Get the free Old Mutual Unit Trusts Namibia Buying Form - Old Mutual Namibia

Show details

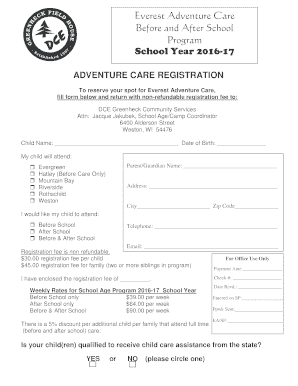

Old Mutual Unit Trusts Namibia Buying Form Please complete in CAPITAL LETTERS using black or blue ink and tick (3) block where appropriate. HOW TO COMPLETE THIS APPLICATION FORM 1. Complete all sections

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign old mutual unit trusts

Edit your old mutual unit trusts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your old mutual unit trusts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit old mutual unit trusts online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit old mutual unit trusts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out old mutual unit trusts

How to fill out old mutual unit trusts:

01

Gather the necessary documents: Start by collecting all the required documents for filling out the old mutual unit trust application form. This may include your identification documents, proof of address, and any other specified forms or declarations.

02

Understand your investment goals: Before filling out the form, it is important to have a clear understanding of your investment objectives. Consider factors such as your risk tolerance, investment time horizon, and desired returns. This will help you choose the most suitable old mutual unit trust for your needs.

03

Read and understand the form: Carefully go through the old mutual unit trust application form, reading all the instructions, terms, and conditions. It is important to comprehend the information provided in order to accurately complete the form.

04

Provide personal and financial details: Begin filling out the form by entering your personal information such as name, date of birth, contact details, and identification number. Additionally, you may need to include your financial details, such as employment status and income.

05

Select the appropriate unit trust: Old Mutual offers a range of unit trusts, each with different investment strategies and risk levels. Select the unit trust(s) that align with your investment goals and indicate your choice in the form.

06

Specify your investment amount: Indicate the amount you intend to invest in the old mutual unit trust. This can typically be in South African Rand (ZAR) or any other specified currency.

07

Choose your investment method: Old Mutual provides various investment methods, such as lump sum or regular contributions. Select your preferred investment method and indicate it in the form.

08

Review your application: Before submitting the form, carefully review all the information provided, ensuring accuracy and completeness. Make any necessary amendments or additions before proceeding.

09

Attach required documents: Attach all the required documents, such as identification proof, proof of address, and any additional supporting documents specified by Old Mutual.

10

Submit the application: Once you have completed the form and gathered all the necessary documents, submit your application either online, via mail, or through a designated Old Mutual branch.

Who needs old mutual unit trusts?

01

Individuals seeking investment opportunities: Anyone looking to grow their wealth through investments can consider old mutual unit trusts. It is suitable for individuals who have the financial capability to invest and are willing to take on a certain level of risk for potential returns.

02

Investors with long-term financial goals: Old Mutual unit trusts are ideal for individuals with long-term financial goals, such as retirement planning or saving for major life events. These investments typically offer the potential for higher returns over an extended period.

03

Investors seeking diversification: Unit trusts allow investors to diversify their portfolios by investing in a broad range of assets, such as equities, bonds, and properties. This diversification helps mitigate risks and potentially enhance overall investment performance.

04

Individuals looking for professional management: Old Mutual unit trusts are managed by experienced investment professionals who make investment decisions on behalf of the investors. This appeals to individuals who prefer to have their investments managed by experts, rather than making individual investment decisions.

05

Those seeking convenience and flexibility: Old Mutual unit trusts offer convenience and flexibility in terms of investment amounts, investment methods, and access to funds. Investors can choose to make regular contributions or a lump sum, while also having the ability to access their funds when needed, subject to any applicable terms and conditions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit old mutual unit trusts from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like old mutual unit trusts, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Where do I find old mutual unit trusts?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific old mutual unit trusts and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit old mutual unit trusts in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing old mutual unit trusts and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is old mutual unit trusts?

Old mutual unit trusts are investment vehicles where investors pool their money together to invest collectively in a portfolio of assets.

Who is required to file old mutual unit trusts?

Fund managers who manage old mutual unit trusts are required to file them.

How to fill out old mutual unit trusts?

Old mutual unit trusts can be filled out by providing details of the assets held, any income earned, expenses incurred, and any other relevant information.

What is the purpose of old mutual unit trusts?

The purpose of old mutual unit trusts is to provide investors with a diversified investment portfolio managed by professionals.

What information must be reported on old mutual unit trusts?

Information such as the value of assets held, income earned, expenses incurred, and any other relevant financial data must be reported on old mutual unit trusts.

Fill out your old mutual unit trusts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Old Mutual Unit Trusts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.