TX TRS 6 2019 free printable template

Show details

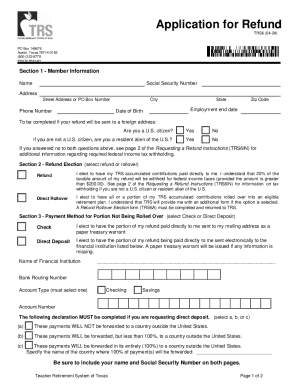

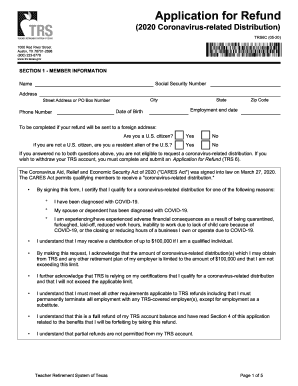

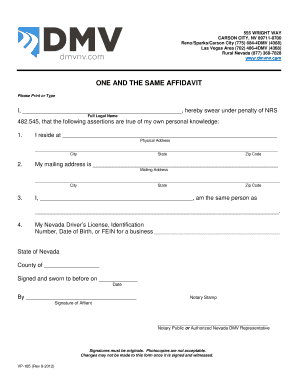

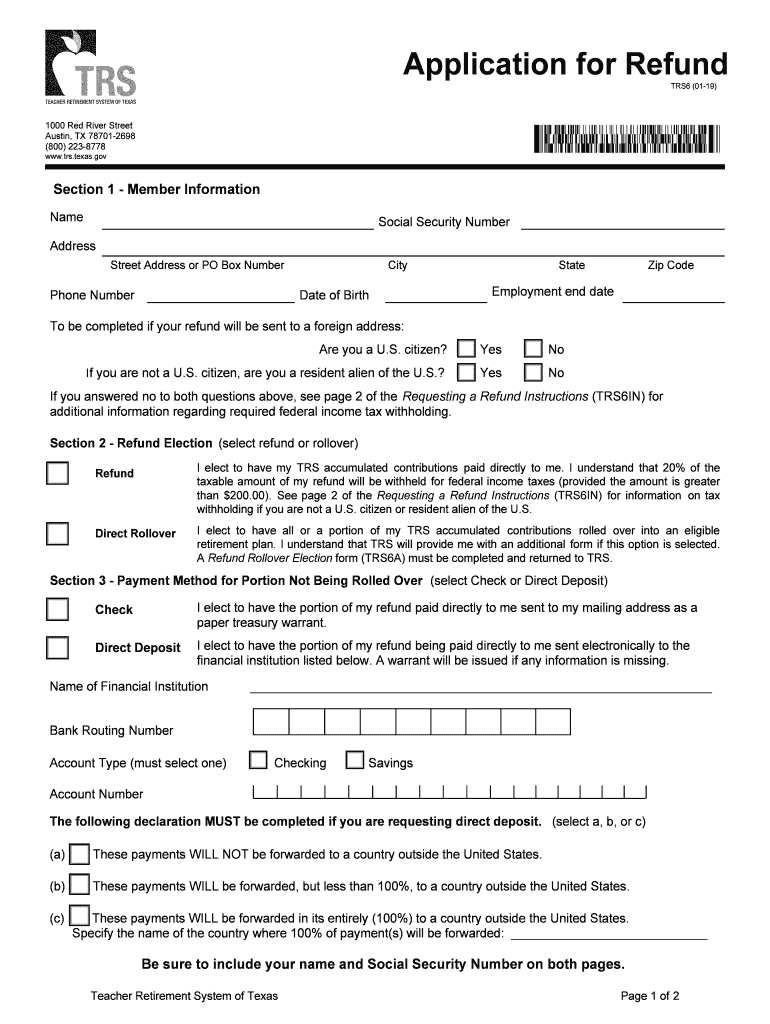

Application for Refund TRS6 (0119)1000 Red River Street Austin, TX 787012698 (800) 2238778 www.trs.texas.govSection 1 Member Information Asocial Security NumberAddress Street Address or PO Box NumberPhone

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX TRS 6

Edit your TX TRS 6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX TRS 6 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX TRS 6 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX TRS 6. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX TRS 6 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX TRS 6

How to fill out TX TRS 6

01

Obtain the TX TRS 6 form from the Texas Retirement System website or your local TRS office.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill out the personal information section, including your name, address, and Social Security number.

04

Indicate the reason for submitting the form in the appropriate section.

05

Provide any necessary supporting documentation as indicated in the instructions.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form before submission.

08

Submit the completed form to the appropriate address as outlined in the instructions.

Who needs TX TRS 6?

01

Individuals who are applying for retirement benefits from the Texas Retirement System.

02

Members of the TRS seeking to update their personal information or change their retirement options.

03

Beneficiaries of TRS members who need to claim benefits after the member's death.

Fill

form

: Try Risk Free

People Also Ask about

Do Texas teachers get health insurance after retirement?

Texas offers health insurance coverage to both active (TRS-ActiveCare) and retired (TRS-Care) school employees.

When can I retire as a teacher in Texas?

To be eligible for normal-age service retirement, you must meet one of the following conditions: you are age 65 with at least five years of service credit, or • you meet the Rule of 80 (your age and years of service credit total at least 80) and you have at least five years of service credit.

Can I collect Texas teacher retirement and Social Security?

Yes! If you are drawing Social Security when you retire, or when you start drawing Social Security in the future, you should be certain that Social Security knows the amount of your TRS payment.

How much do retired teachers pay for health insurance in Texas?

HMO Rates for 2021-22 Plan Year Coverage TierNEW 2021-22 Total RateRate after Minimum District Contribution*Employee Only$524.90$299.90Employee/Spouse$1,264.28$1,039.28Employee/Children$819.60$594.60Employee/Family$1,345.58$1,120.58

Do Texas teachers get Medicare at 65?

If you're a TRS-Care participant, when you turn 65 or become eligible for Medicare, you're eligible to enroll in the TRS-Care Medicare Advantage medical plan and the TRS-Care Medicare Rx prescription drug plan. Likewise, if you're retiring past age 65, you're eligible to enroll in these plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify TX TRS 6 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including TX TRS 6, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute TX TRS 6 online?

Filling out and eSigning TX TRS 6 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit TX TRS 6 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your TX TRS 6 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is TX TRS 6?

TX TRS 6 is a tax report form used by businesses in Texas to report and pay certain taxes related to sales and use.

Who is required to file TX TRS 6?

Businesses that collect Texas sales tax or that are required to report various other state taxes must file TX TRS 6.

How to fill out TX TRS 6?

To fill out TX TRS 6, businesses need to provide their tax identification number, sales figures, tax collected, and any exemptions that apply.

What is the purpose of TX TRS 6?

The purpose of TX TRS 6 is to ensure proper reporting and collection of sales taxes and other state taxes owed by Texas businesses.

What information must be reported on TX TRS 6?

TX TRS 6 requires reporting of total sales, taxable sales, total tax collected, exemptions claimed, and the business owner's details.

Fill out your TX TRS 6 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX TRS 6 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.