TX TRS 6 2017 free printable template

Show details

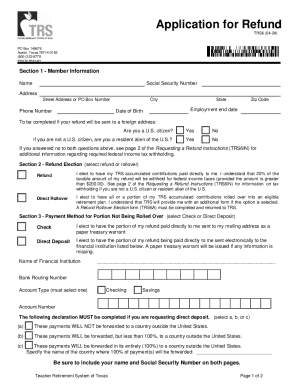

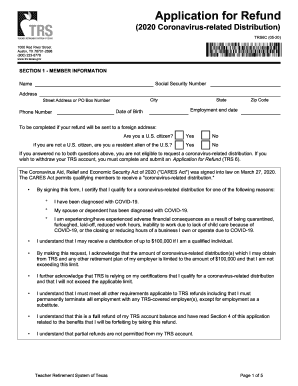

TRS 6 Rev. 0617 *+6* TEACHER RETIREMENT SYSTEM OF TEXAS 1000 Red River Street, Austin, Texas 787012698 Telephone (512) 5426400 or 18002238778 www.trs.texas.gov APPLICATION FOR REFUND Name Social Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX TRS 6

Edit your TX TRS 6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX TRS 6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX TRS 6 online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX TRS 6. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX TRS 6 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX TRS 6

How to fill out TX TRS 6

01

Obtain the TX TRS 6 form from the Texas Teacher Retirement System website or your employer.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Specify your retirement date and the type of retirement option you are choosing.

04

Provide information about your service credit and your years of service.

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed form to the Texas Teacher Retirement System or your school district office.

Who needs TX TRS 6?

01

Active members of the Texas Teacher Retirement System who are planning to retire.

02

Individuals seeking to apply for retirement benefits under the Texas TRS program.

03

Teachers and educators who have accrued service credit within the Texas educational system.

Fill

form

: Try Risk Free

People Also Ask about

Will Texas retired teachers get a COLA in 2023?

At its September meeting, the Board unanimously voted to approve a 2.5% cost-of-living adjustment (COLA) increase for eligible retirees and beneficiaries in 2023.

Can I withdraw money from my Texas teacher retirement?

Once you have terminated all employment, you may then withdraw your accumulated contributions and interest in your member account. Once you have terminated your employment if you want a refund of your TRS contributions you must complete a form TRS 6 “Application for Refund.”

Can you get both TRS and Social Security Texas?

You are eligible for one-half of your spouse's social security if he/she is living, and 100% of the social security benefit if he/she has passed; however, if you are drawing TRS, Social Security will subtract two-thirds of your TRS from the spousal benefit.

How long does it take to get money from TRS?

* Generally, a refund payment will be issued within 60 days after all required documents have been received and your employer's monthly payroll report has been processed by TRS. The process can take up to 90 days depending upon your last date(s) of employment.

Can I cash out my TRS account?

You are eligible to withdraw the accumulated employee contributions from your TRS account. However, you must refund the total amount in the account. The drawback here is the employer contributions are not refundable.

How can I get my TRS money?

Obtain the Application for Refund form (TRS 6) and Special Tax Notice Regarding Rollover Options under TRS from the TRS website or by calling the TRS Automated Telephone System at 1-800-223-8778. Read and complete the Application for Refund form (TRS 6), sign the form, and have it notarized.

How long does it take to get a refund from TRS Texas?

* Generally, a refund payment will be issued within 60 days after all required documents have been received and your employer's monthly payroll report has been processed by TRS. The process can take up to 90 days depending upon your last date(s) of employment.

Will retired Texas teachers get an extra check?

The payment will go to eligible retirees and beneficiaries who retired before December 31, 2020, and will be up to $2,400, or the amount of the retiree's annuity, whichever is less. Payments were issued on Jan. 14, 2022.

How long does it take to get first retirement check from TRS?

TRS begins the calculation process. Allow 60-90 days after all balances have been paid in full and all forms have been received and reviewed to receive your first pension check.

How do I get my TRS money?

How to Apply for a Refund Obtain Application for Refund form(TRS 6) (pdf) and Special Tax Notice Regarding Rollover Options under TRS from the TRS website or by calling the TRS Automated Telephone System at 1-800-223-8778. Read and complete Application for Refund form(TRS 6)(pdf), sign the form, and have it notarized.

Does TRS pension reduce Social Security?

Government Pension Offset The GPO is that if you are entitled to Social Security benefits based as a survivor or spouse and have a TRS pension where you did not pay into Social Security, your survivor or spousal benefit will be reduced by 2/3rds your pension.

Will Texas teachers get a 13th check in 2023?

Governor Dan Patrick announced that he intended to use these excess funds to provide retirees with another 13th check in 2023, which would be the third such check retirees have received since 2019.

Can you claim TRS and Social Security?

Social Security will never reduce your benefits by more than half of your TRS pension, and the maximum reduction of Social Security benefits due to WEP in 2022 is $512. There is one additional provision to be aware of called the “Government Pension Offset”, or GPO.

Are Texas retired teachers getting a raise in 2022?

Retired Texas teachers, denied cost-of-living raises since 2004, get even smaller checks in 2022.

Can I collect Social Security and TRS in Texas?

You are eligible for one-half of your spouse's social security if he/she is living, and 100% of the social security benefit if he/she has passed; however, if you are drawing TRS, Social Security will subtract two-thirds of your TRS from the spousal benefit.

How do I cash out my Texas teacher retirement?

Unfortunately, it's not possible to borrow money from the Teacher Retirement System of Texas. Your only option is to terminate your TRS membership and request a refund or roll over your contributions to a different retirement plan.

Will Texas retired teachers get an extra check this year?

Senate Bill 7 provides a payment to eligible retirees and beneficiaries in either the same amount of their monthly annuity or $2,400, whichever is less. It is estimated 426,000 annuitants will receive the supplemental payment. Eligible retirees and beneficiaries will receive the check in January 2022.

What happens to my Social Security if I become a teacher in Texas?

You will receive a Social Security benefit, but if you have taught (or intend to teach) for five or more years in a non-Social Security district, you'll likely be affected by the WEP. It's tricky to calculate the actual amount that you'll be penalized, but the formula will not eliminate your entire benefit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit TX TRS 6 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like TX TRS 6, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find TX TRS 6?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific TX TRS 6 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit TX TRS 6 on an iOS device?

Create, modify, and share TX TRS 6 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is TX TRS 6?

TX TRS 6 is a Texas state form used for reporting certain transactions related to sales and use tax.

Who is required to file TX TRS 6?

Businesses that engage in specific transactions involving taxable sales or purchases are required to file TX TRS 6.

How to fill out TX TRS 6?

TX TRS 6 should be filled out by providing accurate information regarding the transactions being reported, including dates, amounts, and relevant details.

What is the purpose of TX TRS 6?

The purpose of TX TRS 6 is to ensure compliance with state tax laws by providing a record of certain transactions for audit and reporting purposes.

What information must be reported on TX TRS 6?

TX TRS 6 must include transaction dates, amounts, vendor information, and any applicable tax rates associated with the transactions.

Fill out your TX TRS 6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX TRS 6 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.