Get the free REFUND CREDIT 21 Hours 14 Hours 14

Show details

OEDT sponsors and provides instructor led courses, workshops, conferences, customized trainings,

and technical assistance to community based organizations, behavioral health providers, and public

health

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign refund credit 21 hours

Edit your refund credit 21 hours form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your refund credit 21 hours form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing refund credit 21 hours online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit refund credit 21 hours. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out refund credit 21 hours

How to fill out refund credit 21 hours

01

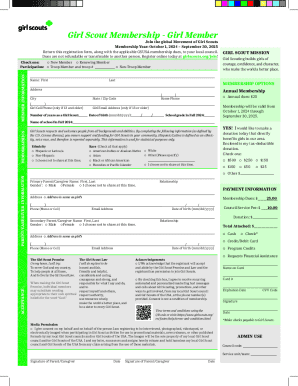

Gather all the necessary documents such as your purchase receipt, credit card statement, and any other supporting evidence.

02

Identify the reason for the refund, whether it is a defective product, incorrect billing, or any other valid reason.

03

Contact the customer service department of the company or organization from which you made the purchase.

04

Explain your situation and provide all the required information and documentation to support your claim.

05

Follow the instructions given by the customer service representative in order to complete the refund process.

06

If necessary, fill out any refund request forms or provide additional details as requested.

07

Wait for a response from the company regarding the status of your refund.

08

If approved, ensure that the refund amount is credited back to your original form of payment within the stipulated timeframe.

09

Keep track of the refund process and follow up with the company if needed.

10

If the refund is not approved or there are any issues, escalate the matter to higher authorities or seek legal advice if necessary.

Who needs refund credit 21 hours?

01

Anyone who has made a purchase and wishes to receive a refund for the transaction.

02

Individuals who have been charged incorrectly on their credit card statement and need to claim a refund.

03

Customers who have received defective or damaged products and want to return them in exchange for a refund.

04

People who have faced unsatisfactory service or experience and would like to get a refund for the amount paid.

05

Individuals who have been double-charged for a transaction and need to request a refund for the duplicate charge.

06

Consumers who have changed their minds about a purchase and want to avail the refund policy of the company or organization.

07

Anyone who has followed the terms and conditions of a refund policy and is eligible to claim the refund amount.

08

Customers who have been the victims of a fraudulent transaction and need to recover their money through a refund.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send refund credit 21 hours to be eSigned by others?

Once your refund credit 21 hours is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for the refund credit 21 hours in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out refund credit 21 hours on an Android device?

Use the pdfFiller mobile app and complete your refund credit 21 hours and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is refund credit 21 hours?

Refund credit 21 hours is a credit given to individuals who have overpaid on their taxes and are eligible to receive a refund.

Who is required to file refund credit 21 hours?

Individuals who have paid taxes and have determined that they are eligible for a refund credit of 21 hours.

How to fill out refund credit 21 hours?

To fill out refund credit 21 hours, one must gather all necessary tax information, calculate the amount of refund credit owed, and submit the appropriate forms to the tax authority.

What is the purpose of refund credit 21 hours?

The purpose of refund credit 21 hours is to provide individuals with a refund for any excess taxes that have been paid.

What information must be reported on refund credit 21 hours?

Information such as income, deductions, tax credits, and any other relevant tax information must be reported on refund credit 21 hours.

Fill out your refund credit 21 hours online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Refund Credit 21 Hours is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.