UK HS304 Claim Form 2016 free printable template

Show details

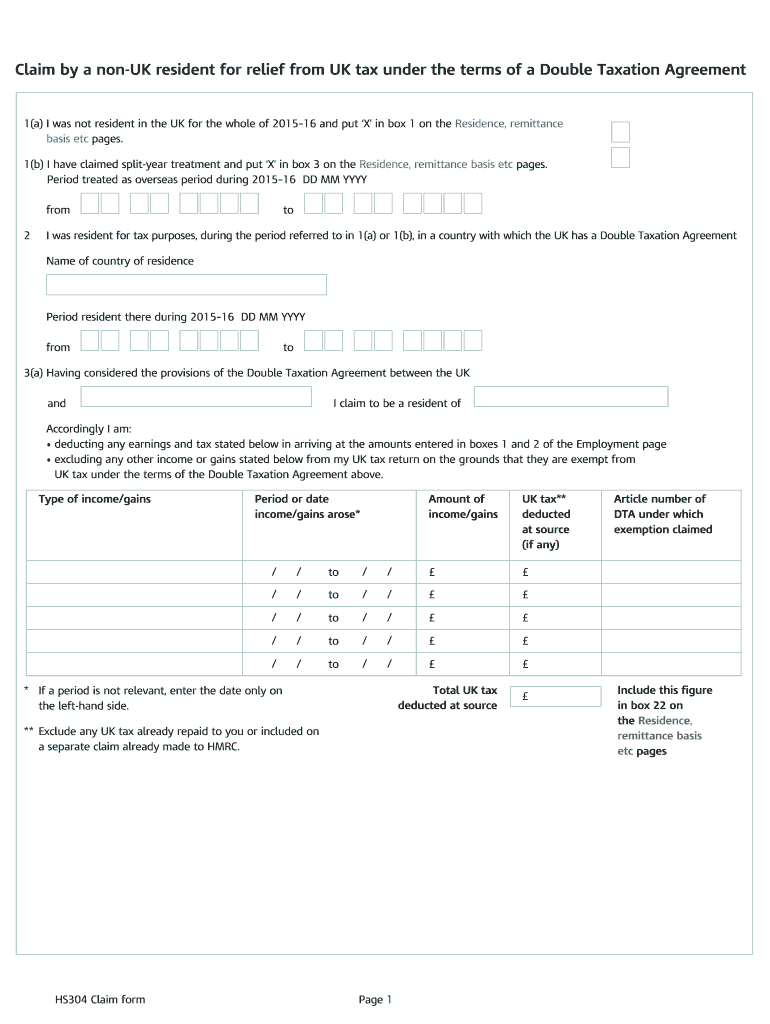

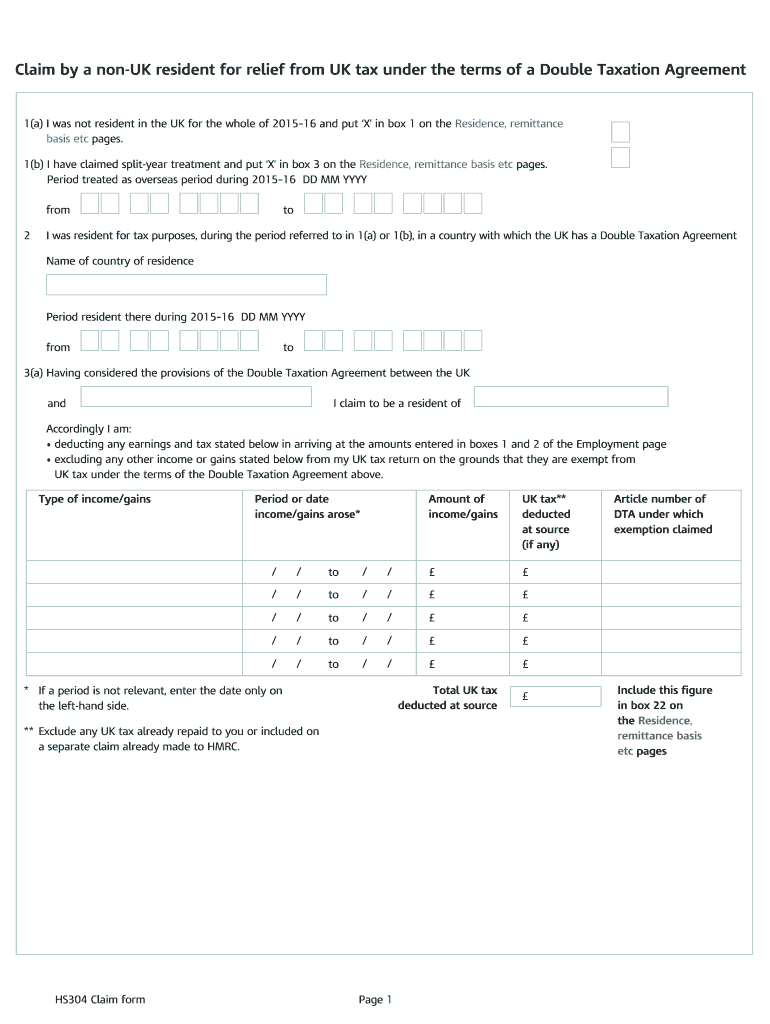

Claim by a non-UK resident for relief from UK tax under the terms of a Double Taxation Agreement 1(a) I was not resident in the UK for the whole of 2015 16 and put X in box 1 on the Residence, remittance

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HS304 Claim Form

Edit your UK HS304 Claim Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HS304 Claim Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK HS304 Claim Form online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UK HS304 Claim Form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HS304 Claim Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HS304 Claim Form

How to fill out UK HS304 Claim Form

01

Obtain the UK HS304 Claim Form from the official HMRC website or local tax office.

02

Fill in your personal details including name, address, and National Insurance number in the designated fields.

03

Specify the type of claim you are making and provide relevant details as required.

04

Complete the income and expenditure sections accurately to reflect your financial situation.

05

Attach any necessary documents or evidence to support your claim, such as payslips or bank statements.

06

Review the form for any errors or omissions before signing and dating it.

07

Submit the completed form to the HMRC via post or online, depending on the submission guidelines.

Who needs UK HS304 Claim Form?

01

Individuals who have suffered a loss of income or financial hardship due to specific circumstances, such as redundancy or illness.

02

Employees who are eligible for tax relief and wish to claim back taxes from HMRC.

03

Self-employed individuals seeking to claim expenses related to their business.

Fill

form

: Try Risk Free

People Also Ask about

How many days do you have to be out UK to be tax exempt?

You're usually non-resident if either: you spent fewer than 16 days in the UK (or 46 days if you have not been a UK resident for the 3 previous tax years) you worked abroad full-time (averaging at least 35 hours a week), and spent fewer than 91 days in the UK, of which no more than 30 were spent working.

How long do you have to stay out of the UK to avoid paying tax?

You can live abroad and still be a UK resident for tax, for example if you visit the UK for more than 183 days in a tax year. Pay tax on your income and profits from selling assets (such as shares) in the normal way.

Do I pay UK tax if I live abroad?

As long as you pay tax on your wages in your home country, you will not have to pay tax in the UK. You must file a Self Assessment tax return, together with a completed SA109 form. Use the 'other information' section of your SA109 to include: the dates you were stuck in the UK because of coronavirus.

What is HS304 in UK tax?

HS304 is the name of the form and corresponding guidance document that you need if you are a UK non resident and want to reclaim UK tax under Double Taxation Agreement rules.

Do I need to complete a UK tax return if I am non resident?

Non-residents only pay tax on their UK income - they do not pay UK tax on their foreign income. Residents normally pay UK tax on all their income, whether it's from the UK or abroad. But there are special rules for UK residents whose permanent home ('domicile') is abroad.

How long do you have to live outside the UK to avoid capital gains tax?

If you're abroad You have to pay tax on gains you make on property and land in the UK even if you're non-resident for tax purposes. You do not pay Capital Gains Tax on other UK assets, for example shares in UK companies, unless you return to the UK within 5 years of leaving.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK HS304 Claim Form in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your UK HS304 Claim Form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get UK HS304 Claim Form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the UK HS304 Claim Form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit UK HS304 Claim Form on an iOS device?

Create, edit, and share UK HS304 Claim Form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is UK HS304 Claim Form?

The UK HS304 Claim Form is a document used to claim relief from Import VAT on goods imported into the UK for certain qualifying businesses and individuals.

Who is required to file UK HS304 Claim Form?

Businesses and individuals who import goods into the UK and wish to claim relief from VAT must file the UK HS304 Claim Form.

How to fill out UK HS304 Claim Form?

To fill out the UK HS304 Claim Form, you need to provide your business details, details of the imported goods, the amount of VAT you are claiming relief from, and any relevant supporting documentation.

What is the purpose of UK HS304 Claim Form?

The purpose of the UK HS304 Claim Form is to facilitate the process of claiming VAT relief on imported goods, ensuring that businesses comply with tax regulations while minimizing their tax burden.

What information must be reported on UK HS304 Claim Form?

The information that must be reported on the UK HS304 Claim Form includes the claimant's details, the HTS codes for the goods, import VAT amounts, details of the importations, and evidence supporting the claim.

Fill out your UK HS304 Claim Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK hs304 Claim Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.