general residence homestead exemption application.

Fill out your general residence homestead exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Residence Homestead Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.