This sworn statement is used by an individual desiring to claim a lien against a piece of property for labor performed or laborers or material furnished. A notice of intent to file a lien must be filed with the county recorder ten days prior to the filing of the lien statement.

Get the free Lien Statement - Individual

Show details

This document is a Lien Statement as per Colorado Revised Statute §38-22-109(1), used by individuals to assert a lien against property for labor and materials furnished or work performed, including

We are not affiliated with any brand or entity on this form

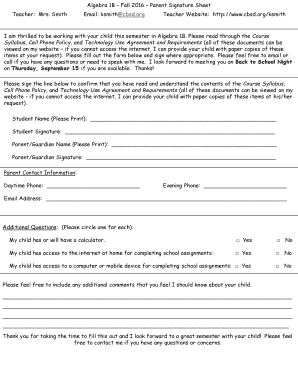

Get, Create, Make and Sign lien statement - individual

Edit your lien statement - individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lien statement - individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lien statement - individual

How to fill out Lien Statement - Individual

01

Obtain the Lien Statement form from your local or state government website.

02

Read the instructions carefully to understand the specific requirements for your jurisdiction.

03

Fill out your personal information, including your name, address, and contact details.

04

Provide information about the property involved, including its address and legal description.

05

Specify the amount of the lien and the reason for the lien.

06

Sign and date the form, confirming that the information provided is accurate.

07

Submit the completed Lien Statement to the appropriate government office, along with any required fees.

Who needs Lien Statement - Individual?

01

Individuals or businesses who are owed money for services rendered or goods provided and wish to secure a claim on a property.

02

Contractors or subcontractors who have not been paid for work completed on a property.

03

Creditors looking to establish a legal claim against a debtor's property for unpaid debts.

Fill

form

: Try Risk Free

People Also Ask about

What happens when a lien is placed on you?

A lien secures the government's interest in your property when you don't pay your tax debt. A levy actually takes the property to pay the tax debt. If you don't pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.

What is the most common lien?

Bank Liens Previous mortgages are the most common kind of bank lien and receive high priority. If your prospective property has been sold before, the old mortgage should show as paid on the title records.

What is lien in American English?

A lien is a legal claim on a piece of property that must be paid off before the property can be sold. If a court decides that a person must repay a debt, a lien may be placed against that person's property. The seller may obtain clear title by paying the contractor and removing the lien.

What is a lien example?

For example, if someone takes out a loan to buy a car, the car dealer would be paid using the borrowed funds from the bank. In turn, the bank would be granted a lien on the vehicle. If the borrower does not repay the loan, the bank has the right to execute the lien, seize the vehicle, and sell it to repay the loan.

What does a title lien statement mean?

What is a lien? A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

What is a lien in simple terms?

noun. ˈlēn. : a charge or encumbrance upon property for the satisfaction of a debt or other duty that is created by agreement of the parties or especially by operation of law. specifically : a security interest created especially by a mortgage. — assessment lien.

Can I put a lien on myself?

A property owner can choose to place a lien on their property. A voluntary lien is a claim over the property that a homeowner agrees to give to a creditor as security for the payment of a debt. A mortgage lien is the most common type of voluntary real estate lien, also called a deed of trust lien in some states.

Can someone put a lien on my house without me knowing?

An involuntary lien can occur without your knowledge, depending on the circumstances. A creditor often places a judgment lien after suing you and winning the case.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Lien Statement - Individual?

A Lien Statement - Individual is a legal document that provides information about any liens that an individual has against their property.

Who is required to file Lien Statement - Individual?

Individuals who have a lien filed against their property or those who have received a notice of lien are required to file a Lien Statement - Individual.

How to fill out Lien Statement - Individual?

To fill out a Lien Statement - Individual, gather necessary personal and property information, detail the lien, and follow the provided template or instructions for submission.

What is the purpose of Lien Statement - Individual?

The purpose of the Lien Statement - Individual is to disclose any existing liens on property to ensure transparency during property transactions and maintain accurate public records.

What information must be reported on Lien Statement - Individual?

The Lien Statement - Individual must report the individual's name, property details, description of the lien, lienholder information, and any relevant dates.

Fill out your lien statement - individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lien Statement - Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.