Get the free COMMERCIAL LOAN APPLICATION SUMMARY

Show details

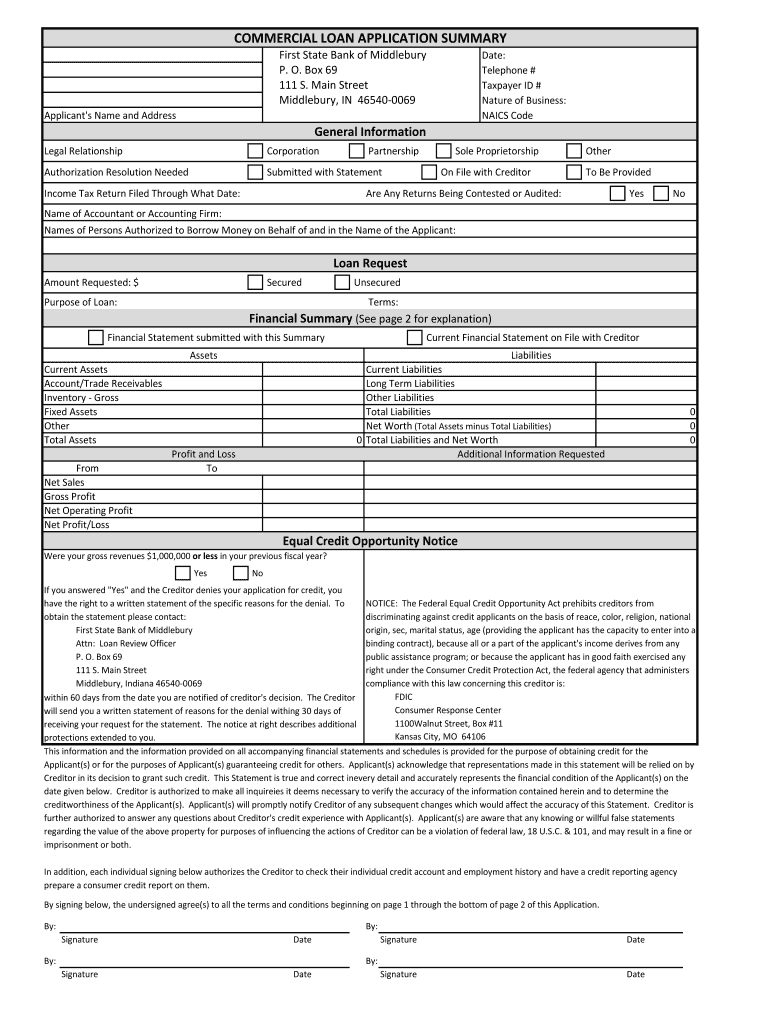

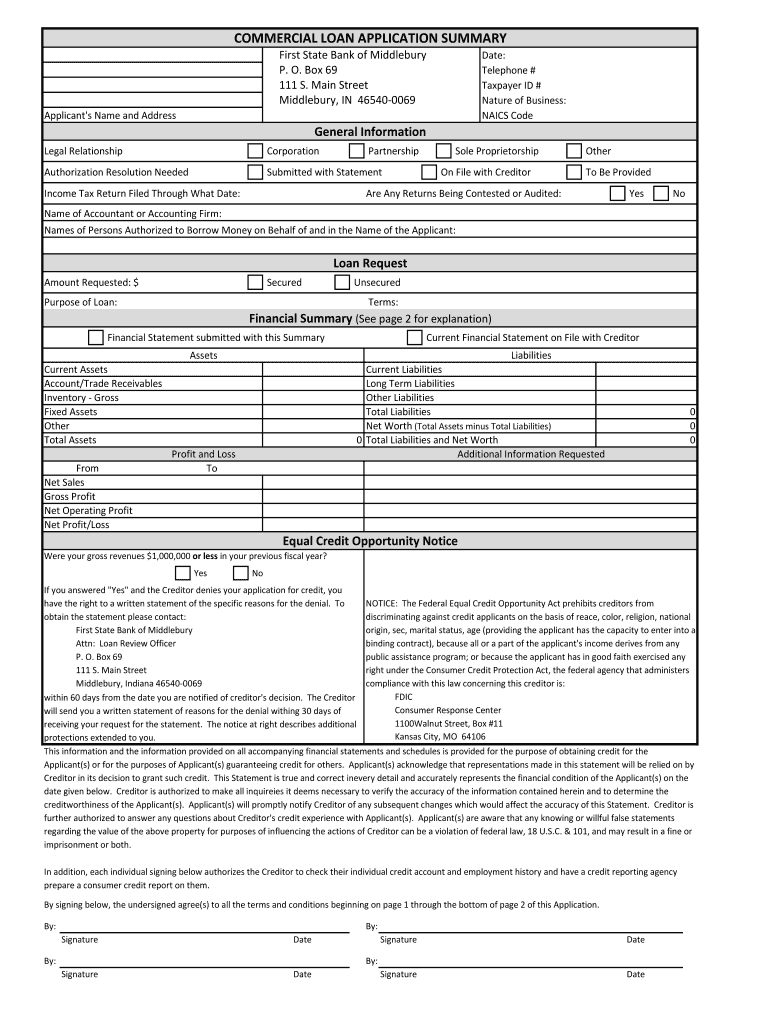

COMMERCIAL LOAN APPLICATION SUMMARY

First State Bank of Middlebury

P. O. Box 69

111 S. Main Street

Middlebury, IN 465400069Date:

Telephone #

Taxpayer ID #

Nature of Business:

NAILS CodeApplicant\'s

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial loan application summary

Edit your commercial loan application summary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial loan application summary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercial loan application summary online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit commercial loan application summary. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial loan application summary

How to fill out commercial loan application summary

01

Gather all the necessary documentation required for the application, such as financial statements, cash flow projections, business plan, and personal financial information.

02

Start by providing basic information about your business, such as its legal name, address, contact information, and industry sector.

03

Include details regarding the loan amount you are seeking, the purpose of the loan, and the desired repayment terms.

04

Outline your business's financial history, including its revenue, net income, and expenses. You may need to provide financial statements and tax returns for the past few years.

05

Describe the collateral or assets that can be used as security for the loan, such as property, equipment, or inventory.

06

Include information about the key individuals involved in the business, their roles, and their backgrounds. This may include resumes, personal financial statements, and references.

07

Provide a well-written and concise executive summary that highlights the key aspects of your business and why you are seeking the loan.

08

Review the completed application thoroughly to ensure accuracy and completeness before submitting it to the lender.

09

Submit the application along with all the required documentation to the appropriate lender or financial institution.

10

Follow up with the lender to track the progress of your application and address any additional information or documentation they may require.

Who needs commercial loan application summary?

01

Entrepreneurs and business owners who are looking to secure funding for their commercial ventures.

02

Start-up companies or small businesses that require capital for expansion, equipment purchase, or working capital.

03

Established businesses that wish to refinance existing loans or invest in new opportunities.

04

Real estate developers and investors seeking financing for commercial property acquisitions or developments.

05

Manufacturers or distributors in need of financing for inventory, equipment, or supply chain management.

06

Professional service providers, such as doctors or lawyers, who require funding for practice expansion or equipment upgrades.

07

Retailers or restaurant owners who need capital for store renovations, marketing campaigns, or inventory expansion.

08

Companies in industries that require significant capital investments, such as technology, healthcare, or construction.

09

Non-profit organizations and educational institutions that require funding for program expansion or facility improvements.

10

Individuals or groups looking to acquire and operate a franchise or start a new business venture.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete commercial loan application summary online?

With pdfFiller, you may easily complete and sign commercial loan application summary online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit commercial loan application summary straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing commercial loan application summary, you need to install and log in to the app.

How do I edit commercial loan application summary on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute commercial loan application summary from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is commercial loan application summary?

The commercial loan application summary is a document that provides a concise overview of the details of a commercial loan application.

Who is required to file commercial loan application summary?

Lenders and financial institutions are required to file a commercial loan application summary.

How to fill out commercial loan application summary?

The commercial loan application summary can be filled out by providing all the necessary information related to the loan application, such as borrower details, loan amount, purpose of the loan, etc.

What is the purpose of commercial loan application summary?

The purpose of the commercial loan application summary is to provide a quick overview of the loan application for review and assessment.

What information must be reported on commercial loan application summary?

The commercial loan application summary must include details such as borrower's name, contact information, loan amount, purpose of the loan, repayment terms, etc.

Fill out your commercial loan application summary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Loan Application Summary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.